Strategies in Light 2019 was a special event from many perspectives. It was the 20th anniversary event and a number of attendees indicated that they had attended all 20. LEDs Magazine hosted its 5th annual Sapphire Awards Gala highlighting innovation in the LED and solid-state lighting (SSL) sectors. The conference was as packed with learning opportunities as ever with presentations running the gamut of LED quality to connected lighting and Internet of Things (IoT) opportunities. Still, the 20th anniversary afforded Plenary and keynote speakers the opportunity to look back and forward at LEDs, SSL systems, and LED-based lighting design.

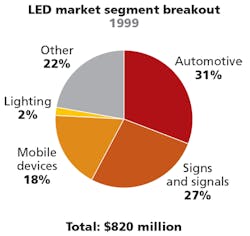

Bob Steele (Fig. 1), one of the Strategies in Light founders and co-chair in 2019, opened the first keynote session with a look back, noting that in the year 2000 the first conference was held in a hotel near the San Francisco airport. Steele said there were 235 people at the first conference and that interest confirmed the founders’ feelings that high-brightness (HB) LEDs would be an important sector. The total revenue of the HB-LED market at the time was $820M (million). Of course that excluded the legacy LEDs used as indicators. The high-brightness focus was due to the potential for growth and the market was in fact growing 67% at the time. The top applications were automotive interior and rear-facing exterior lighting and outdoor signs. Steele said white LED efficacy was around 15 lm/W — slightly lower than an incandescent bulb.

The chart in Fig. 2 shows that application breakdown back in the year-2000 timeframe. There was very little LED usage in lighting applications at the time. Steele said the primarily examples were architectural or façade lighting on buildings, machine-vision lighting, and flashlights. Other niches were high-reliability applications.

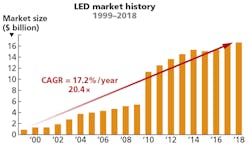

Fast-forward 20 years and Steele took a look at what happened over two decades. He started with a revenue growth chart (Fig. 3) that showed a 17.2% CAGR (compound annual growth rate) that equals more than a twenty-fold increase in annual revenue exceeding $16B (billion) annually today.

As you can see from the chart, the growth was far from linear. Periods of recession impacted the market and then there were the waves of new applications and growth followed by periods of oversupply that depressed prices and the aggregate revenue. Steele identified four key application drivers. Automotive and signs carried the market through 2002. Mobile phones were the key segment from 2003–2007. Backlights for TVs and computer displays drove growth from 2008–2012. And only in 2013 did general lighting take over as the key driver. All of these sectors are still active, as we will discuss later in the article, and some — especially automotive — are still critical to the health of the LED sector.

Still, what is a bit surprising is that you can easily see the inflection point in 2009–2010 where backlight applications spurred a short-term growth rate near 100%. There is no equivalent spike attributable to general lighting in recent years. But lighting has generated tremendous new opportunity. It’s just that the backlight and mobile markets declined so rapidly, according to Steele, with component prices falling and brighter LEDs reducing the number of components required in such applications, so those declines hid the spike in general-lighting usage.

LED technology evolution

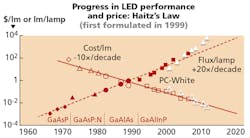

Next, Steele moved to the LED technology evolution and began with a depiction of Haitz’s Law (Fig. 4) that Roland Haitz first presented in 1999. Haitz projected the escalation of LED performance relative to the decline in cost. Haitz’s Law is seen as the LED analog to Moore’s Law in the digital semiconductor space. The original projection only went to 2010. But Steele pointed out that the industry has outperformed a linear extension of the projection. The projection would suggest a price of $1/klm (one dollar per kilolumen) in 2020, and Steele said the industry has already exceeded that milestone.

Putting the progression in terms that are more easily understood, Steele discussed performance improvements in regard to efficacy. Over the span of 2000–2012, the industry achieved an average efficacy increase of 24% for cool-white LEDs. And over the span of 2004–2012, the industry achieved an average efficacy increase of 20% for warm-white LEDs. It was those performance improvements that paved the way for LEDs to dominate in general lighting.

