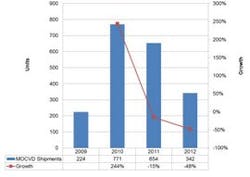

Date Announced: 29 Mar 2012 Wellingborough, UK –- IMS Research (recently acquired by IHS) forecasts 342 GaN LED MOCVD reactors will ship in 2012, a significant decline of 48% vs 654 in 2011, according to its most recent GaN LED Quarterly Supply and Demand report. The first two quarters of 2012 are currently expected to experience the lowest shipment levels, with a modest recovery in the second half as companies begin adding capacity in response to expectations of rapid demand growth from the general lighting market in 2013 onwards. The MOCVD market saw a large boom in 2009 and 2010 due to capacity needed for LED TVs and peaked in the second half of 2010. 2011 saw lower but healthy shipment levels as new Chinese manufacturers and Chinese-Taiwanese joint ventures entered the market backed by government subsidies for MOCVD reactors despite an oversupply in 2H’10. With the oversupply expanding in 2011 and China’s MOCVD subsidies expiring in most regions, shipments and orders have since stalled. In addition to China’s supply-side subsidies, the over-supply rose on weaker than expected demand due to global macroeconomic weakness, slower than expected growth in LED TV penetration and the adoption of fewer LEDs per panel in many backlighting applications. In addition, LED lighting is still a relatively small market. As a result, MOCVD order intake sharply declined in the second half of 2011 resulting in low expectations for 1H’12 MOCVD revenues.IMS Research analyst Jamie Fox commented that, “We believe the market peaked in Q3’10 and Q4’10 with 239 and 238 GaN reactors shipments respectively. Almost every quarter since then has been a decline. For 2012, we expect the first three quarters combined to be about the same as just one of those peak quarters. Apart from China, the market is extremely quiet. Without the Chinese growth, the market would have almost completely collapsed.” It is worth noting however that even with this severe market decline 2012 is still forecast to be 52% higher than 2009 (342 vs 224). In Q4’11, shipments actually increased sequentially, as some big orders in China fell in the quarter, particularly for Aixtron, as mentioned in an earlier blog. However both our survey of customers’ purchase intentions, and the publically available information on Aixtron and Veeco’s order intake, clearly tell the story of a big decline expected in Q1’12, which will see shipments of around half of Q4’11. Further highlights from this quarter’s edition of the report include:- China accounted for 76% of the 2011 market, reaching a peak of 92% in Q4’11. - Aixtron led in Q4’11 by units as predicted, but Veeco was #1 for the full year 2011. - Yangzhou Zhongke was the #1 customer in Q4’11, and Sanan was #1 for 2011. - Elec-Tech heads the list for likely top customer of 2012. - Despite a trend to 4 and 6 inch wafers globally at tier 1 manufacturers, 2 inch remains the majority due to China’s reliance on 2” wafers. About IMS Research IMS Research is a leading independent supplier of market research and consultancy to the global electronics industry, offering syndicated market studies, custom research and consultancy services. Clients include most of the household names in the industry. IMS Research has offices in Europe, the US, China, Taiwan, South Korea, and Japan.

Contact

Jamie Fox – Lighting and LEDs Research Director T: +44 (0) 1933 402255 Alternative Contact (US) Jonathan Baldwin Tel: +1 512 302 1977 [email protected]

E-mail:[email protected]

Web Site:www.imsresearch.com