Lumileds has a very long history traversing the transition in lighting from conventional sources to LEDs. Originally a joint venture of Philips and Agilent (HP), the company was fully acquired by Philips Lighting and then sold, along with Philips Automotive Lighting to Apollo. Now, as a privately-owned company the challenge of transformation, transition, innovation, and continued growth falls on Matt Roney who took over as CEO in October 2020, after joining Lumileds to run the company’s automotive business at the start of 2020. Roney recently talked about his decision to join Lumileds, his view of the solid-state lighting (SSL) transition, Lumileds' place in the industry, and his mission to advance the company in four business segments.

LEDs Magazine: Thanks for doing this interview, Matt. We haven’t had the chance to talk before or meet during the pandemic year, so what I know about you is really limited to Lumileds press releases. Can you tell us what led you to the semiconductor and lighting space, and Lumileds in particular?

Matt Roney: Thanks, Maury, it’s nice to meet you, virtually, and to share a bit about me and Lumileds. You asked about what led me to this industry and this company at this time; the answer is pretty simple. My forte is business transformation. It’s something I’ve done in a number of industries and in different circumstances, including private equity ownership. Shortly after my last firm, Paladin, was acquired by Stanley Black & Decker, I became familiar with Lumileds and, like so many others, was quickly hooked on and excited about the solid-state lighting sector. It’s a sector in transition. The first twenty-plus years have established the sector; I think, though, that the next twenty years will be transformational.

LEDs: I take your point about a business sector in transition, but what specifically attracted you to Lumileds?

Roney: Lumileds’ potential to innovate and shape an entire sector was an eye-opener. I am drawn to highly technical companies in complex operating environments with innovation as a driving force, and Lumileds has it all.

Lots of people, probably most of LEDs Magazine’s readership, think of Lumileds as the LED manufacturer they’ve known since 1999. But today, with the integration of Philips Automotive Lighting, we’re a global company with a 100-year heritage — we have conventional lamp factories serving the global automotive aftermarket industry, so we still have a significant operation that will continue to transition from conventional lamps for many years. I found Lumileds to be a fascinating company with this long, rich history of innovation and technological firsts. The first automotive LED daytime running lights and the first LED headlight with Audi, the first TV backlit with LEDs, the Sony Qualia 005, the first LED camera flash for cell phones, and the DOE L Prize-winning first 60W bulb replacement.

"I am drawn to highly technical companies in complex operating environments with innovation as a driving force"

On top of that, there’s an extraordinary employee base at Lumileds. You’d expect a CEO to make that claim, but in Lumileds’ case, we have people that are the inventors and innovators of both the technology and the development of the markets we compete in. I joined Lumileds to run the automotive business, and I couldn’t be more excited now diving headfirst into my role as CEO.

LEDs: What kind of transition challenges have you found since joining Lumileds?

Roney: Well, in normal times I’d probably talk about headwinds in the auto industry, the ongoing integration of two different and significant business units, and the transition of a conventional manufacturing effort to one for solid-state lighting. Navigating these challenges with a company that has an amazing foundation and ensuring that we’re on a growth trajectory is normal — and we’ve focused on that — but this has not been a normal fourteen months.

LEDs: How has COVID-19 impacted Lumileds?

Roney: It may be counterintuitive, but I think we’re stronger for it. The company, our people, really know how to manage through change and transition. COVID got thrown on top and the employees really stepped up. They navigated the complete shutdown of the automotive industry for a few months. And then they managed the shutdown and restart of our operations for operations that don't get shut down very often, especially without lots of planning. We kept operating throughout, investing and innovating, and now we’re seeing the rewards of the global effort that it took to get us through. It has really been a remarkable accomplishment as a company.

LEDs: In terms of the LED transition, in general I would say the LED industry was pretty far through that transition when you came aboard. Maybe in the auto sector it wasn’t as far along as it would be in the general lighting sector, but the solid-state lighting transition was pretty much a done deal.

Roney: Well, there are still an awful lot of sockets out there that have conventional bulbs. So for many in illumination, it may look like the transition is pretty much a done deal, but there’s still a tremendous amount of innovation happening with everything from human-centric lighting and horticulture to micro LEDs — not to mention the integration of controls, IoT, and smart lighting that you wrote about recently and noted that there’s still much to be done. Fulfilling the promise of LEDs is not yet complete, in my opinion.

And if we look at the auto industry, automotive headlighting is just about to pass the 50% mark for LED headlighting. In fact, we’re celebrating that in Germany our first LED headlight retrofit bulb was just approved as road legal for aftermarket replacements. There’s still a fair bit of solid-state lighting transition to come.

LEDs: I didn't realize that Lumileds actually manufactured conventional lamps. I thought those came from Philips Lighting.

