The opening keynote session at Strategies in Light Europe featured three strikingly different topics, reports MAURY WRIGHT, with the first focused on the smart lighting revolution, the second discussing financing the LED revolution in general, and the third looking at the state of the LED component sector with a keen eye toward the general-lighting application.

The co-located Strategies in Light (SIL) Europe, LuxLive, and lightspace dot london events took place Nov. 23-24 in London at the ExCel convention venue, and closed the 2016 year in the LED and lighting sectors with the future outlook for the industries looking promising. Here we will focus on the SIL Europe conference sessions, although we also have a few photos from the exhibition space (Fig. 1). As you might expect these days, the conference was heavy on smart lighting and Internet of Things (IoT) talks, although frankly there was a broad mix of compelling talks on everything from LED components to business models and financing, and new and emerging applications for solid-state lighting (SSL). Simply consider the three keynotes that we will cover in detail. The themes were smart lighting followed by financing LED projects and closed with a talk on LED technology and applications.

FIG. 1. The adjacent Strategies in Light and LuxLive exhibitions included everything from top LED manufacturers to stalwarts of the global lighting industry, and the IoT theme pervaded throughout.

Interested in articles & announcements on smart lighting?

Osram and smart lighting

Geert van der Meer, CEO of Osram's Digital Systems Business Unit, led off the opening keynote session with the stated mission of discussing the IoT in lighting (Fig. 2). And van der Meer began by describing the slow revolution that society has experienced since the Internet came into widespread use in 1995. Specifically, he said the Internet has changed the way we communicate and in fact changed behavior in general, especially among young people.

He showed a photo of a group of young adults having dinner, and each of the eight or so diners was looking at a mobile phone. He said, "Rather than interacting with each other, they would rather play with their cellphones and make sure they look great on Facebook."

FIG. 2. Geert van der Meer of Osram led off the Strategies in Light Europe keynote session.

The message was that technology is having a dramatic influence on how we behave. And that behavioral change in turn impacts the infrastructure that we as society use. For example, there has been a tremendous change in terms of where the population lives globally with young people in particular preferring city environments. That same demographic also prefers a mobile lifestyle whether in terms of communications or work. These societal trends led van der Meer to suggest that the world needs a smart infrastructure to support the trends. Moreover, he said the smart infrastructure is becoming affordable essentially due to Moore's Law and the cheap yet powerful semiconductors and ICs that power everything from smartphones to communication networks.

Cloud computing

One technology that van der Meer singled out is cloud computing, and he asked the audience, "Are you ready for the big data explosion?" He said that explosion would start simple but then evolve rapidly, just as society experienced with the mobile phone. "It will change how we as people are behaving and living," said van der Meer.

Moving on, van der Meer turned his attention to the smart infrastructure that will ultimately enable technology change. And he zeroed in on smart homes, smart buildings, and smart cities.

Smart homes will happen, according to van der Meer, but that technology will be relatively simple and involve a relatively modest number of IoT nodes. Smart buildings are both much more complex and offer more potential for companies to profit. He said there is some smart infrastructure in buildings today with building management systems, but noted that in the coming years it would be a rapidly growing opportunity for new technology deployment. "We will see the largest penetration of smart lighting into the smart buildings," said van der Meer.

Again, van der Meer looked to the past to chronicle how buildings have changed. Over the last 40 years, he said, the building industry has done a great job in reducing energy usage- slashing the per-square-meter consumption by 50%. Unfortunately, he said people need much more space in a building today. The square meters of space per person has increased by 200% over the same 40 years.

Connected buildings

The net effect in buildings is that energy use has continued to escalate, and the only answer is smart infrastructure for a number of reasons. Presenting what he called a model for smart buildings (Fig. 3), van der Meer described the evolution of the infrastructure relative to lighting. First there was just power and switches. Buildings have already evolved to having widespread use of room-level sensors and enabling control of lighting for occupancy and daylight harvesting.

The building industry is in the early stages of networking the rooms of a building. And centralized control capabilities must be layered on top of those networks. He noted that other building systems including HVAC (heating, ventilation, and air conditioning) and security are going through a similar transition. In all cases, the fully smart infrastructure will require more sensors, more capable and interoperable networks, and most significantly more data analytics to mine data and trigger relevant actions.

FIG. 3. A model for smart buildings presented by van der Meer shows the progression of the IoT into the sector.

There are technology obstacles to going beyond the room level, especially for lighting. Latency, for example, remains an issue, according to van der Meer. People are accustomed to throwing a switch and experiencing immediate actions such as having the lights switch on. Some network-handled triggers and actions, especially with control in the cloud, could take minutes to come to fruition. So local control remains necessary as an override even if programmatic centralized controls are implemented.

