When looking at the spread of lighting that you see on the shelves of retail stores, it is clear to see that the landscape is relatively unchanged from what it was before the adoption of LED lamps. Of course there are LED lamps where there used to only be incandescent and CFL technologies, but it is interesting to note that most of the brands that dominate this landscape are the same lighting companies that dominated it previously. This is not to say that there are no new players that have entered the market, Cree is a perfect example of this, but some of the players that were expected to enter the market on a large scale are conspicuously missing.

A couple of years back, I had predicted that the big three lamp manufacturers (Philips, OSRAM, and GE) would probably become the big six or seven companies. I had predicted that electronic component companies such as Samsung, Sharp, and LG that had the vertical integration and a recognizable brand name would be able to come into the market and stake their claim. Needless to say, their penetration into the market has not been as smooth as I thought. This is not to say that some of these companies didn’t try. Samsung had a few lamp offerings up until 2013 in Lowe’s, and Sharp had LED lamp operations in the US until January of this year.

This does not mean that the fight is lost for these companies though. The future of lighting does not only stand on who can sell the most lamps and luminaires but who can evolve with the market, or even better, who can lead the evolution of the market. As many of us know, the market is moving away from pure illumination towards a more dynamic interactive experience. We have all seen the introduction of controllable lighting systems like Philips’ Hue and TCP’s connected lamp system. This is where vertically integrated companies such as Samsung and LG, that offer a much wider spectrum of products, can begin to penetrate the market on a larger scale.

At L+B in Frankfurt this year, it was obvious that LEDs are now the mainstream. Of the more than 1000 booths that I saw, no more than 15 focused on non-LED lighting technologies. The more interesting booths focused on wirelessly integrating a myriad of household products to be controlled with one’s tablet or smartphone. Companies that produce a larger variety of these household items (TVs, smart phones, washer and dryers, ovens, fridges, etc…) are banking on a person wanting to stick with a specific brand, as their products will probably interface with each other more easily. If these companies succeed in creating a more connected home and are able to sell a heavy mix of lamps and luminaires in with their offerings, they might be able to better exploit their position within this market to take market share away from the established lighting companies.

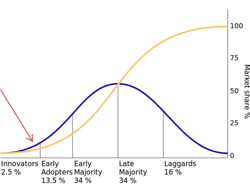

It will be very interesting to see who takes round two of this battle. As I showed in a previous blog, the penetration of LED lamps in the overall lighting market is still in the innovator stage, as seen in the graph below.

There is still a long fight ahead for these companies, and while the first round is always important, winning it does not guarantee success in the future.