Following Steele, John Edmond of Cree took the stage. As a co-founder of Cree, Edmond has a long history in LEDs much like Steele. Edmond said he “has been doing this for 32 years,” meaning working on material science for LED manufacturing. But for his Strategies in Light keynote, Edmond was challenged to project advancements in LEDs and SSL for the next two decades.

Still, Edmond took a brief look back also referring to Haitz’s projections. He said that where Haitz projected 200-lm/W efficacy by 2020, the industry is at 230 lm/W or better today. Haitz projected 1250 lm/$ by 2019. When Cree released its A-lamp replacement bulb to retail in 2013, Edmond said that lamp was right on Haitz’s curve at about 250 lm/$. But he said that today, high-power LEDs deliver $3500 lm/$ and mid-power LEDs deliver $10,000 lm/$. Haitz had projected 10,000 lm per LED package, yet the industry has reached 15,000 lm per LED package with chip-on-board (COB) devices. His conclusion was that LEDs are way ahead of schedule.

And indeed the story is about costs as much as technology driving adoption. Edmond said you can still buy an incandescent lamp today. Regulations have mostly eliminated manufacturing of incandescent A-lamps, but retailers are selling off stock.Edmond said a 60W incandescent on a popular industry distribution website costs $1.38. The same website has an LED equivalent that cost $0.95, uses 9W of power, and has LEDs valued at $0.10 in the lamp.

Edmond’s point was to ask the rhetorical question, “Why should we work on LEDs anymore?” He said the LED lamp he mentioned wasn’t top of the line but had decent reliability and efficiency. But he added, “There is a lot more still to do.”

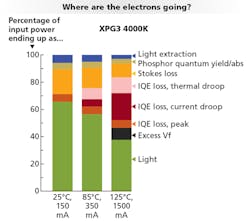

Opportunities in the LED

To explain the opportunity, Edmond explained where the electrons that go into an LED are used in a typical product today (Fig. 5). The efficiency in terms of light produced is in the 50–55% range depending on drive current and temperature. The remainder of the energy is lost through droop and recombination processes that aren’t producing light. The industry must focus on:

1. Reducing current droop

2. Reducing thermal droop

3. Reducing on resistance

4. Phosphor innovation

Edmond said the improvement work must encompass LED quality to minimize defect density, improve epitaxial crystal quality, and improve active carrier density and injection. At the same time, chip and package design must improve thermal management, spread current more efficiently, and improve phosphor conversion. Such work could yield a 15% improvement in efficacy to 265 lm/W or more for cool-white LEDs and 240 lm/W or more for warm-white LEDs.

Digging deeper into a vector for improvement at the package level, Edmond discussed light quality in terms of color rendering and phosphor technology that could deliver higher quality without an efficacy tradeoff. Edmond first reminded the audience of the efficacy penalty associated with a high CRI, or high rating on another metric such as TM-30. At 70 CRI, 2700K CCT, and 25°C operating temperature, a typical mid-power LED would deliver in the range of 205 lm/W. Edmond said there is only a 4% drop in efficacy to go to 80 CRI. But to go to 90 CRI there is a 21% penalty from the 205-lm/W level.

One approach being pursued by the industry to minimize the penalty is red phosphor with a very narrow emission band, sometimes called a red line phosphor, that eliminates the red emission in the non-visible infrared (IR) spectrum — a typical issue with 90-CRI LEDs today. Lumileds executive Jy Bhardwaj similarly touted narrowband red technology in a keynote a couple of years back. And GE Lighting has worked in that technology area.

Edmond believes such a phosphor could enable recovery of 14% of the losses associated with 90-CRI LEDs, bringing efficacy near 190 lm/W. Edmond predicted that 80-CRI lighting will become as outdated as candles with such advancements. Of course, such an accomplishment isn’t an outright improvement in efficacy but rather a needed improvement at a desired level of light quality.

Moving to smart lighting

But like many keynoters at Strategies in Light over the past few years, Edmond foresees new system-level applications and benefits as equally if not more important than energy efficiency and light quality in the next two decades. Indeed, the LED is just an enabler to the move toward connected lighting and autonomous or programmatic controls.

