At the Arrow-hosted LED Lighting Design Seminar in Newport Beach, California on Dec 1-2, Cree’s CEO Chuck Swoboda delivered a keynote address that chronicled the company’s focus on LEDs for general lighting, provided an update on the latest LED technology, and predicted a quicker uptake of solid-state lighting (SSL) than many analysts expect. Swoboda noted that LED epitaxy technology is nearing peak efficiency but suggested gains will still come in light extraction, phosphors, and packaging.

Of the major LED chip makers, Cree alone is almost exclusively focused on general illumination applications for LEDs. The company does supply LEDs into other applications such as mobile phones, but R&D is specifically targeted at general lighting.

Swoboda discussed the decision the company made about five years ago to focus on general lighting. He said very succinctly, “It seemed like the biggest market and the hardest to do.” And there is no tempering of his expectations and goals. He predicted that Cree can obsolete every type of light source over time with LED technology.

The CEO is invariably frank about the difficulty of proliferating SSL technology in lighting as opposed to other areas. He noted that when you supply an LED to a company developing a mobile phone, the application is well defined and the engineers know precisely how to design in the LEDs. However, said Swoboda, “Lighting is a generic term that has hundreds of different unique problems that are often solved differently.” The luminaire and fixture makers face that difficulty in transitioning to LED light sources and Cree understands that it must help them to succeed. Swoboda said, “Every application is different and we have to spend more money to make it easier for our customers to use our product.”

The company is pursuing several paths to help the customer, for example building out a global network of customer application centers. And Cree is developing a much broader product line than you will find from most LED makers, said Swoboda, with the intent of matching the components and packaging to unique application requirements.

The system side of Cree

Swoboda also pointed to the company’s system business as being very important in driving success both in terms of component development and charting a course that the component customers can follow. He explained that Cree bought the LED systems business that is now Cree LED Lighting to help move the market as a demonstration vehicle.

The company is certainly selling luminaires and striving to make the systems business a profitable one according to Swoboda, but the larger focus is on accelerating the LED component sales that make up two thirds of Cree’s revenue. He said that the company’s lighting business is being used to establish a roadmap that other luminaire makers can follow.

Swoboda also discussed the value that the systems business has brought to the LED design and manufacturing process. “You would be surprised what the benefit is when your R&D guy that has to make an LED component is forced to sit across the table almost every day and argue with his sister division about why his LED doesn’t solve a lighting problem,” he said. “What you quickly find out is the semiconductor guy quickly learns that lighting is not like every other market.” He believes the interaction has led to the component engineers thinking differently about the LED, and in turn to components that solve general-lighting-centric problems.

The goal of course is quicker adoption of LEDs into lighting. According to Swoboda, LEDs will comprise a meager 4% of the general lighting market in 2010. During his Q&A session a member of the audience asked Swoboda to comment on the premise that LEDs would pervade 80% of the lighting market by 2020. Swoboda quickly said, “I hope it won’t take that long. I want to know how we can do it in 2015.”

Driving LED adoption

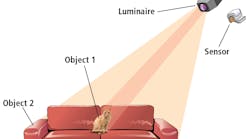

Swoboda discussed what he sees as the key to driving LED adoption -- looking at the technology and system design as intertwined elements. He suggested that many see LED system design, LED components and modules, and LED chips as three separate pieces rather than considering the implications that any one of the pieces has on the other two.

The SSL industry also needs to recognize where the opportunities lie according to Swoboda. He noted that fixtures and luminaires that target industrial and commercial installation currently afford the greatest market potential saying, “This is not about the light bulb.” He was quick to note that Cree is developing technology that enables retrofit light bulbs, but that the application focus would give preference to the largest applications.

The path to success sounds straightforward. Swoboda said, “Our goal for LED lighting is this: To help people design products that are better in every single respect to [legacy technology].”

Swoboda acknowledged that costs are a problem saying, “Today we ask our customers to buy a product and live with a ten year payback.” Were a vendor to approach Cree about buying into technology with a ten year payback for use in its factory, Swoboda said he would tell that vendor to “come back when it’s two.” While acknowledging the cost issue, Swoboda also stressed that SSL success has to come from value, saying “It’s not meant to be cheaper than the light bulb it’s meant to be better.”

LED component advancements

The road to superior lighting products invariably runs through advances in the LED component technology – and that means brighter, lower-cost LEDs. Swoboda recalled that, “When we got up to about 100 lm/W, many people said there was no reason to make brighter LEDs.” The point is that the efficiency was passing that of legacy sources, so some people questioned the need for even brighter LEDs.

Swoboda reminded the audience, however, that delivering good LED lighting is very much a system-level problem. He said, “Brighter LEDs are actually the way to make the most cost-effective lighting product” because they provide flexibility in the design. For instance, a design can reduce drive current -- simplifying the thermal design and extending the luminaire lifetime. But Swoboda also noted that “In some cases, if you don’t have color control perfect, you don’t have a product.”

Swoboda repeatedly emphasized the myriad lighting applications, the need for a broad product line, and the need for low component costs, but these factors seem to be at odds with one another. Historically low cost equates with high-volume manufacturing of a single product yet Cree has a broad product portfolio. Swoboda said, that Cree can manufacture a die in high volume to help drive costs down while using different package designs to yield components for different applications.

Swoboda did note that a move to larger wafers would soon start to drive cost down since a 6-inch wafer provides double the number of die compared with a 4-inch wafer. He pledged that Cree would be first in volume production with a 6-inch line for nitride (InGaN-based) LEDs.

There is a broad industry push to 6-in wafers underway. Rubicon Technology announced back in August that it was supplying 6-inch sapphire substrates for volume production of LEDs under a one year contract. It’s widely believed that the unnamed customer is an Asian manufacturer. Still the manufacturing message from Cree is clear that it has a roadmap toward lower component costs that’s rooted in semiconductor technology and that’s a proven way to drive costs down.