The COVID-19 pandemic kicked off a frenzy of sorts in the disinfection marketplace. Many assumed that recent and massive performance boosts in white-light LEDs for general illumination would translate to the UV-C LED space. Lighting manufacturers embraced the ultraviolet application. Analysts predicted multibillion-dollar markets with double-digit CAGRs.

Unfortunately, that extraordinary growth has not immediately materialized. “It was much harder than everybody thought,” said Erik Swenson, vice president at Nichia America Corp., based in Wixom, Mich. “There’s a lot more science to it than simply providing UV-C energy. Safety concerns come into play as well. The gold rush lasted maybe six months and then a lot of the lighting manufacturers backed away.”

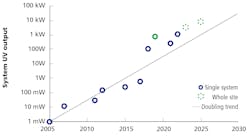

One take is that the opportunity just isn’t there. Another hypothesis is that the COVID bubble was just a distraction from the steady UV-C LED development that has been ongoing since the early 2000s. Oliver Lawal, CEO of Erlanger, Ky.–based AquiSense Technologies, said, “I struggle when I hear that the market is not what was predicted, because from my perspective, it’s exactly what we predicted." In fcat, he believes his firm was right on target on expected market share and the device performance needed to make it happen (see Fig. 1).

With technical advances and commercial deployments underway, now is an opportune time to revisit the disinfection market to better understand UV-C LED progress to date and future projections.

UV-C LEDs versus mercury-vapor sources

The problem with assuming that blue LED successes would immediately translate to the UV-C LED disinfection application is that the materials and markets are almost entirely different. Blue LEDs are based on indium gallium nitride (InGaN), whereas UV-C LEDs are based on aluminum gallium nitride (AlGaN). AlGaN presents a number of challenges, particularly in the areas of quantum efficiency and photon extraction. The wall plug efficiencies (WPEs) of UV-C LEDs are still in the single digits, compared to around 80% for blue LEDs and 35% for mercury-vapor lamps, which are the primary competitors for UV-C LEDs in the disinfection market.

The good news is that the current efficiencies of UV-C LEDs are nowhere near the physical limits of the AlGaN material system. Manufacturers have applied many of the engineering practices developed for white-light LEDs but are also developing new approaches to address the primary issues.

“The roadmap is incredibly exciting,” Nichia’s Swenson said. “Our newest UV-C LED operates with double the WPE over its predecessor from the year before. The theoretical maximum of UV-C LEDs is much less than for blue LEDs, but the next couple years are still going to be exciting and similar to the early developmental years of white-light LEDs, with a steep hockey-stick growth curve in terms of WPE and lifetime.” He cites devices operating with 80% output after 10,000 hours with a junction temperature of 90°C.

Frank Harder, chief revenue officer at UV-C LED startup Bolb, in Livermore, Calif., touts devices with WPEs approaching 10%. Its technological advances have brought internal quantum efficiency to nearly 70% and boosted photon extraction, he claimed.

Still, comparing UV-C LEDs with mercury-vapor lamps at the device level does not provide a full competitive picture, Swenson noted. At the system level, additional components such as ballasts reduce the WPE of mercury-vapor sources. Mercury-vapor lamps produce near-omnidirectional emission patterns, unlike LEDs, which produce highly directional output, making it possible to capture more usable energy. Mercury-vapor lamps require warm-up time, and frequent power cycling leads to premature failure compared to UV-C LEDs, which turn on instantly and can power cycle frequently with no reduction of lifetime. “All of these advantages add up to the point that at a system level, UV-C LED efficiencies are much closer to mercury-vapor efficiencies than people give them credit for,” Swenson said.

Morgan Pattison, LED technology consultant for Solid State Lighting Services and adviser to the U.S. Department of Energy Lighting program, was more skeptical. “The two don’t even out that much at the system level,” he countered. “It really depends on the specific application.”

Other advantages to LEDs include zero mercury content, which helps countries meet their Minamata Convention targets for the reduction of mercury. Moreover, arrays of ultracompact LEDs enable the design of smaller products in the form factors that best suit the application target.

Three markets

The UV-C LED disinfection market can be divided into three application segments: water, surface, and air. Each has its own requirements, challenges, incumbent technologies, and level of maturity.

Water disinfection. Water treatment is by far the most mature UV-C LED disinfection application. Currently deployed AquiSense units have an aggregate flow rate of 1.3 million gallons of water per day (MGD), Lawal said. A number of factors have led to UV-C LED success in this market. Water quality regulations for pathogens are well-established. Water disinfection with mercury-vapor technology is already a familiar treatment, lowering the barrier to entry, which allows the systems-level advantages of UV-C LEDs, such as smaller form factor and “instant on,” to come into play.

To date, the majority of UV-C LED water disinfection systems have been deployed at point of use (POU; see Fig. 2) and point of entry (POE), but the technology is scalable. A number of systems have been installed by municipal water districts around the globe, including one in Las Vegas with a flow rate of up to 6 MGD.

“For small systems, we’re past the early adopter stage,” Lawal said. “For municipal or larger industrial installations, we’re in the early adopter stage. I think the next five years will see us move into really significant market share.”

Surface disinfection. Germicidal ultraviolet (GUV) has an established role in surface disinfection, particularly in medical facilities. Mercury-vapor sources currently dominate the market, but because of safety concerns, GUV systems must be applied in unoccupied spaces, either via robots or with stationary units. As highly directional sources compatible with beam-steering techniques, UV-C LEDs offer an alternative for safer operation. “You can target surfaces much better without all the waste light that you produce with mercury-vapor lamps,” Harder said. “The energy consumption goes down, the form factors can become shallower. The overall experience of operating those robots becomes much more palatable, and then there is an opportunity for mass adoption.”