The well-known progression is that you go to LEDs replacing fluorescent lighting and achieve about 50% improvement in energy efficiency. With LED, Edmond said, “You have something different. You have a platform for sensors in the ceiling that are just like the satellites in the sky that make GPS work great.” He said networked sensors in each luminaire deliver 30% additional efficiency sensing occupancy and 15% additional efficiency through daylight harvesting. And Edmond made the typical jump to savings with other systems such as HVAC and security, although he added that the benefits in tying in some systems are limited.

The real potential is in new applications — a story we have heard often — such as for office space utilization, indoor wayfinding, and more. But Edmond prescribed a slightly different path to move to that next level. Perhaps it was just his internal engineer surfacing. But he described the concept of open APIs (application programming interfaces) that would allow third-party access in developing the killer application for connected SSL.

Personal convenience

Edmond used a cartoon animation to illustrate the potential beyond even the 3-30-300 story we’ve heard so often and focused on personal convenience. About such a connected lighting system at the end of the workday, he said, “I know this person’s going to the elevator. So by the time we get to the elevator, it’s there. Now your Tesla knows you’re coming down the steps and it’s going to cool it down and it’s going to drive up to you. Of course, you are going to sit in the backseat because it’s an autonomous car.”

The fable continued to suggest your garage opens automatically when you arrive. The air conditioning in your home has been turned on. Perhaps your kitchen devices start dinner or prepare you a drink. “So what does connected lighting do?” asked Edmond. “It’s a platform for connecting people and devices and systems to each other and to the Internet, which is huge.”

Companies of course will have to buy the value proposition. And that goes back to that 3-30-300 story. Edmond said that companies will save $300/ft2/yr by increasing productivity for white-collar workers. Savings can be even higher in big-box stores. And the potential to increase sales in high-end retail is also significantly higher.

To close his keynote, Edmond contemplated a few other disruptive applications that may be enabled for connected SSL. He reminded the audience how hard it could be to predict how connected lighting might be used in 2040, because few could have predicted even ten years ago how we use mobile phones today. He said, “Predicting the future is hard, but creating it is exciting.”

Edmond expects horticultural lighting to bring about a revolution to indoor farming, eliminating pesticides and directly controlling plant pathogens (We will be holding another Horticultural Lighting Conference on Oct. 31 in Denver to discuss some of those trends; visit http://horticulturelightingconference.com/usa for updates). LEDs will be key to entertainment, and micro LEDs will enable cinema-scale displays, according to Edmond. He points out that LEDs continue to evolve in façade lighting on buildings and landmarks. And finally, he identified adaptive headlamps and road-marking as a tremendous safety opportunity enabled by brighter and more-densely-packed LEDs. He showed a video from auto supplier Valeo that depicts the automotive technology beyond today’s typical matrix headlamps, when resolution allows projection of messaging.

Technology to design

The progression of keynotes then moved to the next logical step — contemplating lighting design given the evolving capabilities of LEDs. Nancy Clanton, CEO of Clanton and Associates, presented. She has a long history of working with LEDs and we have covered a number of her projects including on some foundational work with LED street lights and safety. She also took a look back and forward following a trend in the Strategies in Light keynote sessions.

Clanton recalled her first LED project from 2008, saying, “I didn’t know that the industry was just beginning. No one told me you couldn’t put LEDs in tight spaces. No one told me that at that time one driver should only operate 2 ft of LEDs.” She said the project experienced 100% failure, but the reputable manufacturer replaced everything and doubled the number of drivers. Still, everything failed again. She said, “The manufacturers were learning along with us. And we eventually had project success.”

Fast-forward to today, and Clanton is working exclusively with LEDs, or SSL, and said, “We are doing things now with this technology that you could never do with fluorescents.” That applies to high-pressure sodium (HPS) as well. Clanton specifically mentioned an outdoor area-lighting project at the historic Denver 16th street Mall. It was an iconic project done originally with incandescent lighting that was converted to HPS, which was not pleasing and visibility was terrible in what was presumably an outdoor nighttime gathering spot. Clanton retrofitted — and rectified — that mistake with LEDs, restoring the original incandescent charm (Fig. 6).

Dreams

Still, Clanton’s talk was to be about her dreams for LEDs in lighting and she immediately suggested to the luminaire developers in the room that they need to work on glare. She is clearly no proponent of visible point-light sources. She acknowledged the need for new glare metrics and stated, “We have to figure out not just quantity of light but quality of light.”

