This article is reproduced by kind permission of DigiTimes.com, a Taiwan-based technology website.

Much happened in 2005 for the Taiwan LED industry with companies going through consolidations, a decline in shipments for handset applications, and slow penetration for new segments such as car-use and large-size backlighting.

Most LED specialists in Taiwan, whose sales were sluggish in the first half of this year, anticipate LEDs used for third-generation (3G) mobile phones, the car-use segment, and seven-inch LCD backlighting should stimulate demand in 2006.

Biing-jye Lee, president of Taiwan's largest LED chipmaker Epistar, recently sat down with DigiTimes to share his comments on what the Taiwan LED industry could do in 2006, in terms of new applications and mergers, to create a better business structure.

Strong handset demand should continue to drive LED shipments and be a major force among a variety of LED applications. What are the prospects for the handset-use LED market in 2006?

No doubt, mobile phone applications will still be the major growth driver for LED shipments, as half of overall LED output is for mobile phones. Annually, the worldwide mobile phone market could reach up to more than 700 million units, which definitely would stimulate LED demand.

Although growth for mobile phones is predicted to be limited next year, the adoption of white LEDs used in handset panel-use backlighting is still rising significantly. More handset models equipped with camera flashes could bring more use of white LEDs. Consequently, LED demand for handset applications, in terms of volume and value, is still looking positive in 2006.

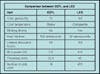

Companies that own patent licenses from international LED vendors should have opportunities to grab orders from international handset vendors. Five LED makers in Taiwan already license white-LED patents from Osram Opto Semiconductors and Intematix. Everlight Electronics, the first LED maker in Taiwan that received a license from Osram in 2003, turned out to be the most profitable company in the Taiwan LED industry by the third quarter of 2005.

In contrast, companies that cannot license white LED technology only land orders from China-based handset companies, whose orders are much different in terms of volume and prices when compared to orders from first-tier handset vendors.

The seven-inch LCD backlight market is considered to be the next major application for LEDs, following the handset segment. How do you see the demand?

The migration from cold-cathode fluorescent lamps (CCFLs) to LEDs for the seven-inch LCD panel-backlighting segment really depends on pricing. Unspecified LED players have cut the quotes for the segment to a new low of NT$120 (US$3.60) to stimulate market demand. Despite the pricing issue, LED technology will eventually end up replacing CCLF as a backlighting source.

In addition to the seven-inch backlighting segment, notebooks are another other LED application to keep an eye on. Companies like Japan's Sony, Fujitsu, and Toshiba each have rolled out LED backlight-based models. Compared to the battery life of eight hours that a standard notebook has, Sony's recent launch of the VIAO TX series can support up to 14 hours in battery life, without any significance compromises in the product's other design and functions.

What are your views about the car-use LED market in 2006?

In general, it takes a longer time to get through the verification process for car-use applications. However, the verification period by car manufacturers has been shortened from three years to two.

A takeover of United Epitaxy Company (UEC), which once cooperated with Osram in the past, will definitely assist Epistar in the AlGaInP (aluminum gallium indium phosphide) LED market. Epistar has received car-use LED verifications from two customers, while UEC has also secured one order from an unspecified car vendor. After our merger, Epistar expects to see more advantages in the car-use LED sector in 2006. I believe that the effect from the two companies' merger will become very pronounced in 2007.

In addition to the LED applications that you mentioned, what other potential markets could LEDs penetrate in the future?

New applications for LEDs still point to the LCD panel-backlighting segment, especially for large-size models. In my estimation, LEDs will not overtake CCFLs as the mainstream backlighting source for large-size LCD panels in 2006, but the overall LED market will grow dramatically in 2008.

In addition to the issue of price, a large-size LED-based LCD panel will need to be twice as efficient as a CCFL one in order to accelerate the switch over in technology. If the price gap between a large-size LCD panel based on CCFLs and LEDs narrows to only NT$3,000 (US$90), LEDs may have more of a chance to overtake CCFLs in the segment. The unit price of one-watt LEDs is predicted to go down to US$0.50, down from US$2-3 at present.

Moreover, specific lighting applications could be another area for the LED market to develop, such as replacements for neon lamps. Regardless, LED players will need to work on exploring the possibilities of utilizing LEDs in this segment.

Above all, total LED output is expected to grow next year. However, LED makers should be aware of possible bottlenecks, such as production scale, R&D improvement and patent issues, all of which are major factors affecting their full-year performance.

Do you think that mergers or acquisitions could be the best way for Taiwan LED makers to enhance their strength in the worldwide industry?

Taiwan LED specialists are used to positioning themselves competitively in the global market and the positive outlook actually attracted a number of new players to participate in the industry. However, oversupply of LEDs with too many players in the industry has led to irrational price-cutting. While facing lower average selling prices (ASPs) for LEDs and more competition, I believe that mergers will be the future trend for the Taiwan LED industry.

In fact, Epistar was once in talks about a possible merger with three LED players, before the deal with UEC. Even though an agreement between Epistar and UEC has been reached, there are still two companies that have expressed interest in cooperating with us.

For us, a merger between two companies doesn't mean that one of the two has to be eliminated completely. A merger is more about two companies complementing their product offerings, technologies, patent items, and customers to increase benefits. That was the major impetus behind the merger between Epistar and UEC.

What goals will the new Epistar initially target after completing merger procedures?

After the merger with UEC is completed, our first priority is not about how we expand our market share. Actually, the merged company doesn't have any specific goals to achieve next year. Instead, we will focus on stabilizing the operations of the merged company, as well as smoothly integrating and combining both sides' technologies and patents.

After the merged company is successfully reorganized, seeking cooperation with international vendors would necessarily be the next task for us but I cannot elaborate further on this point at this time.

After the merger, though, we plan to reduce the number of factories from nine at present to five, for easier management.

The purpose of merging for Taiwan LED makers would be to enhance their business structure and financial scale so as to stand a good chance of playing an important role in the global LED industry. South Epitaxy's earlier acquisition of Epitech and the merger between Epistar and UEC are just two examples, and more consolidations will take place in the Taiwan LED industry. Overall, I believe that collaboration could bring more positive effects to domestic LED players.

Would you like to talk about competition from China LED players?

In the short term, China-based LED players don't pose much of a threat to domestic [Taiwan-based] players. However, their strength in the LED packaging segment has gradually increased and we should keep an eye on their improvements.

As developing LED epi-wafers and chips takes a long time and needs plenty of technical R&D engineers, the threat from China LED chipmakers may take shape in 3-5 years. Despite the lack of technical know-how, China's human resources gives them the edge in manufacturing and production costs, which will encourage more Taiwan LED chipmakers to add production lines in China. This move to reduce costs, however, may give China players opportunities to steal our R&D talent.

Epistar and UEC are currently evaluating expanding production lines in two of UEC's China plants in Wuxi and Xiamen, after the merger. However, the shortage of power in the area is an issue that needs to be resolved.

How about the threat from South Korea LED packaging firms?

Supply is exceeding demand in the domestic LED industry and the oversupply has attracted South Korea vendors like Samsung Electronics to outsource more LED packaging capacity from Taiwan players.

Considering this as a supply chain for LEDs, collaboration between South Korea and Taiwan LED specialists could work really well. However, rising competition from the South Korean LED packaging industry in the future is inevitable when Samsung starts ramping up LED packaging output.