Conference speakers largely agreed that the race to the bottom price-wise is inevitable in LEDs and lighting, reports MAURY WRIGHT, but ideas for new value-added applications and services that can deliver prosperity to the SSL sector abound.

The Strategies in Light (SIL) and The LED Show conferences took place March 1-3, 2016 in Santa Clara, CA, and attendees at the events were put to the ultimate test of the proverbial glass-half-empty or -full conundrum. Eroding prices in both packaged LEDs at the component level and lighting products at the solid-state lighting (SSL) system level are creating a series of roadblocks to success in terms of profits for industry participants. But conference speakers were quick to identify new applications and services that could spur profitability. Moreover, the show floors were packed with attendees and exhibitors that clearly see enduring opportunity in the SSL sector (Fig. 1).

Interested in more articles & announcements on applications of LEDs?

The glass-half-empty message was front and center at the Investor Forum on Tuesday before the main conference even began. Investment bank Canaccord Genuity sponsored the forum and Jed Dorsheimer, managing director of equity research in display and lighting markets, led with an overview of the LED lighting industry (Fig. 2). He began by saying, "The industry feels a little lost right now." He compared the current market to 2005 before the TV market began to consume LEDs, and a time when there was a significant oversupply of LEDs at the component level.

Of course, in the earlier era, the TV backlighting market would rescue the industry with general lighting poised to drive a subsequent era of success. But Dorsheimer said China entered the market more recently with the government subsidizing LEDs, resulting in an extended "hangover period of oversupply."

Dorsheimer described meeting with some aggressive players in the LED manufacturing sector several years ago who described their plan to capitalize on what they called the boomerang effect. The companies planned to drive component prices so low that many manufacturers would exit the market. Then the survivors would be able to recapture their investment by controlling market share and raising prices. But Dorsheimer said the price erosion has even run some of the companies banking on the boomerang effect out of the business.

FIG. 1. The exhibit floors at the co-located Strategies in Light and The LED Show events featured displays of the latest enabling technologies, ranging from LEDs to connected SSL products and systems.

The marginal cost of purchasing LEDs is essentially free, according to Dorsheimer. He said fab utilization rates are at about 40% and there is at least a two times oversupply of components. And making an even stronger statement, Dorsheimer added, "Lighting is not going to save this industry."

Glass half full

Then Dorsheimer turned to the glass-half-full opportunity with a focus on lighting. Pricing in lighting products is also eroding quickly. But putting himself in the shoes of lighting manufacturers, he asked, "Are we even in the lighting business? Or are we in the business of delivering experiences to consumers?" Lighting manufacturers will give lumens away for free, said Dorsheimer, and the successful ones will monetize other attributes of what lighting can do going forward. He made an analogy with the mobile phone operators that give away voice calls but monetize data services.

Indeed, Dorsheimer began what would be a recurring string of presentations during SIL week about applications enabled by network connectivity and intelligence in LED-based lighting products. And he said it's no given that stalwarts such as Philips Lighting, Osram, and Current, Powered by GE (formerly GE Lighting) would even be in the business in ten years.

Dorsheimer said for the lighting manufacturers, "the first step in fixing a problem is admitting that you have one." He said the manufacturers are largely in a period of "profitless prosperity" with the noted exception of Acuity Brands, which Dorsheimer said had been successful leveraging a different distribution approach.

FIG. 2. Jed Dorsheimer of Canaccord Genuity painted a bleak future for an LED industry beset with oversupply issues, but he also said lighting companies can succeed by delivering LED-based products with value-added services.

But the entire industry must move to an information technology (IT)-like systems approach to lighting. Dorsheimer said Canaccord had studied 16 relative niches where profits may be abundant. And some of the niches will be large. Examples include human performance/productivity, building management, horticulture, "pharming" (a term he used to describe the burgeoning medicinal and recreational marijuana industry), and visible light communications (VLC).

Energy efficiency will remain important but won't continue to win business. He said you cannot attract a facility manager with the promise of a 20% reduction in operating expenses, but if you can also provide analytics on shopping aisle traffic that can be applied to inventory management, you have a much stronger value proposition. Dorsheimer admonished the lighting manufacturers to "find a niche, own that niche, and deliver a clear value proposition."

Dorsheimer returned to the LED component topic at the end of his talk. He said the phosphor-converted white LED market is a dead market that may never recover from the oversupply situation even with some coming consolidation, and that there is only incremental technology improvement still to come (see the sidebar for more on LED technology from SIL). He said red, green, and blue (RGB) LEDs could be a different story with quality LEDs needed for tunable applications. There will be other niches of success in components including green LEDs, micro LEDs, laser diodes, and OLEDs, according to Dorsheimer, and he said wide-bandgap semiconductors were going to be a growth area for use in all of the sensors that will be embedded into LED-based lighting products.

Plenary keynote

In one of the keynote presentations on the first day of the full conference, Mark Lien, director of government and industry relations for Osram Sylvania, also addressed the disruption that is spreading in the lighting industry (Fig. 3). Lien couched his discussion in the framework described by Peter Diamandis and Steven Kotler in the business book Bold.

Lien said the digitization of an industry brings about a transition from a linear to an exponential timescale. He used the human genome mapping project that began in 1990 as an example. After seven years, researchers had mapped a mere 1% of the genome. But the project was actually halfway complete because the remainder of the work happened on an exponential timescale.

