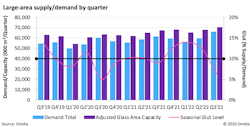

LONDON (November 2020) — Demand for flat panel displays (FPD) is set to reach 220 million m2 in 2020, more than 4% higher than 2019 according to Omdia’s latest research. In Q3 2020 alone demand has risen by over 12% QoQ. The latest data comes from Omdia’s recently updated OLED and LCD Supply Demand & Equipment Tracker.

However, capacity for large area FPD production is only growing net 2% in 2020. Korean panel makers are in the process of shuttering their domestic LCD factories and will reduce Gen 7 and Gen 8.5 TV capacity by approximately 19 million m2 this year, the equivalent of about 31 million 43-inch TVs.

There have also been disruptions in the supply chain. Multiple new FPD factories in China have suffered delayed ramp-ups as travel restrictions on foreign engineers prevented the set-up of key equipment during 1H20. Now in 4Q, production is further being impacted by tight supply of Gen 10.5 glass substrates for some panel makers.

Consumer Demand:

This demand has been spurred by a shift to ever larger TV sizes. In 2020 the weighted average LCD TV size will reach 47-inches, up from 45.4-inches in 2019. COVID-19 has also significantly impacted FPD supply and demand in unexpected ways throughout 2020. With lifestyles of people around the world shifting to ever more work, study, and entertainment at home, demand for tablets, notebooks, monitors, and TVs has surged. With consumers reducing spending on commuting, eating out, travel, etc., discretionary expenditures are being transferred to home improvements, including consumer electronics purchases.

Omdia’s latest tracker is available here: https://omdia.tech.informa.com/OM013149/OLED-and-LCD-Supply-Demand--Equipment-Tracker--2Q20-Analysis

“Currently we forecast a healthy, balanced market in 2021, where supply and demand area are both expected to grow about 6%. However, many unknowns remain on how COVID-19 will continue to impact demand, and how the improved market might encourage Korean panel makers to delay factory shutdowns and Chinese makers to expand capacity”.

Charles Annis, Displays Practice Leader at Omdia, commented: “Very tight supply in 3Q20 caused panel prices to rapidly rise and should help most leading FPD makers to return to profitability; a very welcome turn of the market as most have suffered consecutive losses since 1Q19.

The majority of IHS Markit technology research products and solutions were acquired by Informa in August 2019 and are now part of Omdia.

Omdia is a registered trademark of Informa PLC and/or its affiliates. All other company and product names may be trademarks of their respective owners. Informa PLC registered in England & Wales with number 8860726, registered office and head office 5 Howick Place, London, SW1P 1WG, UK. Copyright © 2020 Omdia. All rights reserved.

Learn more about Omdia

Our exhaustive intelligence and deep technology expertise allow us to uncover actionable insights that help our customers connect the dots in today’s constantly evolving technology environment and empower them to improve their businesses – today and tomorrow.

We combine the expertise of more than 400 analysts across the entire technology spectrum covering 150 markets and publish over 3,000 research reports annually, reaching over 14,000 subscribers, and covering thousands of technology, media, and telecommunications companies.

About Omdia

Omdia is a global technology research powerhouse, established following the merger of the research division of Informa Tech and the acquired IHS Markit technology research portfolio, Ovum, Heavy Reading, and Tractica.

Contact:

Jonathan Cassell, Omdia (formerly IHS Markit)