This article was published in the November/December 2012 issue of LEDs Magazine.

View the Table of Contents and download the PDF file of the complete November/December 2012 issue, or view the E-zine version in your browser.

+++++

There has been much interest in China’s efforts in the LED manufacturing industry and a debate on whether it is a failure or not. I believe that China will have one of the top 10 LED companies in the world within the next five years. With the enormous Chinese domestic market primed to consume LEDs, the market momentum behind low- and mid-power LEDs (Fig.1), the unrelenting support of the government, the proven speed of progress in the last two years, and the ability to spend money freely, Chinese LED makers have a recipe for success.

China’s LED background

China has been eyeing the LED industry since the early 2000s. For the longest time acquiring MOCVD technology and building reactors was the key target. However, after fruitless and frustrating years watching the LED industry take off outside China, the central government decided to encourage industry to purchase MOCVD systems in parallel with its own development effort in 2010. This “encouragement” effort escaped the central government’s control with local municipal government agencies offering subsidies for MOCVD systems, and free land and other incentives for the establishment of LED plants and companies.

There were three main types of companies that took up these offers; Chinese LED companies that the government had “anointed” including Xiamen SanAn Photoelectric Co (SanAn) and Elec-Tech International Co Ltd (ETi), Taiwanese LED companies like Epistar and Forepi, and the rest who saw the land as the most valuable part of the deal, or that aimed to go public as soon as possible and reap the profit. Many people outside China focus on the third group of companies that are literally dying, and conclude that China has failed in the effort to build a viable LED industry.

In examining the Chinese LED companies that are most likely to be successful, we will focus on SanAn and ETi.

SanAn at a glance

SanAn was founded in 2000 and went public in 2008. It is one of the pioneers in the Chinese LED industry and is focused primarily on making LED chips, but does not sell packaged LEDs. It has aggressively amassed talents from Taiwan and US in epitaxial and chip-manufacturing technology. There are 80-100 ex-Epistar engineers and a former high level engineering manager from Bridgelux working at SanAn. The company is the largest in China in terms of scope and capacity with 144 MOCVD systems and 60 more on order.

SanAn started a substrate business in 2012 and has other investments and subsidiaries in midstream and downstream sub segments of the LED manufacturing industry. In June 2012, it opened a R&D center in the heart of Silicon Valley in order to absorb talents from the US. SanAn’s activities are not limited to LEDs. In August 2012, it started a joint venture with Emcore and moved into terrestrial concentrating photovoltaic (CPV) systems.

ETi at a glance

ETi was founded in 1996 specializing in small household appliances and went public in 2004. In 2009, it decided to enter the LED business. In 2010, it paid Epivalley of Korea to license its epitaxial and chip technology via a joint venture. Various teams of engineers from Korea, Taiwan and US were brought in but they did not work harmoniously together. Currently, a team headed by an ex-Forepi engineering vice president has stabilized the production process. Out of the 60 MOCVD reactors installed, about 20 are in production. Another 70 are waiting at customs about to enter the country.

Table 2 summarizes ETi’s operations in 2011 and the first half of 2012. Again subsidies are counted in the profit figures. At this point LEDs account for a lower percentage of ETi’s revenue than at SanAn.

Chinese domestic market

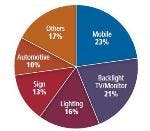

One harbinger of future success for the Chinese is the huge local market for products that use domestically-manufactured LEDs. The LED market, in China and globally, consists of lighting, mobile, large display, signage and automotive application segments (Fig. 2). China is one of the top producers and consumers in all of these segments. The key question to ask is: Are Chinese made LEDs “good enough” for the domestic market?

In the large-display segment, iSuppli reported that China produced 69 million LCD TVs in 2011 and 76% were made by domestic brands. This number is forecasted to grow to 96 million in 2016. Domestic consumption was about 40 million in 2011, up 15% from 2010. Beijing Optoelectronics Technology Co Ltd (BOE) is the largest panel manufacturer in China and fifth largest in the world. There had been rumors that BOE would make an investment in Forepi of Taiwan to to lessen its dependency on Korean LED suppliers. But in mid November, SanAn stepped in and invested in Forepi. Chinese LED makers haven't yet been the preferred supplier in large-display backlighting, and we will have to see how that changes over time.

In signage, China already makes 85% of all LED signage in the world and for the domestic market, most of the LEDs used are made in China. In automotive, analyst firm CSM says China is the largest producer at 14.5 million units in 2011 and it also has the largest single market for automotive. In April 2010, Chinese auto maker Chery created a joint venture with SanAn called Wuhu AnRui Optoelectronics Co Ltd to enter the automotive lighting market. With over 100 automotive manufacturers, there will be many opportunities for new LED suppliers. However, it will be a while before China can fulfill all the LED needs for this segment.

Lighting segment

Still long term, the biggest market for LEDs globally will be in general lighting. The focus of the Chinese LED industry has been on lighting, and according to GG-LED the Chinese domestic market for LED indoor lighting in 2012 will be RMB 25 billion ($4 billion). Many domestic LEDs have gone into lighting and the market is littered with poor quality items. However, the government is working hard to help sort out this chaos as we will discuss below.