Data security issues lurk

Data security, of course, is also a prime concern with a smart building, especially as lighting, HVAC, building security, and other systems are linked. "Many people will try to hijack your building," said van der Meer. Ironically, some desired elements of a smart building can also be a security issue. The industry needs standard interoperable networks, but then van der Meer said that fact means the "bad guys know how things work in the building." But the building industry can implement data security just as IT network operators have done so.

As proof that the smart building goal is attainable, van der Meer used the 42-floor Ernst & Young office building in Toronto, Canada that is slated to open in June 2017. "That whole building has one integrated lighting system," said van der Meer. The Osram Encelium system deployed is wireless, based on ZigBee, and uses wireless controllers that van der Meer showed easily fitting in the palm of his hand. Each controller can link to 100 nodes with nodes being sensors, switches, luminaires, and more. "Simple" was how van der Meer described the elements of the system with a sensor, switch, controller, and radio for a luminaire all fitting in his jacket pocket.

Data security has been addressed in the building, according to van der Meer. He said Osram added a proprietary security layer to the ZigBee stack. He said the security implementation has the endorsement of the US GSA (General Services Administration) that has approved the implementation for use in government buildings in the US. "The issues that we have indicated can be solved and people are working on it," said van der Meer.

Monetizing smart lighting

Of course, the discussion invariably turned to the issue of how companies can make money in the smart building sector. And the conclusion was that lighting companies have the greatest opportunity. Research van der Meer presented from US Department of Energy (DOE) partner Navigant showed that HVAC and building security are larger sectors today, but smart lighting in buildings is projected to grow much faster than the other systems. Sensors and luminaires with integral networks are the biggest opportunities for profits.

For the profit opportunity to happen, however, technology is not enough. The lighting industry must address the needs of the customer - the building owner. And energy efficiency alone is not enough of a benefit. There are four primary needs of the building owner that smart lighting can address, according to van der Meer:

• Fullfill regulatory/basic requirements

• Reduce operating cost or TCO (total cost of ownership)

• Improve operational efficiency

• Enhance end-user experience

The lighting industry has always focused on the first two of the above requirements or what van der Meer termed the classical use cases. And of course the energy efficiency of LEDs is a major factor in reducing TCO. Ironically, van der Meer said lighting loses relevance with the building owner after an LED retrofit, because the energy cost attributable to lighting drops to such a low percentage of building energy use. So the lighting industry must develop a strong value proposition to the last two needs from above to maintain and grow relevance.

Indeed, lighting can address those needs. For example, improved productivity of the workforce increases operational efficiency. And as we have covered before, lighting networks can also enable optimum space utilization through occupancy detection and analytics. User experience can be enhanced by lighting tuned for health and wellbeing and by providing indoor navigation services. Osram announced its entry into the indoor positioning space in March 2016.

The 3-30-300 model

To provide a basis for understanding the opportunity in smart lighting, van der Meer introduced what he called the 3-30-300 rule with a visual image of a pyramid with 3 at the peak, 30 in the middle, and 300 at the base. He said when a lighting company is selling a project based on energy savings, that company is working in the €3/m2 level, basically the cost of energy per square meter. "The nice thing would be if you could work on the €30/m2 level," said van der Meer. He said that level is what tenants typically pay for rent in a building. And it would be even better to work at the €300/m2 level where people or employee cost is part of the equation.

To dramatize the rule, van der Meer suggested a case where you could deliver a 3% improvement at each of the three levels. A 3% improvement in energy efficiency saves a business €3000. But improving space utilization by 3% delivers €30,000 in savings. And enhancing personal efficiency by 3% yields €300,000 in savings. The 30 and 300 levels represent what the IoT means for lighting manufacturers and how they can monetize the technology.

Financing the revolution

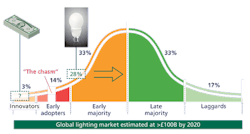

Dominic Noel-Johnson, vice president of energy efficiency at Green Investment Bank (GIB) in the UK, presented the second keynote, entitled "Financing the lighting revolution." The presentation began with a graph that illustrates the adoption curve for LED-based lighting (Fig. 4). "In the LED market you are clearly past the early adopter stage," said Noel-Johnson. "You have crossed the chasm." He said the US market is 28% LED at present. In the UK, he said, the LED sector is growing at 40% year over year. He commented that the industry is in solid shape from the technology perspective, and has manufacturing in place to support growth.

"The bad news from my side is the financing side of that is just almost in the absolute infancy at this stage," said Noel-Johnson. Specifically, he was speaking of the third-party financing or institutional capital from sources like pension funds and infrastructure investors. Participation in the SSL sector by such sources of capital could significantly accelerate LED adoption.

