Strategies Unlimited analyst SHONIKA VIJAY explains that although increased lifetimes of LED lamps/luminaires will reduce shipments, the SSL market will see a demand for advanced networked technologies with cost- and energy-savings opportunities in outdoor lighting operations management.

The trend of devices being smart, connected, or classified amongst the Internet of things (IoT) is catching on like wildfire, and the lighting world has been no exception. As the world gets more interactive, so does our lighting. This push for connected lighting is driven not only by innovation and technological evolution but also by regulatory influences. As the penetration of LED luminaires increases in the lighting installed base, end users are looking to optimize the return on their solid-state lighting (SSL) investments by coupling their lighting systems with lighting controls (see our previous column on the LED luminaire market). Many customers are going beyond the control of lighting systems to make operational decisions by using monitored lighting data, tracking their lighting assets, and assessing the functionality of lighting equipment.

Interested in more articles & announcements on lighting networks?

What is connected lighting?

Strategies Unlimited has recently released its latest market research, "Connected Outdoor Lighting Report: Lighting Analysis and Forecast 2015." Connected lighting can have numerous definitions depending on the features and capabilities one includes from a lighting system. For this report, Strategies Unlimited looks at controls that enable network capabilities where the lighting system could be controlled via a central management system. Both wired and wireless systems are examined in this research to analyze the current market landscape of connected outdoor lighting and project how the market will grow in the next eight years. The report looks at Power Line Communication, 6LoWPAN, ZigBee, and Proprietary/Other lighting communication technologies.

The forces behind connected lighting

There wasn't much talk about connected lighting a few years ago. The most we heard in terms of smart lighting were lights that had non-networked or standalone photocells/photosensors, motion sensors, and/or dimming. Now, the usage of these standalone lighting controls is diminishing as society is continuously trying to perfect operations with constant data feedback systems. At Strategies Unlimited, we believe that regulatory influences, the need for organizations to cut costs, and the continuing imperative to operate more efficiently and effectively will foster the growth of the connected lighting market.

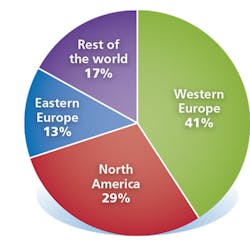

FIG. 1. Connected outdoor lighting revenue is segmented by region, with Western Europe the leader in revenue at 41% and North America accounting for 29% of revenue.

Due to the long lifetime offered by LED lighting, manufacturers are realizing that shipments from LED lamp/luminaire failure are going to decrease as LED penetration increases in the installed base. Incumbent technologies such as incandescent, halogen, CFLs, and high-intensity discharge (HID) light sources can last between 1000-8000 hours (depending on the technology) compared to more than 25,000 hours that manufacturers claim for LED light sources. By offering customers connected lighting systems with a promise of extending the lifetime of the lighting systems and reducing energy costs, manufacturers can expand their lighting portfolios and hopefully mitigate the effects of reduced shipments due to the low LED light failure rates and replacements.

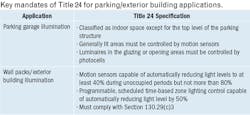

The second force propelling the adoption of connected lighting is regulations, such as Title 24 established in California. Title 24 and other mandates are pushing connected lighting into the forefront. Such regulations require the installation of lighting controls for new construction, retrofits, and major renovations. A table from the Strategies Unlimited report summarizes the key mandates of the standard for parking garage and exterior building applications.

Organizations are constantly racing to cut costs and operate more efficiently. The need to lower operational costs is driving the adoption of connected lighting in private and public sectors. On average, street lights are operational for 11 hours daily, parking garage lights for 18 hours, and exterior building lights for 11 to 13 hours. The data collection features of connected lighting are creating the opportunity for its end users to not only power lights when needed but identify malfunctioning light sources more quickly and save on the number of worker hours for replacement. So now instead of having city workers drive long stretches of roads to identify failed street lights or hearing complaints from residents about burned-out street lights, cities can quickly identify and fix these problems strategically. Organizations are taking advantage of the features and capabilities offered by connected lighting to reduce operational and maintenance costs.

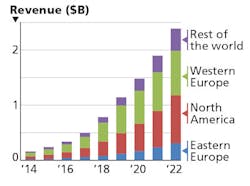

FIG. 2. Strategies Unlimited forecasts connected outdoor lighting revenue to grow on average 40% annually from 2014 to 2022.

Global market for connected outdoor lighting

Fig. 1 shows the revenue breakdown by region with North America and Western Europe contributing to the majority of the shipments. Developing regions are still lagging in the outdoor connected lighting market since their constituency is very price sensitive. Installations in these developing regions are currently happening on a smaller scale and less frequently than in North America and Western Europe. For the North America region, wireless communication is the most widely installed type of lighting communication. Cities such as Los Angeles and San Diego, and states such as Florida, have undergone large, publicized connected street-light installations and are reporting positive results in terms of decreased maintenance costs; increased lifetime and consumer satisfaction; and so forth. Though wireless lighting technologies are gaining strong market traction, wired communication technologies may still be more appropriate for select applications such as tunnels and remote stretches of roadways.

As more cities demonstrate successful connected lighting projects and receive positive feedback, the rate of connected outdoor lighting projects will increase. Fig. 2 shows the global forecast for connected outdoor lighting; Strategies Unlimited forecasts the market to experience an average annual growth of 40% from 2014 through 2022. Connected outdoor LED lighting is expected to grow at a higher compound annual growth rate of 52% from 2014 to 2022.

Turmoil of a new market

Overall, we do anticipate the connected outdoor lighting market to experience healthy growth in the coming years; however, this market still has some issues it needs to consider. Most cities pay fixed-rate tariffs for the operation of street lights, so the savings of connected lighting systems may currently go unnoticed in many cases because fixed-rate tariffs do not account for the actual energy consumption of these street lights. Lighting systems (especially LED street lights) coupled with lighting communication technologies usually experience lower operational hours than what cities get billed for. Smart controls can help end this fixed-price model under which cities are being billed.

Another concern this market faces is the lack of standards for lighting communication protocols. LEDs Magazine has run a number of features and columns addressing the varying needs of both the indoor and outdoor lighting markets for networked lighting standards (see one recent article on a standard for intelligent outdoor lighting). There are currently numerous lighting communication protocols for outdoor lighting, and most of them lack interoperability and compatibility with other protocols. This means that most of the time when a city or municipality invests in a connected outdoor lighting system, it is usually locked into this system. This may not necessarily be detrimental; however, it may cause problems in cases where one is looking to shop around for lower-priced lighting communication systems in the future.

For any new market, there will be challenges that need to be addressed. For prosperous growth of the connected outdoor lighting market, more attention will need to be put on interoperability, compatibility, and rate tariff issues.

Editor's note: Keep up with the latest LED and lighting viewpoints from the analysts on their blog atstrategies-u.com/blogs.

SHONIKA VIJAY is the analyst for the outdoor and replacement LED market at Strategies Unlimited (strategies-u.com).

MORE INFORMATION

Strategies Unlimited recently released the market research report "Connected Outdoor Lighting: Market Analysis and Forecast 2015." DETAILS: http://bit.ly/1DnaG2N