The first Strategies in Light conference, sponsored by market research and consulting firm Strategies Unlimited, was held in February 2000 at the Hyatt San Francisco Airport. It was the first conference of its kind, addressing the technology, markets, and business opportunities in high-brightness LEDs. It attracted an international audience of 250, with managers, senior executives, and even CEOs from the US, Europe, Japan, and Taiwan. The high-brightness LED market was still in its infancy at that time but was experiencing high rates of growth that continued on for 20 years. As the market grew and the LED industry expanded to meet end-use demand, Strategies in Light grew along with it in terms of attendance and topics covered in conference sessions.

Arguably, the solid-state lighting (SSL) revolution, as it has often been called, began in the early/mid–1990s with the development of InGaAlP (indium gallium aluminum phosphide)-based, high-brightness red-orange-yellow LEDs by Toshiba and Hewlett-Packard, and the development of high-brightness InGaN (indium gallium nitride)-based blue and green LEDs by Nichia and Toyoda Gosei (for which the inventors Shuji Nakamura, Isamu Akasaki, and Hiroshi Amano received the Nobel Prize in Physics in 2014). The introduction of these technologies opened up very large market opportunities for LEDs that had never been addressable before. These included full-color outdoor signs, automotive interior and exterior lighting, backlights for mobile device displays, traffic signals, specialized lighting applications, and many more.

It took a few years for production volumes to ramp up and prices to come down to the point at which these new LED technologies could be widely deployed across multiple applications. When the first Strategies in Light conference was held in early 2000, the world market for high-brightness InGaAlP and InGaN LEDs had reached $820M (million; 1999), having grown at an annual average rate of 62% since 1995.

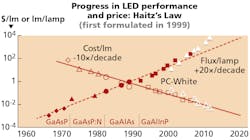

In the late 1990s, industry visionaries began to imagine the possibility that LEDs could one day achieve widespread use in general lighting, although the technology was a long way from being able to be used for this purpose. The best white LED efficacy in 1999 was about 15 lumens/watt (lm/W) — the same as an incandescent bulb, and far less than fluorescent lamps — and white LED prices were very high. Around that time, LED pioneer Roland Haitz, R&D manager for the Optoelectronics Division at Hewlett-Packard (later Agilent Technologies) formulated what was later to be known as “Haitz’s Law” (the LED analog of Moore’s Law for silicon semiconductors). First published in a 1999 paper titled “The Case for a National Research Program on Semiconductor Lighting,” Haitz predicted that the cost of LEDs ($/lm) would decline by a factor of 10 every 10 years, and the output of LEDs (lm/lamp) would increase by a factor of 20 every 10 years. A graphic representation of Haitz’s Law, updated through 2010, is shown in Fig. 1.

Haitz’s projections held up quite well through at least 2010, and in recent years his projections have even been exceeded. Haitz’s Law, made relatively early in the development of high-brightness LED technology, set the stage for the astounding achievements in technology and dramatic growth in the markets that would take place over the next 20 years.

Market dynamics

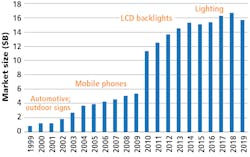

In 2000, the market for high-brightness LEDs (hereafter referred to as just LEDs) exceeded $1B (billion) for the first time, and it increased at a rapid rate thereafter. The market accelerated as prices continued to drop, efficiencies improved, existing applications expanded, and new applications were developed. In the early 2000s, automotive lighting applications (both for interior and exterior uses) and outdoor signage were the dominant market drivers.

Beginning in 2004, mobile phone applications dominated the market as LED-backlit full-color displays became a common feature, along with backlit keypads. Later in that decade, the use of LEDs as backlights for liquid-crystal displays (LCDs) in TVs, monitors, and smaller displays became the dominant growth market. Beginning in around 2011, the advent of high-performance (100+ lm/W) and lower-cost white LEDs saw a rapid penetration of LEDs into the general lighting market.

A key feature of Strategies in Light over the years was the presentation by Strategies Unlimited’s principal market analyst of the annual LED market update and forecast. These market data are summarized in Fig. 2, which illustrates the growth of the LED market from 1999 through 2019. Also labeled are the main market growth drivers for the various time periods. The average annual growth rate for the entire 20-year period was 15.9%.