Roney: When Apollo bought Lumileds, they bought two pieces from Philips. There's the historical Lumileds, which dates back as you know to the Agilent and Philips joint venture, and then there’s Philips automotive lighting. Apollo bought them both. Those were two separate divisions inside of Philips that were carved out and put together as one company. When I talk about transition and transformation, I also consider the cultural integration of those two businesses.

LEDs: As a private company, Lumileds doesn’t report revenue or financial details from your different business segments. We still have some data from our Strategies Unlimited reports that is an indicator of your packaged LED revenue. But can you share some relative indicators on the size and growth potential of your different businesses?

Roney: There are four really important segments that we play in and they all play critical roles in our business. There is the automotive aftermarket, which is conventional lamps and LED retrofit bulbs and auxiliary lighting. That's got its own unique go-to-market channel. Second is the automotive LED business; this is directed to setmakers and the OEM carmakers themselves. Our specialty business, which encompasses mobile flash, display, IR, and UV, continues to grow and evolve. And the fourth segment is our illumination business, which is architectural lighting, human-centric lighting, and horticulture, etc. They all play equally important roles for us in terms of relative size, growth, priorities, and investment and in product portfolio going forward.

LEDs: With regard to the specialty segment, the flash application doesn’t surprise me because the mobile device manufacturers demand great performance out of LEDs for camera flash. But frankly I was surprised you mentioned display. I thought the backlight market had been conceded to suppliers in Asia. Or perhaps are you talking about emerging applications such as self-emissive displays?

Roney: We don’t think about any of the specialty segments as point-in-time opportunities. Our interest is in innovating, improving, and forging ahead. So our display innovations in the mid-2000s led the way for today’s backlight market that largely served out of Asia. But the future of displays — direct view with micro LEDs, AR, XR, and head-mounted displays — that’s being created inside Lumileds as we speak.

LEDs: I don’t recall Lumileds saying anything publicly about those kinds of applications much. And I don't think I would find much about it on your website.

Roney: I think that speaks largely to the deep customer relationships we have and our history in the segments I described. Speaking softly may cause some to assume we’re not doing anything, and believe me, I have my share of marketing people that want to talk — but we’re engaged across the entire value chain in each of our segments.

LEDs: You mentioned micro LED earlier, but I haven’t seen any announcements from you on that subject.

Roney: Micro LED is a natural fit for Lumileds because of our depth in technology and innovation and because of our system and process knowledge. We were the first to make the transition to 6-in. wafers and learned a lot from that. Much of the industry is still on 4-in. wafers. Being able to get the kind of wafer uniformity and homogeneity and being able to tightly control bow and all those sorts of things is going to be really critical in the transition to small pixel size on larger wafers for micro LED. Even though I believe we are leading the innovation here, we aren’t talking a lot about it, but stay tuned, we will.

LEDs: With regards to micro LEDs, when you say “across the value chain,” what do you mean? Are you trying to own some of the process of doing mass transfer of micro LEDs?

Roney: The mass transfer technology has implications in the die design. So, unless you are engaged with certain mass transfer providers, you really can't become an epi wafer supplier. As you’d expect, we have development activities that are directly supporting our micro LED innovation.

LEDs: Are you also pursuing things like the integration of some part of the driver electronics more closely with the LED?

Roney: That is another area where Lumileds, through partnerships, has the ability to do a lot of different things. There are some natural paths for us to take and we already do some of that today.

LEDs: You mentioned automotive as an area where you don’t necessarily reveal details of your work. Some of your competitors have made major announcements about dense pixelated headlamp developments and other innovations. Should I assume you have such R&D underway even if it’s not very evident?

Roney: Yes, we're working at all of those things and we even have some unique ways of doing it with completely configurable arrays. Our Neo Exact die architecture, for example, allows very close spacing of LEDs and is one of our keys for matrix headlighting. In addition, we’re working on micro LEDs for fully pixelated headlights. So there's a lot of things we've got going on in those spaces, but we just don't publish press releases about them.

LEDs: Your answer also suggests another question. The auto market is strong but also supply constrained right now. Doesn’t that limit your potential business in the segment?

Roney: The best way to describe automotive is that this year has been pretty good. It could be even better because there’s more demand than the industry is able to produce because of the chip shortage, and essentially the entire supply chain is strained trying to deal with the rebound in production level. So we’re seeing it in all kinds of areas, whether it’s certain of our electronic components that we buy to put into Level 2 systems as well as sub-components that go into LED products or even some raw materials. So, it’s the chips that get the headlines, but the entire supply chain is strained. That means that there will continue to be some pent-up demand for automobiles and that the industry will not be able to produce enough to meet that demand right now, which means there’s more runway for vehicle production growth coming over the next couple of years.

