Our first HortiCann Light + Tech conference took place on Oct. 31 in Denver, CO, ironically coincident with an early snowstorm that served as a clear reminder that you can’t grow plants outdoors year-round in many places. Indeed, the HortiCann program addressed greenhouse operations, especially with supplemental LED lighting, and a number of applications that are completely dependent on solid-state lighting (SSL) indoors. The program wavered between science and business and there were compelling presentations on technology beyond lighting that will be critical to the success of controlled environment agriculture (CEA). Indeed, all environmental systems must be automated and even artificial intelligence will come to play in determining plant needs. We have chosen here to highlight a few of the sessions, especially a few that delivered on our expanded HortiCann focus covering technology beyond lighting, and also explicitly welcoming cannabis presentations given the widespread move to legalize that cultivar.

We’ll get to the good stuff here in a second, but first let’s review the background behind our recent event —and sorry to those who know the story. We had planned the Oct. 31 event as our 4th Horticultural Lighting conference. In fact, we had held the second of those events in 2017 in Denver. And last year we were in Portland, OR.

But while planning the 2019 event we noticed the increased importance on integrated technology in efficient growing operations. Both the lighting and other environmental conditions need to be under real-time control. The papers proposed to us made that clear, and also established the interest in more coverage in cannabis. So we expanded the scope of the event and adopted a new name or brand that more closely matches the mission.

Keynote presentation

Let’s now get into some details of what we felt were very significant sessions, starting with the Keynote presentation. Neil Mattson got the HortiCann program off to a start by setting the scene for both the opportunities linked to CEA but also framing the potential roadblocks that lurk (Fig. 1). Mattson is a professor at Cornell University and a leader in the Greenhouse Lighting and Systems Engineering (GLASE) Consortium. He described himself, however, as a “lowly plant physiologist.”

In reality, Mattson’s work is focused on how to feed a growing global population in the most efficient and sustainable way possible. That work centers on research primarily in CEA settings such as greenhouses where SSL is typically used to supplement sunlight. About researchers such as himself, Mattson said, ”The greatest service we can provide is training the next generation of students.”

HortiCann speakers would go on to address numerous scenarios throughout the day, ranging from vertical farms or indoor operations where artificial light is the only light plants receive, to greenhouses with supplemental lighting. In the greenhouse application, supplemental lighting extends the growing season and boosts yield, resulting in a growing (pun intended) proliferation of greenhouses with lighting in the US and around the globe.

“In the US, for example, it’s been estimated that there is going to be an almost 20% increase in lit area per year over the next several years,” said Mattson. Citing data from Mordor Intelligence on the hydroponics market, Mattson said the value of CEA crops climbed by almost 10% between 2014 and 2019, reaching $25.6B (billion) annually. The growth will continue at a shallower 6.8% rate through 2024.

Growth and energy

Mattson implied that the growth in production is due largely to an increase in CEA supplemental lighting. Back to that 20% growth in lit area through 2025 predicted by the US Department of Energy (DOE) — such a growth rate is good news for the growing population that needs access to healthy and quality produce, but it comes with a cost in terms of energy and the environment.

Spoiler alert here, but as you might expect, LEDs come to the rescue. Indeed, the DOE said that if conventional lighting were used and the expansion of lit-area projects holds true, CEA would result in an increase in energy consumption from 6 TWh in 2017 to 33 TWh in 2025 — in the US alone. That increase in energy usage is equal to the need for six additional large power plants in the US. Installing LEDs in new lit areas and retrofitting existing lights with LEDs will deliver significant energy savings just as has happened in general illumination.

We are in the very early stages of that LEDification process. In 2017, LEDs were only present in 2% of the greenhouses in the US. Cannabis operations were slightly better with 4% SSL in the installed base.

Is CEA effective?

The presentation then took a surprising turn. Mattson explained that CEA is no panacea; it’s not a clear-cut winner compared to field-grown crops. Indeed, a full-lifecycle comparison of CEA- and field-grown crops is something that Mattson and his colleagues take seriously and have undertaken with funding from the National Science Foundation.

Mattson presented data from a chapter in an upcoming book titled Food Supply Chains in Cities: Modern Tools for Circularity and Sustainability. Mattson was among a number of researchers that collaborated on the chapter.

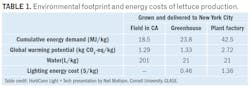

The focus of the chapter is a three-way comparison of the environmental footprint of lettuce including the growing process and delivery to the market in New York City (Table 1). The comparison pitted lettuce grown in California fields to lettuce from a greenhouse with supplemental lighting near New York to a vertical farm or plant factory located directly in New York City. The comparison accounts for transportation costs as well as the environmental impact in the growing operation.

As you can see in the table, the California-grown lettuce wins out in terms of cumulative energy use and in terms of carbon emissions. Only in terms of water usage is the field at a disadvantage. And the vertical farm needed $1.36/kg of lettuce in lighting energy costs alone while the greenhouse needed $0.46/kg.

