When ams Osram sold off its horticultural lighting company Fluence, it insisted it was still in the horticultural game. This wasn’t doublespeak. Ams was exiting finished lighting systems, but it would still provide LEDs for those systems.

Driving the point home, the Premstaetten, Austria–based group has introduced a line of packaged LEDs designed for horticultural use, with a target market of tight-spaced growing environments such as vertical farms and what the company called “high-density greenhouses.”

Ams also said it is positioning the emitters for use in interlighting — lights placed among the leaves of a crop in a greenhouse as opposed to above the plants.

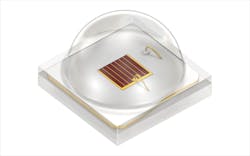

The new Oslon Optimal combines some of the distinctive features of the two existing Oslon horticultural LED lines — Oslon SSL and Oslon Square. The Optimal’s 1-mm2 die size matches that of the SSL, which is half Square’s size of 2 mm2.

But Optimal comes with the more advanced optics of Square, using Square’s newer and larger spherical lens, which widens the viewing angle and is said to avoid hot spots of concentrated light.

Oslon Optimal is also based on the same InGaAIP (aluminum gallium indium phosphide) thin film used in Square, which the company claimed enables it “to handle high drive currents and high operating temperatures, while maintaining excellent operating lifetimes with minimal drop in photon flux over time.”

The packaged footprint for the products in all three lines is 3 mm2. SSL and Square remain in the Oslon portfolio. Ams Osram had not provided pricing to LEDs Magazine by the time this article posted.

The new Optimal line includes four chips, each at a different wavelength. The 660-nm Hyper Red and 730-nm Far Red are available now. Ams has scheduled third quarter availability of the 450-nm Deep Blue and of the Horti White.

“The mix of colors and white provides fixture manufacturers with the flexibility to address the spectral requirements of any horticulture application,” ams said.

In the Horti White, ams reduces the red output compared to general illumination white LEDs. “This allows growers to use more direct red emitters…to provide the red wavelengths needed for biomass growth, and to reduce the reliance on less efficient phosphor-converted white emitters to cover the red part of the spectrum,” the company said.

A spokesperson told LEDs that, compared to the 1-mm2 SSL, the 1-mm2 Optimal improves the performance of the Far Red emitter by over 15% and of the Hyper Red by over 5%.

In identifying “interlighting” as a target market, ams seemed to be nodding to Signify, the company that acquired Austin, Texas–based Fluence a month ago after agreeing to the purchase last December. Signify refers to the practice as interlighting, while Fluence, previously under ams Osram, has called it intercanopy lighting. GE Current calls it intracanopy lighting.

Fluence, under Signify, remains an important customer for ams Osram.

The sale of Fluence is one of many divestitures of illumination operations that ams has made since acquiring Munich-based Osram in July 2020 and honing the company-wide focus on chips. Most recently, it sold off Hong Kong–based façade and architectural lighting firm Traxon Technologies.

MARK HALPER is a contributing editor for LEDs Magazine, and an energy, technology, and business journalist ([email protected]).

For up-to-the-minute LED and SSL updates, follow us on Twitter. You’ll find curated content and commentary, as well as information on industry events, webcasts, and surveys on our LinkedIn page and our Facebook page.