FIG. 4. Dominic Noel-Johnson of the UK's Green Investment Bank said the LED sector is past the early adopter phase but needs third-party investment capital to realize the £100 billion potential.

His presentation moved to answer the question "How do we initiate the growth of third-party financing into the LED market?" He said some people might argue that the industry is doing quite well without such financing. But referring back to his chart that projected the value of the lighting market at £100 billion ($122 billion) in 2020, he said, "That requires very large and deep pools of capital to propel and finance these actual capital investments."

Noel-Johnson said that over the next 15 years, the normal replacement cycle of lighting would move the world to LED technology. But he added, "Why wait when we can do that now?" Capital will enable bigger projects and a broader base of organizations that can afford both energy-efficiency retrofits and projects such as networked lighting that enables other services.

Green Investment Bank

The GIB is a startup operation launched by the UK government four years ago to accelerate the UK transition to a green economy. We have covered a number of GIB-backed SSL projects including a major retrofit of car-park lighting back in 2014.

The GIB has made around £100 million ($122 million) in investments for LED lighting projects over four years; Noel-Johnson speculated that the number represents 5-10% of all third-party financing of lighting in the UK during that time. That places the total invested in the UK between £250 million and £500 million ($304-$608 million). While those numbers sound large, Noel-Johnson said they are small in terms of third-party capital. And he said the small number means financiers and institutional investors don't care about the LED sector yet because it's just too small. Furthermore, he said manufacturers would struggle to structure deals to interest such investors. Most of the financing of LED lighting projects to date has been from corporate sources, according to Noel-Johnson.

Diving deeper into third-party financing, Noel-Johnson said deals have included finance leases, which are traditionally on a company's balance sheet, and operating leases, which are typically off balance sheet. He noted that energy service agreements (ESAs) are a growing option for off-balance-sheet deals. The source of funds might be lighting manufacturers and energy services companies (ESCOs). But the International Financial Reporting Standard (IFRS) promulgated by the International Accounting Standards Board (IASB) has issued IFRS 16 that will shift operating leases to on balance sheet starting in 2019. That will make ESAs and similar vehicles such as energy performance contracts (EPCs) more important and will be the primary method that GIB uses to invest in lighting.

Energy service agreements

Indeed, ESAs - which might be called energy as a service or lighting as a service - will be the next big thing, according to Noel-Johnson. He said such an approach has been around for a while but has yet to unlock the potential of the market (see our feature on the ESCO model for retrofits). In such a deal, the third party owns the assets and the customer pays for the service via energy savings - Noel-Johnson termed it "pay as you save." Most often the third party maintains and operates the asset and takes on the performance risk; that is the element that differentiates the ESA from a lease.

ESAs sound great, so why aren't more in place? There are many reasons, according to Noel-Johnson, starting with trust issues. And many business owners just don't consider their lighting as being part of the value chain of their business. Others see the deals as too complex or believe them too good to be true.

The good news, according to Noel-Johnson, is that there is precedent in industry for an ESA-like transition. He said the software-as-a-service concept faced similar challenges ten years ago. The widely-used Salesforce software platform is a prime example and has become a vital part of many corporations' business practices.

What the lighting-as-a-service concept needs, according to Noel-Johnson, is a market disruptor - a newcomer that fundamentally changes the playing field. He mentioned Uber, Airbnb, and Salesforce as examples from other industries. All share the same basic model - transport as a service, accommodations as a service, etc. He said such a disruptor should unlock a lot of potential for lighting manufacturers. The disruptor will need to bring a simple concept, innovative technology and business model, and a trustworthy proposition. That type of a presence would bring more capital into lighting from GIB and other third-party investors.

LED technology and applications

Falk Meissner, chief strategy officer at Lumileds, delivered the final keynote (Fig. 5). He sought to provide a view of the LED and lighting market from an upstream player or LED manufacturer perspective. Meissner started with a chart that documented the growth of the packaged LED market, a chart very much like what you might see in one of our articles covering Strategies Unlimited market reports such as after Strategies in Light 2016 in California.

Lumileds had charted double-digit growth in the 11% range for LED manufacturers over the years leading up to 2014. Then the market went almost flat at around 2% through 2016. Meissner said Lumileds expects growth to return to a 5% range through 2020. The flat period was largely caused by oversupply. And the shallower growth going forward will be paced by mid-power and/or lower-cost LEDs.

FIG. 5. Falk Meissner of Lumileds said the LED industry still needs consolidation to take place, but projected many positives in the future, driven by technology advancement, for top LED manufacturers.

Still, Lumileds is optimistic about its prospects in the LED space. To understand the LED sector, Meissner looked back at the history of the cellphone market. He recounted that a McKinsey study for AT&T in 1980 suggested that the US market for such phones would top out at 900,000 in 2000. Clearly that was a shortsighted projection. Things like small form factor, long battery life, and new applications have driven a mobile phone boom.

