The OLED market grew by 65% year-on-year, although this figure was slightly below expectations.

Samsung SDI maintains its position as the world's leading OLED supplier, while Taiwan's RitDisplay has made strong progress. However, in late 2005 both Pioneer and SK Display, the joint venture between Sanyo and Kodak, withdrew from the OLED business. Unlike Korean and Taiwanese competitors, which will gear up to make inroads into the market through 2006, Japanese vendors are unlikely to join the market race until 2007.

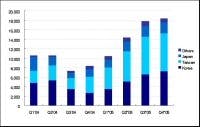

The upward trend by Taiwanese companies, who succeeded in gaining considerable ground for the first quarter, slowed for the fourth quarter, but they still account for more than 40% of the global market, with the world’s largest number of OLED panel makers in Taiwan.

After stagnating from the third to fourth quarter of 2004 due to a supply glut caused by manufacturers’ massive capacity expansions for the first half of 2004, Displaybank says that the market has rebounded since the first quarter of 2005. Specifically, growth during the second quarter was outstanding. This upward trend continued into the second half of 2005, posting overwhelmingly higher figures than those in the first half a year ago. Displaybank believes that the OLED market will see dramatic growth buoyed by positive factors such as launches of commercial active-matrix (AM) OLEDs for the second half of 2006.

In 2006, AMOLED market entrances and the shift towards high-end passive-matrix (PM) OLEDs are expected to become major contributors to accelerating growth in the market to reach 100 million units in 2006 with a value of US$900 million.