Clanton pointed at planar edge-lit lighting as a positive trend. Such technology delivers diffuse light, and Clanton explained that some fixtures are transparent in the off state. That transparency feature enables better application of daylighting. She also counseled the crowd to move away from legacy shapes, stating, “If I never see another downlight again, I’ll be happy.” Yet she lamented the prevalence of LED-based downlights. She said, “The best light is light I don’t see.” but she wants to be able to personalize the light.

Lighting for health and wellbeing was also a touchy subject during the talk. Clanton said lighting designers are generally not being given the information they need to specify installations to what few standards exist. Moreover, she said light levels seem more important than spectrum, yet the SSL industry seems focused on spectrum. She asked for better tools and information, including the simple availability of spectral power distribution (SPD) for every product so that designers can deliver color consistency.

Clanton has also long had environmental and dark-sky concerns. She anticipates access to 2200K-CCT LEDs for use in outdoor applications that would be environmentally friendly but would still provide safe lighting for pedestrians. “Because we are only lighting to two moonlights, we have to completely change our criteria,” said Clanton. She said spatial frequency and shadowing are important, for instance, to enable people to see steps. She called it “the picket fence of outdoor lighting that will match the natural phenomena.” And she suggested that product developers in the crowd could deliver on her dreams.

Market research

For the first time ever at Strategies in Light, a market research presentation from Strategies Unlimited closed the show after the tracks ended. Philip Smallwood (Fig. 7), director of research at Strategies Unlimited, delivered the Closing Plenary.

Smallwood covered some of the same ground as Steele, stating that packaged LED revenue for products used in displays is declining 12% annually. LED revenue for mobile applications is declining 10%. He said the average time a consumer in the US keeps a smartphone is now three years whereas the trend had recently been two years. There has further been impact of OLEDs in the market, and that will escalate if a foldable phone takes off.

Even general lighting is not as robust a market in terms of LED revenue, primarily due to a race to the bottom in pricing of commodity lighting products and the pressure that puts on component pricing. Such pressure leads to more competition and aggressive pricing from China. Higher-output industrial and outdoor markets are an exception given the need for higher-quality LEDs.

Smallwood sees the automotive application, especially for exterior lighting, as a driver for LED revenue in the short term. He said such revenue is escalating 18% despite the fact that the automotive market itself has disappointed. But LEDs are pervading far more models. And price erosion is not as great a factor with a long design cycle in vehicles.

As always, one of the most anticipated elements of the presentation was the reveal of the top ten packaged LED suppliers. The list, country of origin, and market share are:

1. Nichia – Japan, 14%

2. Osram Opto – Germany, 11%

3. Lumileds – US, 9%

4. Seoul Semiconductor – South Korea, 6%

5. Samsung – South Korea, 6%

6. Mulinsen (MLS) – China, 5%

7. LG Innotek – South Korea, 5%

8. Cree – US, 4%

9. Everlight – China, 3%

10. Lumens – South Korea, 3%

There were only small changes in the list from the 2018 market presentation at Strategies in Light. But the gap has narrowed between Nichia and its nearest competitors. Osram clearly continues to benefit from the auto sector. Smallwood also said that MLS from China has achieved significant growth in the past year.

Moving to lamps and luminaires, there have been only subtle changes in that market of late. Penetration of LEDs is around 20% today and even lower in luminaires. Smallwood said LED penetration will hit 50% in 2022. Already lamp revenue is dominated by LED products, although the total lamps market peaked last year at $18B and Smallwood said the LED portion will peak this year at $12.4B. In indoor LED luminaires, revenue will hit $48B in 2022, and will represent 67% of the total global indoor luminaire market.

Considering the featured talks as a whole, and including the many conference sessions at Strategies in Light, one would come away with the thought that LEDs and SSL are vital and vibrant markets. But like geographic economies, industry-sector economies sometimes confuse and obscure underlying financials. These markets can’t shake the reality of looming saturation. Where would the razor market be without the blades? Connected lighting and the IoT still illuminate a possible path forward. Still, it may be niches like horticulture, automotive, and lighting for health that provide unforeseen opportunities.