Air disinfection. The UV-C LED air disinfection market is the least developed at present, with a number of barriers. First, a large installed base of air treatment technologies already exists to remove pathogens, including mechanical filtration and increased exchange with outside air. GUV itself is a newer technology for the building industry, even prior to the introduction of UV-C. Second, UV-C radiation presents a health hazard to eyes and skin, though the biggest opportunity for disease control is in treatment of occupied spaces. Third, unlike the water segment, no standards currently exist for control of airborne pathogens inside buildings. However, all three barriers are being addressed.

On the regulatory front, ASHRAE is currently working on an expedited indoor air quality pathogen mitigation standard, with release expected this summer. These developments have the opportunity to trigger significant change because such standards are incorporated into building codes.

According to Gabe Arnold, systems engineer at Pacific Northwest National Laboratory, conventional HVAC systems may be designed to deliver approximately 2 to 4 air changes per hour, with significant increases in system and energy costs as air changes increase. If the new ASHRAE standard recommends a higher number of air changes as expected, conventional HVAC technology will be challenged. “This is an area where we expect GUV technology to perform extremely well,” Arnold said. “In fact, it may be the most effective measure you could deploy.”

“Compared to HVAC, UV-C LED disinfection uses one-twentieth the amount of energy per effective air change per hour,” said Jennifer Nuckles, CEO at UV systems developer R-Zero in San Francisco.

The most effective approach appears to be upper-room air disinfection, which segregates UV radiation from occupants (see Fig. 3). Upper-room systems need beam steering or beam restriction to aim UV energy across the room without scattering and reflections. “If you're using a low-pressure mercury source, you can’t control that beam that well, and there are all kinds of associated losses,” Arnold said. “That’s why UV-C LED systems are starting to be used.”

Broad acceptance will take time. “You definitely have the early adopters, but the majority are still looking for answers,” said Mark Gaston, director of UV-C product management at Excelitas Technologies, in Waltham, Mass. “It’s going to take years to get large-scale adoption where the market is ready to implement the technology in volume.” Slow budget cycles in target markets like school districts add further delays. Still, the market footprint will expand.

Market prospects are positive, but paced

As the technology improves and the business and regulatory frameworks develop, market share across all three segments will increase. In particular, the POU/POE UV-C LED water disinfection market is expected to move into the early majority phase in the next two or three years. Large-scale industrial and municipal industrial water applications will likely need closer to five years, with surface disinfection following on its heels. Air disinfection continues to progress, but it will probably require closer to 10 years to really become established.

Even Pattison sees strong prospects for the overall UV-C LED disinfection market. “It is going to take time and it is not going to succeed with every application," he said. "But it is going to start becoming compelling from a technology performance and cost standpoint...application by application.”

Keys to market adoption of UV-C LEDs

Significant market penetration depends on more than just performance and price. For example, white-light LEDs had tremendous efficiency and lifetime advantages over the incumbent technologies, but the general illumination market still didn’t truly take off until standards bodies established test protocols and governments around the world moved to phase out incandescent bulbs.

Lawal of AquiSense identifies six steps that will usher UV-C LED disinfection across the chasm from the early adopter phase to the early majority stage:

- Boosting device performance (that is, WPE, output, lifetime).

- Lowering prices.

- Optimizing systems-level efficiency and manufacturability.

- Exploiting the competitive advantages of LEDs for each application.

- Promoting the development of the necessary standards and regulations.

- Fostering demand-side drivers such as educating consumers and taking advantage of corporate commitments to sustainability.

“A lot of people think it’s just about the first two points, but we still need these other things,” Lawal said. “If you don't, you can have a chip that’s 10 times more powerful than today, that costs one-tenth of the price and you still won’t [reach widespread adoption].”

System-level design makes a crucial difference. Product engineers need to develop the correct mechanical and thermal interfaces with optimized drive conditions. Most of all, they need to take advantage of directionality to apply beam-steering techniques. “This allows for a targeted treatment in air, water, or surface applications,” Bolb’s Harder explained. “It increases the overall system efficiency in comparison to mercury lamps by a factor of 6 to 10 times, with today’s wall plug efficiency regime around 7%. In the water industry, our customers now see 7% or 8% wall plug efficiency as the technological tipping point for UV-C LED adoption.”

The last point — the value of demand-side drivers — shouldn’t be underestimated. In response to consumer and shareholder concerns, many major corporations are increasingly demonstrating leadership in social and environmental areas. For instance, Coca-Cola is buying UV-C LED water disinfection systems from AquiSense for installation on Coke machines in Europe. “Coke selected UV-C LED technology instead of mercury vapor largely for sustainability reasons,” Lawal commented. “It was less about price, process, or regulatory compliance. It was their own internal company” seeking to meet ESG objectives.

KRISTIN LEWOTSKY is a freelance technology writer based in New Hampshire (chezhardy.com). Lewotsky leverages her engineering background and deep experience in B2B media to brings technical concepts to varying levels of audience across fields such as microelectronics, semiconductors, optical and wireless communications, automation, and robotics.

*In its March 2023 issue, LEDs Magazine incorrectly credited Fig. 3, which was contributed by Excelitas Technologies and was correctly sourced by the author of this article. LEDs regrets the error.

For up-to-the-minute LED and SSL updates, follow us on Twitter. You’ll find curated content and commentary, as well as information on industry events, webcasts, and surveys on our LinkedIn page and our Facebook page.