Last fall, LEDs Magazine and the Designers Lighting Forum of New York (DLFNY) — which organizes the LEDucation conference — surveyed the industry to gauge its adoption of Power over Ethernet (PoE) and its current and expected utilization of PoE as a connectivity option in lighting networks. To help frame the state of PoE, we set out to ask questions to learn which roles in the lighting design and supply chain have worked with PoE; where PoE is being considered or deployed in projects; and how PoE is viewed in comparison to wireless and other options in connected lighting systems. The survey was not intended as a conventional market research dive into suppliers, service providers, or market share per se.

In 2020, LEDs published a feature contributed by Navigant Consulting (now Guidehouse Insights) that forecasted a 14.9% compound annual growth rate (CAGR) in the market for PoE in intelligent buildings between 2019 and 2028. PoE’s benefits include its ability to supply DC power to luminaires over the same cable as data, reduction in wiring and installation costs, and simplified installation. Outstanding issues include concerns about electrical power loss, Category 5/6 (Cat5/6) cables’ ability to meet lighting needs, and a perception that implementing PoE wiring is more challenging in existing buildings than in new construction.

A September 2021 Guidehouse report summary indicates that “updated PoE standards in 2018 and technology advancements, such as a single-pair PoE, have strengthened its market position.” The firm also estimates the PoE market will grow from $113.8 million in 2021 to $614.9 million by the end of 2030 at a CAGR of 20.6%. Did respondents to the LEDs/DLFNY survey share a similar optimism about PoE?

Demographics and experience with connected lighting

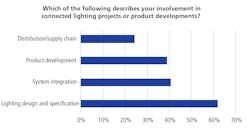

Let’s first break down the survey participants by job function. Approximately 26% of respondents indicated that they worked in engineering and product development; 24% in lighting specification/design; 21% in consulting, contracting, or system integration roles; and 17% as supply chain specialists. Less than 3% of respondents said they were facilities managers or building owners, while the 10% who selected “Other” listed roles such as manufacturer’s representative, manufacturer, specification sales representative, controls specifier, agency, network manager, or third-party test laboratory.

In a multipart question, 62% of respondents have worked on connected lighting projects in a lighting design and specification capacity, and nearly 41% indicated they also had systems integration experience on such projects.

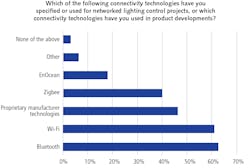

When asked to identify other connectivity technologies with which they had experience in a design/specification or product development capacity, most respondents listed Bluetooth (nearly 63%) and Wi-Fi (nearly 61%) at the top, with Zigbee in third (nearly 40%). Perhaps surprisingly, approximately 46% of participants have experience with proprietary manufacturer technologies, which many see as less desirable options due to potential interoperability issues and and futureproofing concerns.

Respondents who selected “Other” specifically cited experience with DALI (Digital Addressable Lighting Interface); DMX; Casambi wireless offerings (which are Bluetooth Low Energy–based); Zigwave (now known as Z-Wave and typically used for wireless home automation); and Raytec API (a proprietary application programming interface offered with Raytec illumination systems, which are networked via PoE or Internet Protocol).

In a ranking of connectivity technologies — PoE, Zigbee, Bluetooth, Wi-Fi, EnOcean, proprietary manufacturer’s products, or other — from most preferred to least preferred, PoE was mostly likely to hold the position of first or second choice technology. Bluetooth and Wi-Fi were equally ranked as the next choice, while proprietary technology again had a strong showing by occupying third place most often. In terms of security, survey respondents largely ranked PoE and proprietary products as very secure, with Bluetooth and Zigbee vying for the third most secure option.

Connected lighting value statements and use cases

We also asked respondents about the capabilities — or “value statements” — of networked lighting overall, of lighting control systems, and of PoE to gauge the audience’s perception of trends, advanced functionality enabled by connected systems, and the utilization of PoE.

Energy savings: In general, respondents recognized that low-voltage technology in connected lighting installations can produce significant energy savings. Approximately 18% strongly agreed with that association, and another 50% of respondents trended from slightly agree to agree. Only 8% strongly disagreed.