Wireless debate raged at SIL

If there was one topic at Strategies in Light that was most prominent, it was roadblocks to smart lighting, connectivity, and the Internet of Things (IoT), and one element of that roadblock is the lack of an accepted and interoperable ubiquitous wireless network. One presentation in the Investor Forum by Eric Miller, CEO of Avi-On Labs, tempted the crowd with optimism before pulling the rug from underneath the strawman, again revealing the complexity of the conundrum.

Miller began explaining he had done a lot of work with utility smart-grid infrastructure, including large-scale metering systems. What led him to smart lighting was an examination of building and lighting controls. “I never felt like the ease of use, price, delivery ever felt like what I considered something good and I came to conclude that the technology was the limit.” He said he concluded in 2014 that Bluetooth Mesh could be the “magic bullet” that changed the game in the pursuit of ubiquitous controls.

Avi-On has had products in the field since 2014, according to Miller, with the implementation based on a proprietary version of Bluetooth Mesh technology called CSRMesh — a technology that originated with startup CSR and that is now owned by Qualcomm. “We are now migrating to the SIG [Bluetooth Special Interest Group] Mesh and actually facilitated helping that program [get] started,” he added.

Miller’s company manufactures building-block products that would be deployed in a smart-lighting system within a building. Examples include Bluetooth-based sensors, switches, connectivity adapters, in-fixture modules, and LED drivers. He said there have been more than 350,000 Avi-On devices built and there have been projects in the field based on those devices for more than four years.

Of course, what might matter with such a claim is scale. We have heard repeatedly that Bluetooth Mesh implementations have struggled to scale beyond 200 nodes on one network, despite the fact that the theoretical limit is more than 65,000 nodes as we covered after Light+Building and LEDucation last year.

But Miller was quick to claim otherwise at Strategies in Light, and attributed his large-scale utility experience as the basis for Avi-On’s capabilities. He said the company has supplied a 2200-node system in the American Tower Headquarters in Boston, MA, with all nodes in a single mesh range. The company has another 1700-node deployment in a General Dynamics manufacturing plant.

There is no gateway or central controller required. It is what Miller calls a “pure distributed architecture.” A system runs autonomously once deployed. We had a webcast covering such autonomous behavior back in March. Still, the system integrator or end user can add cloud controls.

Conversely, Miller said the well-known Zigbee technology that is based on the IEEE 802.15.4 mesh-network standard requires gateways, and that the largest successfully-operating network he has seen connected to a single gateway is 250 nodes. He said Avi-On had supplied a replacement for a 450-node Zigbee network that would not work properly with a single gateway.

So clearly Bluetooth Mesh is going to win the wireless battle, right? A sports commentator in the US is famous for saying, “Not so fast, my friend.” There remains work to be done.

The allure of a standard such as Bluetooth Mesh is twofold. First, it hopefully provides a way to solve a problem such as simplifying lighting controls. But more important is that it delivers an interoperable ecosystem allowing lighting designers/specifiers and even end users to mix and match products from many vendors. Think Wi-Fi!

Miller’s optimistic pace slowed when asked about interoperability. He said Avi-On was 80% done with the migration of its network transport layer to standard Bluetooth Mesh and will transition to that software this year. That means the radio messages in the air will comply with the SIG Mesh standard. Therefore, the Avi-On technology will run on any chipset certified to the standard. But he said for now Avi-On will be using its own protocol, because “it’s more functional and secure” than the standard.

Miller said the company will migrate its “models” for specific functionality such as “status monitoring” over time and one at a time. “True interoperability means that someone who wrote firmware that you’ve never met, that you are willing to allow that device onto your network, “ said Miller. “You are willing to let the entire performance of your network depend on the quality of job done by someone you have never met.” He said that will be a high bar for Avi-On given the company’s security and reliability focus. He concluded, “I think Bluetooth Mesh will get there relatively faster than any other technology and we are still years away from that.”

Still, Miller remains optimistic for broader near-term deployment of Avi-On technology for several reasons, starting with simplicity of deployment and commissioning. The company’s technology has been sold to consumers for several years through Home Depot and other retailers under the GE brand, manufactured by Jasco. Mostly those products were simply Bluetooth-enabled power switches, for example, to which you might connect a desk lamp. Miller’s point was that consumers had no technical issues. And now the Eaton Halo Home products are based on Avi-On technology and enable more complex connected SSL systems.