Still, Mattson found good news in the results. He said a similar study conducted ten years ago and based on conventional lighting showed an even greater advantage for the field. And LEDs keep increasing in efficiency while researchers better understand how spectrum can boost yield. Mattson did not address produce quality. But clearly the lettuce trucked across country would be inferior. Moreover, the world simply lacks the amount of arable land to grow enough food in the long term.

GLASE research

Next, Mattson turned to the GLASE research work. GLASE is a joint program conducted by Cornell along with Rensselaer Polytechnic Institute and Rutgers University. GLASE was funded by NYSERDA (New York State Energy Research and Development Authority). The $5M (million) program is ultimately intended to guide commercial product development. The researchers have 350 technology milestones and are working in commercial-scale labs/greenhouses.

Acknowledging the high cost of entry tied to installing SSL, Mattson said GLASE hopes to take the risk out of the investment and ensure growers can achieve reasonable payback time using SSL and other technology systems. The organization has broken the research into seven technology development areas:

- Dynamic LED systems

- Energy efficiency

- Controls integration

- Pilot demonstrations

- Spectrum and plant sensing

- CO2 enrichment

- Engineering and modeling

The high-level goal is to reduce energy use for lighting by 70% relative to a 2014 baseline. Some of the savings come from efficient LED sources, but all the elements will potentially impact lifecycle savings relative to yield. The idea is that the savings compound. Just using LEDs may reduce energy use by 50%. The light and CO2 control could add 30% savings to that reduced total — essentially a multiplicative effect. The researchers know that savings in what Mattson called PAR (photosynthetic active radiation) efficacy have already escalated tremendously, and additional savings must come from the other elements and essentially improved productivity.

The greenrush

Turning to cannabis, HortiCann delivered clear evidence of what is being called a greenrush by some in the industry. In some cases, investors to growers to building contractors to security firms to SSL manufacturers have adopted a goldrush-like mentality pursuing the cannabis market. And

as we will discuss in a moment, the pot of gold is real although it may be fleeting, whereas feeding the world populations is not an application that’s likely to saturate. Still, it’s interesting to see the greenrush disrupt the horticultural lighting market in much the same way LEDs began to disrupt general illumination a decade back, and we recently published a column discussing that trend with SSL manufacturers flooding the cannabis market.

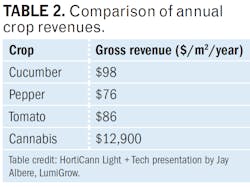

Jay Albere, CEO of LumiGrow, was first up discussing cannabis (Fig. 2). And he made an extremely simple but profound statement about cannabis as a cultivar and market sector saying, “It is different.” Then he led the audience through the differences both in terms of the market and growing technology.

First consider the magnitude of the market. Albere said it’s $12B (billion) this year. He said contemplating that number led him to researching what a $12B market looked like. “E-commerce for cars is a $12B global market,” said Albere. Projected by some prognosticators, the market could reach

$60B globally by 2025. “That figure is equal to the global market for jeans,” said Albere.

Consider how that makes cannabis different. Albere asked, “How many multi-billion-dollar markets can you not sell your products across state lines or you have to pay your taxes in cash?” He said, “If you are growing in a sole source environment with 1000W high-pressure sodium [HPS] lights, then you are the same power density as a data center.” Back in 2012, Albere said there was data to indicate 3% of the power load in California was already from cannabis production. He quipped, “I can’t even imagine what that is today.”

The money

Next, Albere turned to the driving force behind the greenrush. Summarizing, it has something do with that old pro-sports-related movie quote: “Show me the money.” Albere related the experience of two different growers in Canada that each had 30-acre greenhouses growing peppers. Each converted those greenhouses to cannabis. The gross revenue exploded from less than $100/m2 to $12,900/m2. Table 2 shows comparisons with multiple vegetables and cannabis. He said growers in the US aren’t seeing quite those numbers, but cannabis remains far more lucrative than vegetables. Still, he said there are small growers in the US with specialty strains, somewhat like the craft beer industry, that make even more revenue per area.

Already, however, the bubble has begun to burst in some markets, according to Albere. Colorado, the oldest legal recreational market in the US, is not surprisingly the best example. Albere said the wholesale price per pound peaked in Colorado around July 2017 at about $1300. Two years later, the price had dropped considerably but stabilized at around $850 per pound. At one point between October 2017 and October 2018, that was a 40% decline. And remember that price fluctuation or price compression happens on a state-by-state basis in the US.

Maturation and scale

Of course, everything is changing up and down the supply chain. Albere said the only reason that 1000W HPS lights became the standard grow light is they were available due to the street-light market (Fig. 3). Today, most utilities and municipalities have written off such lights for street lighting, but some cannabis growers are still using them. The upstart market used what it could find early on.

Albere’s point was simply this: Cannabis is evolving into a big industry and technology is now coming to play. Moreover, growers will not be able to absorb the dynamics of the market without solid technology in place of whatever happens to be available. Of course, LED lighting is part of that story, but connected lighting, the Internet of Things (IoT), smart sensors, and more will complement the lighting, both reducing energy use and maximizing yield. The old approach just won’t scale. The maturing market demands scalability and Albere said LumiGrow is one company that can enable scalability. The company has long supported connectivity, and it recently added options for cameras that can detect pathogens and diseases before the plants are damaged.