Dominance of wired versus PoE connectivity: More than half of survey participants agreed or strongly agreed that wireless connectivity will dominate lighting applications, while about 36% agreed or strongly agreed on PoE as a dominant choice.

DC grids: 69% of respondents agreed or slightly agreed that the efficiency of a DC grid will determine the extent to which PoE penetrates lighting applications About 6.5% strongly agreed, and 4% strongly disagreed.

Cable reliability and limitations: Regarding the technical capabilities of Ethernet, the majority of respondents agreed that the power limitations of PoE cable runs reduce its usefulness in commercial applications; nearly 20% strongly agreed; nearly 58% slightly agreed or agreed (combined); and less than 5% strongly disagreed. Respondents were more divided on whether PoE and Cat5/6 cabling poses a potential reliability concern for lighting systems. More than 10% strongly agreed that it is a concern; more than 50% agreed or slightly agreed, while those who disagreed made up the balance, approximately 38%.

In previous discussions, several industry sources cited doubts about Ethernet cable’s ability to distribute power without voltage drop over long runs. A 2017 US Department of Energy (DOE) report on connected lighting found cable runs in excess of 50m could see power losses of more than 5%. However, given the years passed since that report, cabling that delivers improved resistance and less voltage drop may conceivably be commercially available.

New construction versus retrofits: Survey participants were split on where PoE fits best for connected lighting projects. Only 9% of respondents strongly agreed that they preferred PoE for only new construction projects, while nearly 10% strongly disagreed. About 45% agreed or slightly agreed (combined response). Approximately 11.5% of respondents strongly agreed that PoE is suitable for most major renovations, with nearly half of respondents agreeing or slightly agreeing that it is suitable in retrofits. Another approximately 40% of respondents disagreed, with 11.5% strongly disagreeing.

Outlook and impacts on sustainable building efforts

Survey participants largely recognized the outcomes relative to the impact of installed networked lighting controls, including PoE, as important. These include incremental energy savings, energy and operations monitoring, demand/response capabilities, enabling IoT applications via lighting networks, improving worker experience in spaces, and enhancing worker productivity.

Likewise, respondents were bullish on the potential return on investment of specific IoT use cases, notably space optimization, hot-desk sharing, asset tracking, indoor wayfinding, and the integration of smart building environments. More than 73% of respondents indicated that they cannot recall a significant negative result from using PoE connectivity in their experience.

When asked in what percentage of connected lighting projects respondents use PoE alone, PoE plus another connectivity option, or a connectivity technology other than PoE, the average breakdown was 30% PoE, 27% PoE plus another option, and 43% another connected lighting technology altogether.

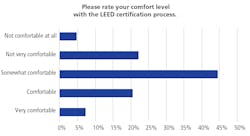

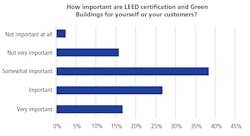

Finally, our survey aimed to gauge familiarity and perceptions regarding qualifications of connected lighting projects for green certification programs, such as the US Green Building Council’s LEED rating system. Although nearly 70% of respondents indicated that they know PoE could achieve a significant number of LEED points, as well as qualify for state and federal rebates, only 16% viewed such sustainability certifications as “very important” to them or to their customers.

Still, these particular responses might be reflecting the comfort level of respondents with the certification and rebate qualification processes — or rather the lack of comfort. Less than 8% of survey participants identified themselves as being “very comfortable” with the LEED certification process. This suggests opportunities for improved or simplified certification programs, or even an increased emphasis and availability of continuing education on such sustainability efforts.

Overall, the general outlook for PoE usage and its benefits in conjunction with connected lighting appears positive from our survey results. We invite readers to share their experiences with PoE and connected lighting technologies, and to suggest topics we should explore in future surveys.

CARRIE MEADOWS is managing editor of LEDs Magazine, with 20 years’ experience in business-to-business publishing across technology markets including solid-state technology manufacturing, fiberoptic communications, machine vision, lasers and photonics, and LEDs and lighting.

For up-to-the-minute LED and SSL updates, why not follow us on Twitter? You’ll find curated content and commentary, as well as information on industry events, webcasts, and surveys on our LinkedIn Company Page and Facebook page.