The outlook for commercial lighting rebates is strong this year, with substantial incentives available for owners planning to invest in energy-efficient lighting and controls for existing buildings. Active commercial lighting rebate programs cover nearly 80% of the U.S., with the largest programs occurring in the Northeast and the Northwest.

This is one finding among research by rebate fulfillment provider BriteSwitch, based in Kingston, N.J., which shared topline data from its 2023 rebate database with the Lighting Controls Association.

This article will dissect this and the following trends identified by BriteSwitch: Average LED and lighting control rebate dollar amounts remain stable; select LED replacement lamp rebates are in jeopardy; horticultural lighting and networked lighting control rebates continue to grow in availability; and substantial rebates for electric vehicle (EV) charging stations are being offered by utilities and governments.

Energy efficiency rebates are funds invested by utilities and organizations to avoid the higher cost of building new power generation infrastructure. For lighting practitioners, the rebates are a mechanism by which they can reduce initial cost and incentivize owners of existing buildings to invest in energy-efficient lighting and controls.

The rebate may be prescriptive (downstream), meaning it offers a financial reward for each qualifying product installed in an approved project; this is the most popular rebate type and fairly straightforward to execute beyond an administrative process. Point-of-sale (midstream) rebates are instant rebates realized at the point of purchase. They are typically limited in availability and focused on common lamp types and luminaires. The third type of rebate is custom, typically applicable for innovative projects that push the boundaries of prescriptive rebates.

Rebates home in on LED solutions

Commercial lighting rebates track changes in technology and costs. Currently, LED is the main lighting technology promoted by prescriptive rebates, which include popular product categories. Owners of existing buildings in a rebate territory are eligible to receive the rebates.

Table 1 lists popular LED rebates and average dollar amounts across North American 2023 rebate programs in the BriteSwitch database. Interestingly, after years of decline in value due to falling product costs, rebates have stabilized over the past three years. The cause may be a combination of market stabilization and reduced demand during the COVID pandemic. This year, average rebates modestly increased, most likely because of inflation.

An interesting takeaway from Table 1 is the big increase in average rebate dollars for LEDs designed to replace traditional general-service lamps. This is likely a final push to promote these LED products before the conventional lamps they replace are phased out by the Energy Independence and Security Act’s backstop energy standards, which take effect in July. As a result of the expectation that many traditional general-service lamps will be removed from the market, many rebate programs for LED replacements will end, according to BriteSwitch.

The growing reliability of rebates for horticultural lighting is another compelling trend. Between 2021 and 2022, the number of rebates tripled, with many offered as prescriptive rebates rather than the custom approach historically used. In 2023, the number increased again, though more modestly, to 677 programs, with approximately 60% as prescriptive rebates averaging $110 per product, according to BriteSwitch. This reflects growing interest in rebate programs to cultivate energy savings in this market with LED options that the program operators see as viable.

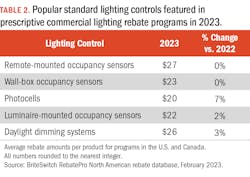

Lighting control rebates

While rebates for lighting controls have remained substantial and relatively stable over the past 15 years, networked lighting controls continue to grow as a key subcategory, according to BriteSwitch data. Table 2 shows the most popular rebates for common automatic lighting controls this year. (Networked lighting control rebates are not shown because approaches remain unstandardized.) Overall, these rebates can make common occupancy and daylight-responsive controls an attractive upfront add-on for an LED retrofit.

Of additional interest to this category is that a majority of programs qualify products as eligible for rebate by requiring their inclusion in the DesignLights Consortium Solid-State Lighting Qualified Products List (DLC SSL QPL). Listed products must satisfy certain technical requirements. Version 5.1 of the SSL QPL requires dimming controllability for a range of products and continuous dimming for most indoor luminaires and retrofit kits.

Note that DLC listing is not required for standard lighting controls, though prescriptive rebate programs often require it for networked lighting controls. In 2016, the DLC launched a QPL for Networked Lighting Controls to support the category, as its research demonstrated significant energy savings for this technology. In 2023, the number of rebate programs promoting networked lighting controls increased 16%, bringing the total to more than a quarter of all prescriptive rebate programs, according to BriteSwitch. If a prescriptive rebate is not available, the installation may be eligible for custom rebates.

Rebate programs are experimenting with how best to promote networked controls, with some basing their message on energy reductions, power savings, controlled wattage, or controlled luminaires. Many programs have adopted incentivizing it as a rebate adder per luminaire connected to a qualifying networked lighting control system. According to BriteSwitch, the average rebate per LED luminaire installed with and controlled by a networked control system is $204.

EV charging stations

Admittedly separate from the lighting industry, the availability of substantial rebates incentivizing electric vehicle charging stations presents a new and rapidly expanding market for electrical contractors and distributors. According to BriteSwitch, 53% of the U.S. has a rebate for residential applications and 65% for commercial/public/fleet use.

Unlike energy efficiency rebates, both utilities and various levels of government are offering EV charging station rebates, with programs often running separately and parallel to energy efficiency rebates.

Though these projects do not involve lighting, they may provide an opportunity for lighting practitioners via electrification integration. As EV charging is costly and may require significant electrical additions, the building owner has an incentive to minimize overall energy consumption, creating new value for upgrade options such as networked lighting controls that can not only maximize energy savings, but also deliver ongoing energy information.

Rebate outlook

Lighting remains the most promoted category in utility prescriptive rebate programs, presenting a potentially substantial avenue for reducing the initial cost of advanced lighting and controls and increasing their adoption. To learn more about rebates, owners can contact local utility programs where available, a rebate fulfillment firm, or manufacturers that offer marketing support. Research each applicable program, as they generally pose different requirements for preapproval, product qualification, and inspection.

This article has been expanded from the abridged version that appears in the April/May issue of LEDs Magazine.

CRAIG DILOUIE is education director for the Lighting Controls Association, a council of the National Electrical Manufacturers Association that educates the public about lighting control technology and application.

Follow our LinkedIn page for our latest news updates, contributed articles, and commentary, and our Facebook page for events announcements and more. You can also find us on Twitter.