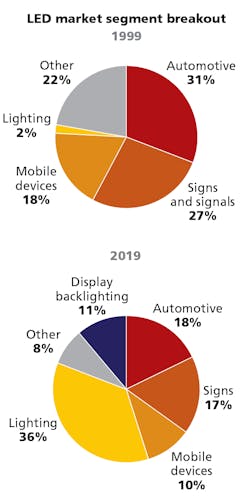

As seen in Fig. 2, while the market continued to grow from the first Strategies in Light over the next 20 years, the applications that drove the market changed dramatically. This change is summarized by Fig. 3, which compares the breakout of the market by application in 1999 compared to 2019. Probably the most notable difference is that in 1999, lighting (consisting of specialty lighting applications such as machine vision) accounted for only 2% of the market, whereas in 2019 it was the largest market segment at 36%.

LED signs and automotive applications have continued to be significant market segments — although at much smaller percentages in 2019 than in 1999. In 1999, LEDs were not used as backlights for LCD screens, but in 2019 virtually all LCD screens from computer monitors to 85-in. TVs used LEDs as backlights, accounting for 10% of the market. (Displays for mobile phones and other portable electronics are counted separately in the mobile devices segment.)

The dream of the visionaries of the LED industry in the late 1990s that LEDs would one day come to be widely adopted in general lighting came true, probably beyond their wildest expectations. In 2019, LED-based lighting products (lamps and luminaires) had worldwide sales of $61.3B (according to Strategies Unlimited), accounting for over 59% of the lighting market.

Technology evolution

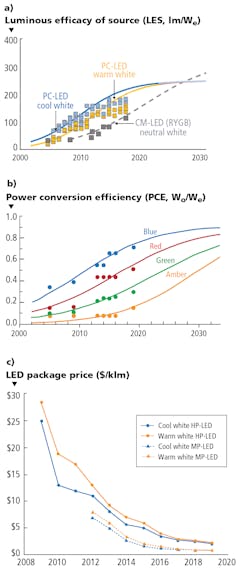

The market growth trends shown in the previous figures were driven at least in part, by continuing improvements in LED technology, including increasing device efficacy and decreasing costs, as predicted by Haitz’s Law. Device efficacy improvements resulted from improved internal chip structures, chip shaping to increase light extraction, advanced packaging for better thermal management, and in the case of white LEDs, improved phosphors. Costs came down following the classical learning curve phenomenon, due to improved chip yields and efficiency, and innovative packaging concepts that dramatically reduced the bill of materials in packages.

Figure 4 shows the progress in LED power conversion efficiency and luminous efficacy, as well as the price evolution for white LEDs. Improvements in the efficacy and reductions in the price of white LEDs were particularly important to the adoption of LEDs in lighting applications. The more attractive price structure of mid-power LEDs made them the preferred choice over high-power LEDs in many lighting applications after 2012.

Beyond the improvements in LED performance and price, the development of a wide variety of package types meant that there was a package type suitable for any application. This enabled the continuing growth of the market by ensuring that package types were available to fit the application, rather than the application being engineered to fit a particular package type.

The introduction of the first high-power (i.e., 1W) device using a 1-mm chip, known as the Luxeon, by Lumileds in 1999 set the stage for the eventual adoption of LEDs in general lighting applications. Although inefficient (about 15 lm/W) and expensive by today’s standards, it was the first device that was developed exclusively for lighting applications. Thermal management was the key to being able to drive the 1-mm2 chip at 350 mA without exceeding the critical temperature limit of the LED.

In the following years, package technology for high-power devices evolved using ceramic rather than metal components, shrinking the size of the package and dramatically reducing its cost structure. Increasing LED efficacy also meant that more lumens could be produced from the same chip area and the same drive current. Consequently, the price of white high-power LEDs declined from over $200 per kilolumen in 1999 to just a few dollars per kilolumen in 2019. Similar cost and efficacy trajectories were followed by other package types as well. The reduction in packaging materials reached its ultimate expression in the form of the so-called chip-scale package (CSP).

