The report, entitled LED Chip Production Capacity Analysis and Forecast by Maker (MOCVD, Epi-Wafer/LED Chip), shows Chinese LED manufacturers are investing heavily due to government support, foreign investment and expansion from existing players in the country.

“Overall LED industry has seen many changes such as delayed investments due to the year-long oversupply and many Chinese makers entering the industry,” said Brian Bae, senior analyst at Displaybank research group.

Bae added “especially in the case of China, as fast-paced investments are made, China’s share of the number of MOCVDs owned remained at 3 percent in 2009 but the share grew up to 15 percent as of second quarter of 2011. If the current investment plan holds, China will show growth rate of 64.2 percent year-over-year and [will be] ranked as world’s number one for the number of MOCVDs owned.”

As a latecomer to the industry, the current LED manufacturing technology level of China is not as sophisticated as that in other countries, but China is rapidly recruiting engineers from developed regions including Taiwan. The growth rate is rapidly increasing due to demand from Chinese LED manufacturers.

Duke Lee, research director at Displaybank noted “In the case of Korea, the demand for MOCVDs have increased sharply from 2009 to 2010 as LED backlights for large-sized LCDs grew. Investments have gone down due to the downed LCD TV market but it is expected to resume with the preparation for the general lighting market.”

Taiwan also sees increased MOCVD demands through the growth of LED backlights for large-sized LCDs with investments coming from such companies as Lextar and CMLT, affiliates of AUO and CMI Group.

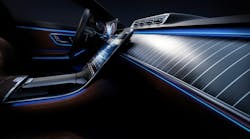

Japan is more advanced in LED technology and its general lighting market is seeing rapid development with equipment investments from several significant players. Japan’s LED manufacturers are putting more emphasis on lighting and automotive LEDs, and have greater penetration into the large-sized TV backlighting sector.