Ensure LED Leading Position

Epistar (2448.TW) announced a plan to fully acquire Forepi (3061.TW), the second-largest chipmaker in Taiwan, through a share swap (1:3.448), implying 18% share dilution to Epistar. The effective date will be the end of 2014, and Forepi will be delisted from the TAIEX.

After the merger, Epistar will become the world’s largest LED chip maker in terms of capacity with a global market share of 15%, which will better position the company to lead in future technology development. We view this deal as positive progress and a win-win situation in the long term, although the synergies for Epistar are limited given the similarity of both companies’ products and clientele base. We also believe Epistar will solidify its leading position in the LED world.

The King of chip makers

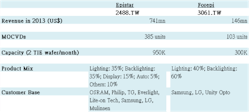

According to the spokesman of Epistar, the main reason for this acquisition is to ensure capacity and to ease the supply shortage. The shortage is expected to be 30% - 35% in 3Q14 for Epistar due mainly to the strong demand of lighting and the high season. Further, Epistar can benefit from the scales economy as well as cost synergy. Epistar currently has 385 metal organic chemical vapor deposition (MOCVD) tools or 950K two inch equivalent (TIE) wafers/month. Epistar expects to expand capacity by 10% by the end of 2014. Forepi currently has 103 tools for InGaN, or 300K TIE wafers/month. As a result, the total capacity will be 488 tools or 1.25M TIE wafers/month vs. Sanan’s 164 MOCVD tools. By the end of 2014, The New Epistar will have more than 500 MOCVDs, further widening the gap with Sanan’s 164 tools.

Source: Strategies Unlimited Research Data

Behind the merge

Sanan Opto, the largest LED chip maker in China with global share of 5%, is the biggest shareholder of Forepi with 19.8% ownership. Sanan Opto’s manufacturing yield has been improved significantly during the past 5 years because it has poached nearly 100 of Epistar’s engineers and invested in Forepi. In addition, its capacity expansion has been aggressive, and the company plans to expand its capacity to more than 200 MOCVDs by 2015. Based on China LED Industry Update from Strategies Unlimited's Perspective, published on 2/11/2014, Chinese TV brands tend to use local LED packagers and chip makers, and Sanan Opto became the major chip supplier to local TV backlighting in China in 2013. Obviously, Sanan Opto has become the major threat to Epistar. After the acquisition, Sanan Opto could convert into 3.1% of Epistar’s common shares (or 2.8% of fully diluted shares). Epistar guided that the current management and board of directors will remain steady without concern about Sanan Opto. On the other hand, the Taiwanese government supports this merger because the government does not want LED R&D talents/patents/ownership to be transferred to Sanan Opto.

Impact on LED industry

We believe the impacts on the LED industry will benefit upstream instead of downstream. We also expect irrational price competition to lessen after the merge and going forward. There will be less direct competition among Taiwanese LED chip suppliers, and the supply will be more disciplined. Furthermore, we expect New Epistar to have more bargaining powers to the downstream market because packagers will have limited options of LED chip supply. In addition, the capacity expansion will be more disciplined as well. Therefore, the pricing of LED packaging will become more stable.

Half of Top 10 Worldwide LED packagers are Epistar’s customers

Source: Strategies Unlimited Research Data