LEDs: Does automotive result in generally higher component prices?

Roney: Automotive has a couple of things going for it, particularly if you’re a leader in the industry. The technological hurdles are quite high, so that creates barriers to entry. Two is the quality requirements are very high, as are the qualifications for design-in and qualification into a setmaker's portfolio. So those things make it very attractive for us and other leaders in the industry. It’s very demanding. If you have all the quality systems and the parts-per-billion type of quality levels in manufacturing, and you have the technology to continue to push the envelope on lumens per watt and put a lot of usable light on the road, then that puts you in a very good spot to protect your market position in a space like that.

LEDs: Now let’s turn to general illumination. A few years back, I wrote quite a lot about how specialization was coming to the LED field with companies seemingly making a different LED for most every general lighting application. What is Lumileds' strategy and where is it headed?

Roney: If the goal is to replicate the thousands of conventional bulbs that probably still exist today, then an application by application approach may be appropriate. We think there’s a finite future in that approach. We want to be smart with our architecture choices that allow us to serve an illumination industry that still has one foot in the world where luminaire design was based on bulbs and the other foot in a world where imagination, not the shape of the bulb, is driving design. So, we straddle that line as well with our LED architecture that allows us to support and adapt, without having to create a new LED architecture each time.

You’d probably be surprised by how much custom and higher level integration work we do with our customers, but it’s only possible because of the approach we’ve taken with our product architecture, because we have such deep and strong phosphor competencies, and because we control our production. These are compelling advantages in the market.

LEDs: I certainly have written a lot about your color LED capabilities and of course that includes monolithic colors with kind of different device physics. And then you guys have also done some really innovative things with phosphor-converted color. Is your work in the color market attributable back to the joint venture and the early research on colors?

Roney: Yes, it is, and also having that in-house phosphor capability. Phosphor conversion not only allows some unique lighting approaches, like our Luxeon Fusion, it supports lighting that is higher in quality, delivers more light, and is more efficient. Ultimately, it too will contribute to our sustainability efforts.

LEDs: You also have among the industry’s deepest portfolio of horticultural LEDs. That portfolio also includes monochromatic and phosphor-converted components. What is the significance of the horticultural market for Lumileds?

Roney: Horticulture is an important part of our illumination segment and we’ve seen significant growth over the last two years. We think it’s in its last stages of transition from a cool and interesting application to one that’s here to stay. Aside from its obvious sustainability impacts, horticulture lighting will impact people’s daily lives. These applications are solving real-world equity issues and enabling some people to eat fresh food. It’s hard not to like and appreciate horticulture lighting and we’re thrilled that it's gaining traction.

LEDs: Turning to evolving LED technology, let’s discuss chip-scale package (CSP) technology. Lumileds was first to announce CSP LEDs at Strategies in Light back in 2013. There was a lot of talk back 5–6 years ago about CSP taking over the SSL market. But we find many SSL manufacturers still don’t use CSP LEDs. Where and why is Lumileds finding CSP success?

Roney: CSP has a place in high-power lighting. It’s robust, it’s got excellent heat transfer properties, it’s small in size, and you can create a tightly packed array and get a lot of light from a small package. That makes it superb for things like headlights, other automotive applications, and other compact, high-output applications in the illumination space. I think you’ll find that most if not all of the primary LED providers to the OEM auto manufacturers use CSP.

LEDs: What about technology outside the human visual range such as infrared (IR) and ultraviolet (UV)?

Roney: We do have a portfolio, as I think you’d expect, for both IR and UV. IR has a big play in automotive, security, and applications like spectrometry. Today you’ll find us in driver monitoring systems, drones, security monitoring, park distance control, and more. UV is an interesting place, too. Though the conversation today is dominated by UV-C germicidal capabilities, medical and other applications use UV-A and B and that’s where we continue to innovate.

LEDs: When you moved into the CEO role, several other companies said to me that Lumileds was really swapping to a heavy focus on automotive and I even wrote something that I think could have been interpreted that way, which wasn’t my intent. I think from our conversation that’s pretty clearly not the case. What thoughts would you want readers to take away from this interview?

Roney: There are a few ideas I hope readers take away from our conversation. Number one of course is that while automotive is an important segment for us, we are not focusing on automotive at the expense of the other segments. Our business is stronger and we’re better able to support our customers and innovate because we play in our four segments: automotive aftermarket, automotive LED, specialty, and illumination. We will continue to invest and grow in each of those.

