Unfortunately, however, analysts had been predicting that Cree would break the $100 million/quarter revenue barrier for the first time. As a result, Cree's share price fell by about 20% in after-hours trading on January 13 following the announcement.

The company's net income increased 92 percent to $25 million, or $0.32 per share, compared with $13 million, or $0.17 per share, in the year-ago period.

The company also reported a sequential decline in gross margin to 50.4 percent of revenue, compared with 56 percent in the previous quarter and 46.6 percent in the year-ago period.

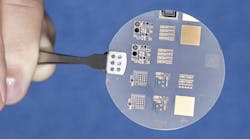

Gross margin decreased sequentially due to increased LED costs associated with Cree's conversion to using three-inch silicon carbide wafers for its LED manufacturing, and also the cost of ramping up its X-class products. Other factors included lower than expected December LED shipments and lower LED average sales prices due to changes in product and customer mix.

"Our fundamentals remain strong and we continue to see strength in the demand for our new products which has enabled us to continue to deliver solid financial results," said Chuck Swoboda, Cree president and CEO. "Overall gross margin decreased in our second quarter, but still remained healthy at 50 percent of our sales, particularly in light of the three-inch chip conversion and product ramp up costs experienced during the quarter."

Swoboda said that Cree will focus on increasing its market share with its new X-class LED products to offset the forecasted seasonal slow-down in mobile phone production.

Cree predicted that it will have revenue in the range of $94 to $98 million in the current quarter, with earnings of $0.24 to $0.27 per diluted share. Analysts currently expect profit of 32 cents per share on sales of $103.5 million.