It’s in lighting where the question of the quality of China-made LEDs comes to the forefront. Critics consistently harp at the Chinese LED makers for the lack of high-power LEDs. But the lighting market favors low- (0.01-0.1W) and mid-power (0.1-0.5W) LEDs for many products (Fig. 1). And technologically, those LEDs are not as challenging for the Chinese to make. High-power (0.5W-5W) and super-high-power (>5W) LEDs certainly have their place in the market, for example in outdoor lighting applications. However, Strategies Unlimited research showed that they only comprised of 33% in revenue (both InGaN and InGaAlP) in 2011.

In terms of efficacy, the Chinese manufacturers are a bit behind the state of the art for low- and mid-power LEDs. But SanAn claims 140 lm/W and ETi is probably at 100 lm/W, and those are suitable figures for many applications.

We can look at SanAn’s success in Taiwan as an example of a “good enough” level of performance. When SanAn opened an office in Taiwan last year, the main effect was further depressing market prices but no one seriously thought they would sell significant volumes in this LED kingdom. For the first half of 2012, however, SanAn sold about RMB 40 million ($6.3 million) worth of chips according to GG-LED. The forecast is for total sales to hit RMB 100 million ($16 million) for 2012. Granted, most of the buyers bought the chips to be packaged for the Chinese domestic market. Still, the fact that they have taken business away from the entrenched local manufacturers on their home turf is shocking.

The muscle of the government

The Chinese government will also come into play in terms of the quality required in LEDs relative to specific applications. Take the replacement bulb. If one takes the 50,000-hr lifetime the US DOE set as a requirement, we can basically ignore most of these Chinese products. But as the world ponders whether we really need a light bulb to last 25+ years, the Chinese government is working on setting its own standards for much shorter lifetime with its own set of testing methodologies, criteria and facilities.

The looser performance goals will reduce the bill of materials and the cost of LED lighting. At the same time, if the testing is carried out rigorously and sub-standard products are forced out of the market, the lessened requirements will actually foster a more uniform market.

One may doubt that government intervention will work, pointing to the fiasco surrounding the “Many Cities, Many Lights” street lamp project in 2010. Another way to look at this intervention is that the money wasted previously was a “tuition fee” paid to learn how to do it right. The second round of this street lamp project and specifications of the RMB 2.2 billion ($349 million) lighting subsidies were much tighter. Remember, the decision makers do not get voted out of office so they get a chance to pay to learn.

The government is doing everything it can to develop the LED industry. The list of LED lighting companies that are eligible to receive RMB 2.2 billion ($349 million) in subsidies consist of only two non-Chinese companies, Philips Lighting and GE Lighting. The government’s 12th Five Year Plan dictates that 70% of LEDs used in China will be made domestically by 2015. That means a guaranteed market for the Chinese LED makers.

“Opium” of the trade?

Looking at the revenue and profit numbers of SanAn and ETi, it is obvious that they are reliant on the subsidies. The fact is that the government will not let these two companies, and a few others, fail. The shortage of energy is a national security issue for China. To be able to control key technologies like LEDs is vital. Besides direct subsidies and all the visible assistance, channeling major contracts to these companies is another way to support them.

Epistar and other companies have been crying foul that they are competing with SanAn and the likes who sell at prices below cost because their land is free and their cost is offset by subsidies. Taiwanese products are sold at premium due to higher quality but the prices are not high enough for them to make money. Looking at the books of Taiwanese LED companies, profit is lacking. In fact, Digitimes had reported that SanAn planned to invest into Taiwan's Genesis Photonics, a firm known for its green LEDs. With the recent Forepi investment, that may or may not happen.

Critics of these subsidies called them “opium” for the LED makers. While we do not see the “opium” going away at any time soon, the fact that the subsidies are much lower for these two firms in 2012 than 2011 is an indication of a trend. Hopefully, for all the competitors, when the subsidies end, the market will approach normality again.

IP lacking

IP and licensing agreements are an obvious missing link in the Chinese LED makers becoming worldwide players. In the domestic market, IP does not matter. Currently, Chinese packagers will use foreign chips, made by manufacturers with IP portfolios, when they know their products will be sold overseas. Alternatively, companies with IP portfolios, like Osram and Philips, will OEM products from China and their IP will protect the Chinese chips and packages inside.

One potential path for the Chinese LED makers to break through the IP wall is to buy one of the companies with IP. The Chinese maker may be willing to pay more than just the financial face value of the target company. For them, they will be buying a leg up in the technology ladder, a door to the outside world and the future.

For the target company, it is actually a good thing. The seller will net a handsome profit. The target company will have access to the Chinese market and more funds to support its future R&D effort. For the rest of the industry, it will be a shock that will have lasting effects.

What’s missing?

The major missing ingredients that money cannot buy in this theoretical plan are management maturity and R&D leadership. Both SanAn and ETi are relatively young companies in the LED business that have grown very fast. To be able to buy a non-Chinese company and manage it is no easy feat – just ask Lenovo. Even if one buys a world class LED company, how does one keep its talents?

Buying complete engineering teams to set up a fab overnight is one thing, choosing the right directions to follow in R&D is much harder. A company needs good R&D leadership and healthy marketing infrastructure to provide input. Chinese companies are always leery of marketing. To be successful, the companies will need to be more open and increase communication with the rest of the world.

Still, I believe at least one Chinese LED maker will have a seat at the table of top 10 LED companies in the world within 5 years. The combination of the huge domestic market, subsidies, and low costs will enable success.