I think the second thing that should be clear is that Lumileds hasn't gone away. Our customers and partners know this, but I can understand how general readers might misinterpret our quietness. We are passionate about innovation and invest accordingly. That leads to lots of interesting opportunities with interesting companies. The fact that you don't see us talking about micro LEDs for display or augmented reality does not mean that that we are not deeply engaged. We are and we plan to take the leadership position.

Likewise, the fact that you haven't seen a lot about pixelated headlights when in fact we do have configurable ADB arrays with our Neo Exact MxN product line, and we do it in a really unique way that others can’t. One of the interesting things about automotive lighting is that the technology you’ll see on 2022 model year cars was probably planned two or more years ago. Imagine the innovation you might see on a 2024 car that’s already been baked in.

The last takeaway is that innovation in the LED space is far from over. Stay tuned.

LEDs Magazine chief editor MAURY WRIGHT is an electronics engineer turned technology journalist, who has focused specifically on the LED & Lighting industry for the past decade.

Look beyond the checkbox to select reliable LEDs: Exploring the fallacy of ‘good enough’

Don’t fall under the spell that maturing LEDs are 'good enough' for your application. For many uses, LEDs are generally considered good enough that selection has become an exercise of checking specification boxes and determining price. But just as any two new cars will get you from point A to B on day one, over time, differences in quality and engineering can quickly become apparent. LED specifications can mask weaknesses that affect quality, reliability, and performance over time.

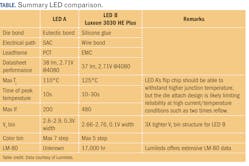

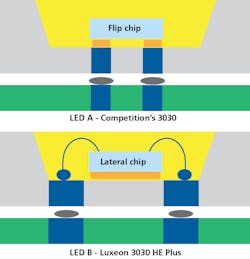

We recently evaluated another manufacturer’s 3030 (3×3-mm) surface-mount device. From a cursory review of numbers on the datasheet perspective, the device appears similar to the Luxeon 3030 HE Plus. The LED chips are connected to a leadframe using silicone glue or solder in a plastic leaded chip carrier (PLCC) package. The leadframe, which can be epoxy molded compound (EMC) or thermoplastic polyester (PCT), provides the electrical connection, reflectivity of the LED light, and thermal dissipation.

The package itself is crucial to performance and reliability because it provides mechanical protection, thermal dissipation, and electrical connection from chip to printed-circuit board (PCB). Material choice also affects the number of reflow steps required to complete assembly and packaging to the PCB as well as the LED’s ability to maintain color and flux consistency over time and use.

We performed a side-by-side evaluation of 10 LEDs each of the competitor’s 3030 LEDs (Fig. 1, top) with our Luxeon 3030 HE Plus LEDs (Fig. 1, bottom). We put all 20 LEDs through two reflow cycles, which replicated the field case that spurred our investigation, and then tested the LEDs at a lighting manufacturer’s facility for performance conforming to each LED manufacturers’ specifications. Datasheets for both manufacturers’ LEDs detail that exposure to three reflow cycles is acceptable. We were interested in exploring the reliability of new LEDs with similar datasheet specifications and their potential for electrical failures.

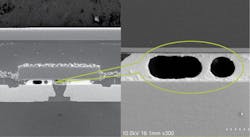

When delivered, LED A has already gone through one reflow cycle with tin- and silver-doped copper solder and a eutectic bonding process in order to attach the flip chip die to its leadframe. After the second reflow to attach the package to a PCB, we performed standard sulfur testing using JIS C 60068-2-43, a test condition Lumileds developed to verify mid-power product robustness in sulfur environments. That Lumileds test is more stringent than the IEC 60068 test used by much of the industry, with Lumileds testing the components at 40°C whereas the IEC specifies 25°C. Both tests require an environment with 15 PPM (parts per million) of H2S (hydrogen sulfide), relative humidity of 80%, for a period of 96 hours in addition to the aforementioned temperature requirements. After the exposure, the test lab performs cross-section and scanning electronic microscopy (SEM) imaging of failed devices. Early solder joint fatigue appears to be related to die bond material and leadframe material inside the package where voids formed (Fig. 2).

LED B (Luxeon 3030 HE Plus) (Fig. 1, bottom) uses silicone die bonding and an EMC leadframe, so die attach quality is significantly more reliable. After undergoing the same two reflows and standard sulfur testing, we observed no lifting or deformation of bonds. That’s due to Luxeon’s robust die bond design and EMC’s superior ability to dissipate heat.

It’s clear then that LED design considerations and manufacturing competence can affect field performance. Lumileds’ focus on robustness and reliability as well as quality of light metrics that are shown on datasheets lead to better field results where failures can be very costly. — Mei Yi, product & marketing manager, Lumileds

Enjoyed this article? Visit our digital magazine for more like this >>