LED industry evolution

Long before the advent of high-brightness LEDs in the mid-1990s, the LED market had been supplied by a number of legacy players, including:

- Japan — Toshiba, Sharp, Stanley Electric, Matsushita Electric, Rohm, Citizen

- Taiwan — Liteon, Everlight, Kingbright, Bright LED, China Semiconductor, Ledtech

- US — Hewlett-Packard (later Lumileds and Agilent), Vishay, Fairchild

- Europe — Siemens Opto Semiconductors (later Osram Opto Semiconductors), TEMIC Telefunken

When InGaN and InGaAlP LEDs became the dominant market-growth drivers in the mid-1990s, most of the larger legacy companies quickly developed and marketed high-brightness products. However, new companies entered the market as well, in particular Nichia and Toyoda Gosei. Prior to the mid-1990s neither of these companies had been in the LED business. However, as the pioneers in the development of InGaN technology, they both entered the market in 1995 and became two of the largest LED suppliers. In fact, by 1999 Nichia had become the world’s largest supplier of LEDs and it has held that position up until the present day. Later, other new suppliers also entered the market, including South Korean and Chinese companies and additional Taiwanese companies. The US company Cree entered the market as chip supplier using its unique GaN-on-SiC (gallium nitride on silicon carbide) technology in the late 1990s, then later became one of the largest packaged LED suppliers. The evolution of the top 10 packaged-LED supplier hierarchy is shown in the nearby table.

The color coding in the table key indicates the location of the top 10 suppliers. Originally, Japan, Europe, the US, and Taiwan dominated the supplier landscape. However, by 2008, the South Korean supplier Seoul Semiconductor had moved into the top 10, and by 2018, four South Korean companies were in the top 10, largely displacing the Japanese suppliers. Of the six Japanese companies present in 1999, only Nichia remained in 2018. Also, in 2018 a mainland Chinese company, Mulinsen (MLS), had entered the top 10. There were many other Chinese suppliers in 2018, but only Mulinsen was large enough to be included in the top 10.

Note that the table includes only suppliers of packaged LEDs. An integral part of the LED supply chain during this period was the chip suppliers. These companies, formed in the late 1990s and early 2000s, used metal organic chemical-vapor deposition (MOCVD) technology to produce InGaAlP and InGaN epitaxial wafers and chips, which they sold on a merchant basis to packaging companies — many of which did not have their own internal epitaxial wafer fabs. Most of these chip suppliers were located in Taiwan, which provided fertile ground for startup epitaxy and chip companies, both because of the technical expertise within the engineering community and the abundant availability of risk capital looking for new growth opportunities. Foremost among these chip suppliers was Epistar. Other significant suppliers included UEC, Arima, Epitech, South Epitaxy, Forepi, Tekcor, and Huga. Beginning around 2004, driven by the cost advantages of large-scale production, consolidation of the Taiwanese chip industry began to take place, in which smaller companies merged or were acquired by larger companies. Ultimately, as a result of such acquisitions Epistar became the dominant chip supplier in Taiwan.

At about this time, Chinese companies began to enter the merchant LED chip market. Early entrants include San’an and Lumei. In later years, Chinese provincial governments provided subsidies for the purchase of MOCVD reactors in order to expand the domestic Chinese LED industry, encouraging many new entrants into the market. However, lacking the technical expertise to successfully operate the reactors, many of these companies failed or were acquired by larger companies.

Commentary

The changes in the LED industry over the last 22 years have been nothing short of staggering: The size of the LED market has grown by a factor of 18; the conversion efficiency of InGaN blue LEDs has increased by a factor of 10; and the cost/lm of white LEDs has plummeted by a factor of 100. In the all-important lighting market, LEDs have transformed the industry on a massive scale, with the worldwide sales of LED lighting products growing by a factor of 10 between 2011 and 2019, reaching $61B. Underpinning all these developments has been a combination of the efforts of key individual researchers and countless engineers, large corporate investments in R&D and manufacturing, and the support of government programs and incentives. It has been a great technological adventure in which Strategies in Light has participated by providing a forum for communicating new developments in technology and applications and bringing industry participants together to exchange ideas and forge new relationships.

Recommended reading

The best accounts of the development of the SSL industry may be found in two books by Bob Johnstone: Brilliant! Shuji Nakamura and the Revolution in Lighting Technology (Updated Edition 2015) and L.E.D. – A History of the Future of Lighting (2017). Both are available on Amazon. You can read excerpts on the LEDs Magazine website at the respective links above.

Get to know our expert

BOB STEELE was a founder of the Strategies in Light conference and has been chair or co-chair of the US conference since 2000. He was chair of the Strategies in Light Europe conference from 2012–2015 and co-chair of Strategies Light Japan from 2008–2010. Steele was also a co-founder of the LED lighting startup QuarkStar LLC in 2010. From 1994 to 2010, he directed the LED market research program at Strategies Unlimited, where he was responsible for all of the company’s activities in LEDs, including conducting custom studies and preparing multi-client reports.