Learning from mobile communications

The mobile phone industry also underwent tremendous consolidation, both in terms of phone manufacturers and network service providers. And in consolidation, Meissner sees similarity with where the LED space needs to evolve. Moreover, LEDs share some other high-level traits that mobile phones experienced. Performance continues to increase. There is a trend to miniaturization and integration. There are new form factors. And a new ecosystem is forming to support the industry - digital lighting or smart lighting in the case of LEDs.

Focusing in on the potential of consolidation, Meissner first considered the general semiconductor industry. He noted the recent Qualcomm acquisition of NXP for $39 billion and prior deals such as Intel acquiring Altera, and Avago acquiring Broadcom. He said the IC sector is fully into a consolidation mode.

Meissner sees that the LED industry is at an earlier stage in terms of consolidation. He said the deals seen in the LED sector are relatively small, such as the Kaistar acquisition of Bridgelux in 2015. Of course, Lumileds' acquisition by Apollo Global Management would happen three weeks after Meissner's presentation.

Still, Meissner's point is clear. The Bridgelux acquisition was valued at only $130 million. Largely the moves have been among Tier 2 players with the exception of Tier 1 Cree taking a stake in Lextar for $83 million. Meissner said the closest thing to a consolidation move was Epistar buying Forepi for $435 million in 2014, and consolidating the die or chip business. The top seven LED players have traded positions in terms of market share, but have remained the same names. And the so-called others behind the top seven have gained market share in aggregate, leading Meissner to say that the market is still fragmenting rather than consolidating.

Better times for LED makers

There are other indicators of better times for at least the top LED makers. Meissner showed a graph of liquidity or liquid assets divided by liabilities for the top seven Chinese LED manufacturers. Only two can cover short-term liabilities, and only one is trending in the positive direction. He said, "The industry needs to change to come to financial health." Ultimately, Meissner still expects consolidation to balance supply and demand down the road.

The growth driver will continue to be general lighting. Meissner said the world needs more light and more efficient lighting. And he cited the opportunity in smart lighting. But the biggest near-term opportunity is simply replacing legacy sources. LED penetration will only be in the 15% range in 2020 in most regions around the globe, according to Meissner, when you only consider luminaires.

Lumileds is also among the strongest players in the automotive lighting market, and that fact is another reason for an optimistic outlook for the LED maker. Meissner said there had already been mass adoption of LED technology in daytime running lights. But he still characterized the headlamp market as just moving into mass adoption of LEDs, leaving much room for Lumileds to grow sales in that application.

Integration and miniaturization

Meissner returned to the general semiconductor industry to make one last point about positive trends for LEDs. He noted the long history of integration in the industry and packing more functionality into smaller packages. "We see something similar for LEDs in the Lumileds illumination portfolio," said Meissner. Lumileds, of course, has been in the forefront of the move to chip-scale packages (CSPs), which is primarily a miniaturization play.

Going forward, Meissner expects to see the integration of LED technology with electronics. Specifically, he was talking about a more highly integrated and smaller light engine that combines LEDs with driver electronics, and even connectivity and intelligence in a tiny form factor. He said such a move by LED manufacturers can improve light quality and simplify design and manufacturing for luminaire manufacturers. On-chip or micro optics may also come to fruition going forward.

New markets and applications

Overall, the trends in packaged LEDs can open up new markets beyond just replacing light points, according to Meissner. He mentioned human-centric lighting (HCL) as an example; others include horticultural lighting and lighting embedded in fabrics and building materials.

Concluding, Meissner talked about the ecosystem for LED lighting, how it's changing, and how to drive it forward. The lighting market was vertically integrated and simple. The future needs an ecosystem that supports concepts such as smart lighting, and new business models such as the lighting-as-a-service concept mentioned earlier. Meissner said we need new channels to support the market for smart lighting, including system integrators and players in big data.

FIG. 6. The SIL Europe exhibit space featured compelling demonstrations of enabling technologies such as optics from Khatod.

The key to the final thoughts by Meissner was the statement: "This is not a pie we just try to cut differently. This is a vastly growing pie. The total amount of value creation in the ecosystem is actually dramatically going up."

Indeed, the keynotes at SIL Europe concluded with what was a recurring theme at events we covered throughout 2016. The lighting industry is pinning its future on connected lighting and the IoT. The retrofit-for-energy business will continue for some time. But connected lighting and new applications and services can open all new avenues to profits for those companies willing and capable of solving the challenges ahead. Now we look to 2017 and Strategies in Light in the US coming Feb. 28 (see our preview and visit strategiesinlight.com). And the SIL Europe and LuxLive events will return in the fall of 2017 with yet another bustling exhibition (Fig. 6).