In the February 2011 issue of LEDs Magazine, we looked at two critical materials in the LED manufacturing supply chain, namely sapphire wafers (used as the starting template for most LED chip growth) and phosphors, a group of different materials that are used to create white LED light.

Metal-organic (MO) precursors

Metal-organic (MO) chemicals or precursors are used in the epitaxial growth of LED semiconductor materials to provide metals such as gallium (Ga), indium (In) and aluminum (Al) to the growing layers (see “Epitaxial growth” section - below).

Trimethyl gallium (TMG) is most in demand, not only for growth of most types of LEDs but also for many other compound-semiconductor devices including gallium arsenide (GaAs) electronic devices, and DVD and Blu-ray laser diodes.

During 2010, in the face of growing demand from the LED market, several major MO suppliers took steps to increase their production capacity (see “MO suppliers address demand” section – below).

Joe Reiser, Dow Electronic Materials’ global business director for Metalorganic Technologies, told LEDs Magazine that, for the LED market as a whole, backlighting applications took off more rapidly than expected last year. This meant there was “some tightness in the market” in terms of MO supply, he said.

This situation resulted in the capacity-expansion announcements by various suppliers. However, said Reiser, “Dow’s plans were already in place before our formal announcements were made.”

In Reiser’s opinion, the tightness should resolve itself in the next couple of quarters. He explained that Dow keeps a close eye on the market for LEDs, particularly in backlighting and lighting applications, so that it can address the market demand looking several years ahead.

While Reiser was not free to discuss specifics related to pricing, it’s clear that prices have risen during the last year, as a consequence of the supply tightness. However, there have not been any significant price spikes.

When considering starting materials, MO suppliers are primarily concerned with the price and availability of Ga and In, while Al is much more widely available. Reiser said that Dow has contacted its key suppliers of these materials, and feels the company is in a “pretty good position” with substantial agreements in place. Of course, Dow is a very large, global company that enjoys substantial leverage with its suppliers.

Epitaxial growth

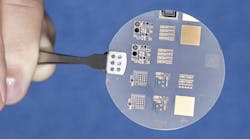

Epitaxy is the process of depositing a high-quality crystalline layer of material onto a crystalline substrate. In the fabrication of LED chips, epitaxy takes place inside a metal-organic chemical vapor deposition (MOCVD) system or reactor. For LEDs based on gallium nitride (GaN), the substrate is usually sapphire, and multiple layers are grown to create the specific LED structure.

Metal-organic (MO) chemicals or precursors provide the source of metallic elements such as gallium (Ga), indium (In) and aluminum (Al). In trimethyl gallium (TMG), for example, the metal Ga is attached to methyl groups (the “organic” part). In the MOCVD reactor, TMG breaks apart and Ga is supplied to the semiconductor layer growing on top of the heated substrate wafer. To grow GaN, nitrogen is also required, and this typically comes from ammonia. Other elements called dopants are also introduced to influence the current-carrying ability of different layers, creating either p- or n-type material.

All the materials introduced into the MOCVD system – MO precursors, dopants, ammonia, As and P sources (for GaAs-based LEDs), and hydrogen carrier gas – must be supplied with high purity, to prevent impurities being incorporated into the epitaxial LED layers, which would then affect the performance of the processed LED chips.

MO suppliers address demand

MO suppliers have made a series of announcements in the second half of 2010 and early 2011:

- Dow Electronic Materials: In November 2010, Dow Electronic Materials broke ground for a new MO precursor manufacturing plant in Cheonan, Korea. This is part of a multi-phase plan http://www.ledsmagazine.com/press/23067 announced in June 2010 to expand TMG production capacity to meet the surging global demand for the material in the LED and related electronics markets. The Korea facility is expected to be operational in early 2011. Dow said that its capacity expansion in the US at existing facilities is also progressing as planned, with new capacity expected by the end of 2010 and continuing through the first quarter of 2011. Total additional capacity resulting from the multi-phase plan is expected to be 60 metric tons per year. Dow Electronic Materials currently manufactures TMG and other MO precursors in North Andover, MA, while packaging is done in both North Andover, MA, and Taoyuan, Taiwan.

- SAFC Hitech: A member of the Sigma-Aldrich Group, SAFC Hitech said in December 2010 that it would build a new, dedicated facility in Kaohsiung, Taiwan for transfilling, technical service and production of LED and silicon semiconductor precursors. Expected to be operational by late 2011, the facility will extend the company's ability to serve the Asian market. Back in March 2010, SAFC Hitech invested $2 million (approximately GBP 1.2 million) in expanding production of TMG at its UK manufacturing plant in Bromborough, Wirral.

- AkzoNobel: In June 2010, AkzoNobel doubled its production capacity for TMG at its production facilities in LaPorte, Texas, USA. In a further announcement in November 2010, AkzoNobel said that continued strong demand had already fully adsorbed the enlarged capacity. Hence, the company has decided to double its TMG production capacity again. The increased volumes will become available in February 2011.

- ATMI and Lake LED Materials: ATMI, Inc. has purchased a minority interest in Lake LED Materials of Daejeon, South Korea, a materials technology start-up focused on providing MO precursors to the LED market. Under the agreement, ATMI will help accelerate commercial LED materials introductions, with select marketing and technology rights. ATMI says that the collaboration represents its first step in a multi-faceted strategy for addressing process efficiency opportunities in the LED market.

- Albemarle: At the end of November, Albemarle Corporation said it would increase prices globally for all grades of trimethyl aluminum (TMA) by 25% for shipments beginning January 1, 2011 or as contracts allow. The company said that the price increase will increase its investment in the best quality product, safest shipping containers, and efficient global distribution. In September 2010, Albemarle said it would build a production facility for TMG in Yeosu, South Korea. The site will effectively mirror Albemarle's TMG capabilities located in Baton Rouge, Louisiana. Production is scheduled to begin in early 2011.

- Chemtura and UP Chemical: US-based Chemtura Corporation and Korea-based UP Chemical Co., Ltd. have formed a joint-venture company to manufacture and sell high-purity MO precursors for the LED market, with particular focus on the South Korean market and the broader Asia-Pacific region. The JV, named DayStar Materials, LLC, expects to have fully integrated manufacturing capability for TMG and TMA in Korea by late 2011.