In a recent webcast, Strategies Unlimited research director Philip Smallwood placed a spotlight on the market potential and demographic opportunities for LED-based horticultural lighting. The firm’s latest research has focused on “applications with transformative implications in the [LED] market,” he explained, and horticultural lighting certainly qualifies.

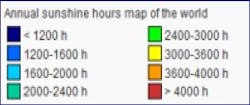

Since high-pressure sodium (HPS) is the main current incumbent lighting technology (with metal halide and fluorescent also installed), the enormous installed base of supplemental horticultural lighting offers a significant growth opportunity for the LED market in replacements or even new construction (see the heat map below showing the amount of daylight hours around the world — which would impact the amount of supplemental lighting used by region). To put this into perspective, Philip reported that there is 1.7B (billion) ft2 of greenhouse space in the United States and Canada — and about 15% of the installed base in the northern US has supplemental lighting. There is immense market potential in Western Europe as well, with its more established growers’ market and more densely populated area in the region. The installed base represents 32 miles2 greenhouse space in the Netherlands alone, and about 20% (perhaps even more) of the space is using supplemental lighting.

Enlargement of the key:

But Philip’s most interesting discussion point was the potential growth opportunity represented by vertical farming operations. You might think that established farming communities would represent huge market potential in the forecast, but really it is places like China — where suitable farmland is decreasing in availability due to rapid industrialization, and safe food production is becoming more of a concern — that represents a large “sleeper” market for vertical farming. Think operations closer to where food is purchased, as well as in places where space is at a premium and transport costs would be high in a traditional produce delivery chain. This also includes the northeastern US, where sprawling outdoor farms are not so commonplace and weather can have a substantial impact on yields. As a result, LED horticultural lighting in vertical farms is expected to grow globally to nearly $350M by 2022, Philip revealed.

There’s so much more in the webcast to frame this market in terms of technology and application opportunity. You can access the on-demand presentation from our website, and get even more defined market data in the Horticultural Lighting report by Strategies Unlimited.

More horticultural lighting resources and references

Don’t know what daily light integral (DLI) means? See this paper from Purdue University.

Look at horticultural lighting on the grand scale with this article from our colleagues at Lux.

But what about the ‘little guy’? Read more on a previous blog.

Need help understanding how to specify fixtures for growers? Check out this ‘buyers guide.’