Albere also made one other point about moving forward. For the most part, universities have been forbidden to work on cannabis whereas crops such as tomatoes or petunias have had professors hard at work optimizing yield. The fact in the US that hemp is now legal across the nation has resulted in universities having the ability to research hemp — and that will further make closely-related cannabis a more scalable crop. Moreover, Albere said the expectation is that state boundaries will also fall in the not-so-distant future.

Spectra and plants

Later, the HortiCann agenda transitioned from a business perspective on cannabis to purely a scientific outlook. Noah Miller, CEO, and Kevin Frender, CTO and CSO (chief science officer) of Black Dog LED, took the stage. The company is based in Colorado and was among the first SSL companies to emerge with a specific focus on cannabis back in 2010. The company has long championed its research on spectrum and the impact on plants.

Indeed, Miller immediately stressed that the presentation would be on plant morphology, which he described as the physical outcome you can see with plants exposed to different spectra. The talk also considered spectral effect on photomorphogenesis and physiological effects. Frender simplified the scope, saying that spectra impacts internodal spacing, leaf size, and apical dominance. The idea is to select spectra by cultivar to optimize different plant characteristics such as stem, flowers, or fruit.

As an example, Frender said NASA has continued research in growing lettuce on the International Space Station to boost yield by getting the biggest leaves possible. “When people take that research and say, ‘NASA says this is the perfect spectra for growing plants,’ and then you apply it to growing cannabis, you get the biggest leaves possible,” said Frender. But he asked rhetorically whether that is really what you want on your cannabis plant.

He said, “If you are growing cannabis plants, then probably you are not growing them for their leaves.” The message was that the energy the plant uses to grow big leaves comes at the expense of growing big flowers. Moreover, he said smaller leaves allow more light to penetrate the canopy, again helping the flowering process.

Internodal spacing

Next, he addressed internodal spacing or the distance between nodes of a plant. Internodal spacing determines stem size. But long stems can be bad for several reasons with a cultivar such as cannabis. The longer stems can flop over and destroy flowers, and again the plant has to spend energy growing those long stems. Spectra that can keep internodal spacing short can yield a more manageable plant that can devote more energy to flowering. He said short internodal spacing is especially critical for grows using a vertically-stacked environment and that you can get the same yield off of a 2-ft-tall plant that you get off a 5-ft-tall plant. On the other hand, Frender said you might want longer stems if you are growing hemp for fibers.

Next, Miller took back the microphone to discuss apical dominance — the phenomenon where the central stem of a plant is dominant over side stems. Miller said you can get a taller and narrower plant, or what he called the “pine-tree effect,” with many main stems towering over the remainder of plants. He explained that a more ideal result is a flat canopy with many of the side stems growing horizontal and then upward, ultimately being the same height as the main stem. He said gigantic main colas or stems introduce fungal problems in the center of the plant and deter flowering on stems.

Photomorphogenesis

Next, Frender broached the subject of photomorphogenesis, or impacting the secondary metabolites in a plant. As we have heard at past Horticultural Lighting conferences, ultraviolet (UV) energy can favorably impact the smell, flavor, color, and chemical composition of plants. In the case of cannabis, growers can use UV to influence THC, CBD, terpene, anthocyanin, and other content. We have had speakers at our conferences suggest that you simply need to expose a plant to UV late in the growth cycle to achieve such results. But the Black Dog team believes that you should have UV as part of the spectrum throughout the plant growth cycle.

The detail provided was really quite compelling, but is beyond what we can cover here. Frender discussed how temperature and vapor pressure interact with spectra, and really how almost every growing operation is different. And the Black Dog team has always been among the most open of the horticultural lighting manufacturers, providing many of these research details on its website.

Strategies Unlimited research

We closed the day presenting some of the research data that our sister organization Strategies Unlimited has published recently. The data came from a number of different reports, such as one on horticultural lighting, that you can peruse on the Strategies Unlimited site. Here we will just offer a quick summary of some data from the North American Cannabis Lighting Market report that was published not long before HortiCann.

The one thing we can’t show you here in an article is a neat animated graphic that Strategies Unlimited created which visually emphasized the momentum in the cannabis market. Those of you attending Strategies in Light in February will likely see the graphic during a Plenary presentation by Bob Steele. But the market has moved very quickly.

In terms of legal growing operations in North America, there was just over 20M ft2 of cannabis canopy in 2018. That number will grow to near 45M ft2 of canopy by 2023. As we hinted at earlier in the article, LED lighting is not widely installed in such applications today. In 2018, LEDs penetrated well under 5M ft2 of canopy and that is projected at near 10M ft2 of canopy in 2023.

Still, the revenue potential is substantial for SSL. There was just over $70M in LED lighting sold into the North American cannabis market in 2018. By 2023, that number is projected at near $288M. We are looking at a market growing at a rate of more than 30%. And as the techniques of success with SSL and cannabis become more widely known, we could see even greater growth via retrofits. And there you have the lighting part of the great greenrush of 2020.