In 2013, several A-lamps were introduced that not only looked and behaved like incandescent lamps, but also were close to or below the magical $10 price point. It is clear that prices and therefore margins will continue to fall for these lamps. This creates a little bit of a quandary for these LED lamp manufacturers. Do they continue to cut prices in an effort to gain more market share, or do they innovate in other ways to gain a foothold in the market? I think the simple answer is: They have to do both.

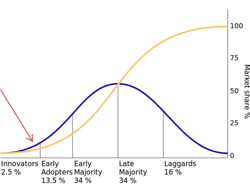

Current penetration of LED lamps in households is still very low, where mainly “innovators” (Shown in the chart below), which comprise approximately 2.5% of the market, have purchased these products. The new price point and the phase out of 40 and 60W incandescent lamps will probably make 2014/2015 (While EISA takes effect in 2014, we expect incandescent lamp supplies to last from 8-12 months) to the starting point for early adopters, which comprise another 13.5% of the market.

Most of these early adopters will only be looking for a replacement to the burnt out lamp in their house. This could be considered a test run for the technology, as they will probably be comparing how LEDs stack up against CFLs and halogen lamps that are still available on the market; this means that initial product quality is very important (A sentiment that is echoed in OSRAM Sylvania’s last socket survey). So, finding innovative ways to decrease lamp price without decreasing the overall value (quality) of the product is the only real way for manufacturers to have a lasting presence in this market. If you decrease price while sacrificing quality, you may sell products early on, but will probably lose out on the early majority and late majority (68%) of the market, which should be the true target for most companies. So, you have to actually innovate to decrease the overall price.

I am not happy to report that I’ve seen the quality of the average LED lamp decrease as cheaper products have entered the mass market. What we need to be asking ourselves now, is whether these lower quality products will lead consumers to purchase different LED brands or pick a whole other technology, slowing LED adoption.