FIG. 3. Mark Lien of Osram Sylvania described how the digitization of lighting has shifted the industry timescale from linear to exponential, and said it will open the sector to many more brilliant minds to drive innovation.

Lien said once a tipping point is hit, things happen quickly and deceptively, and many lighting companies are already feeling the disruption just as major companies have been impacted in the broader technology sector. In 1960, Lien said the average age of an S&P 500 company was 60 years and today that lifespan is 20 years.

Demonetization

In today's landscape, Lien said the demonetization described in Bold is already rampant. During pre-holiday 2015 Black Friday sales, there were LED lamps priced under a dollar. Lien said "things get free" using Wi-Fi at cafés and coffee shops and Craigslist as a replacement for classified ads as examples.

Diamandis and Kotler also described dematerialization that happens in digitized sectors. Lien said that will happen in lighting as LEDs are integrated into the structure of architecture along with sensors. Of course, that will open up possible new innovation in areas such as nanowire LEDs and graphene lighting.

Still, Lien said, "The next five years is going to be one heck of a ride." The message was that there are abundant opportunities that come with demonetization as defined in Bold. Innovative minds are the key and the digital age makes the deep resources once only available to large corporations accessible to nimble startups - a site such as freelancer.com is an example.

Lien said there were two billion users of the Internet in 2010 and that number will grow to five billion by 2020; that means there will be three billion new minds connecting and creating. For example, Lien said wireless lighting powered via a magnetic field the way some mobile phones charge today is a possibility. Such a scheme would pair well with a wafer-thin OLED panel integrated into architecture.

Connectivity and intelligence

For most of the speakers at SIL, the transition to connectivity and intelligence in lighting was a given, but there are still issues in terms of how to sell it. Joe Costello, chairman and CEO of networked-lighting specialist Enlighted, discussed both the opportunity and the sales challenge. Costello said 99.999% of commercial real estate is "dumb" today and projected that installing the sensory system is a $100 billion opportunity in the next ten years.

Costello said Enlighted is actually a data company. But with that data-gathering mission, the company made some surprising discoveries and decisions about how to handle the need of connecting a large numbers of sensors - 22,000 sensors in one Enlighted installation. Costello said 500 sensors would overload typical networks such as ZigBee or Wi-Fi without some way to compress the data. So Enlighted uses decentralized intelligence embedding a digital signal processor (DSP) IC in each luminaire/sensor so the data can be processed at a first level and compressed for transmission to a control console.

Selling lighting based on operational savings, however, remains a tough task, according to Costello. He said connected LED-based lighting is worth about $0.02/ft2/ month to a facility manager - enough to justify the installation of such lighting. But he said facilities just get ignored in large corporations. Enlighted is already selling HVAC management in addition to networked lighting, and is in the early stages of offering space planning, conference room management, indoor positioning, and asset management. These applications combined with the value of the lighting ease the sale, especially in the executive suite.

Costello used asset tracking as an example. He said hospital nurses spend one hour each day looking for what is very expensive equipment, and along with teachers, nurses are the scarcest personnel resource in the US. Bluetooth tags and compatible beacons/sensors in the lighting would eliminate the problem.

Why in the lights?

Of course, the question remains as to why lighting is the best place to install a sensory network that is the heart of building systems. Arne Otto, senior vice president of corporate strategy at Osram, provided some compelling reasons. Otto said the industry must move from "ledification" to value-added services that come with digitization and listed labor productivity, asset utilization, emotion and wellbeing, entertainment, and virtual reality as examples.

Otto said the commercial building sector needs a network that can connect to all types of new sensors beyond occupancy/vacancy and ambient light. He said other sensor types might include carbon dioxide and temperature, and might even go so far as sensors that monitor human vital signs.

Like Enlighted's Costello, Otto favors a decentralized topology and lighting is uniquely positioned as a host for the sensory nodes. He said the homogenous distribution of fixtures on building ceilings is an advantage for sensors and functions such as triangulation. Moreover, he said no industry other than lighting has universal access to power, and the battery-powered beacons are the weak link in some proposed building systems.

Still, Otto sees that the transition to a sensory future will happen in stages. Today the building industry is concentrating on functional silos based on disparate systems. Gateways are evolving to connect the silos. But ultimately Otto said buildings will evolve to the so-called Internet of Things (IoT) concept with every element of a building on a mesh network and with complete decentralized controls and "on-the-spot decision making."

Network options

Inevitably discussions turned at some point to the networks that will be used in the future of connected lighting. One popular topic of late is Power over Ethernet (PoE) and there were PoE proponents at SIL. We also have yet another feature article on the topic in this issue of LEDs Magazine. PoE remains limited in terms of viability to new buildings or major retrofits that, for example, encompass an entire floor of an existing building. Still, wireless networks will clearly come into play in many retrofits and also possibly in new construction.

The surprising wireless candidate that got mentioned in several presentations was cellular wireless as opposed to Wi-Fi, ZigBee, or 6LoWPAN (IPv6 over Low power Wireless Personal Area Network). Indeed, Osram's Otto said, "5G cellular networks may give Cisco a challenge" with Cisco mentioned because of the company's PoE interests and overall dominance in Ethernet and Wi-Fi inside commercial buildings.

FIG. 4. Michael Poplawski of the DOE's Pacific Northwest National Laboratory examined the options for connecting the nodes in a sensor-heavy lighting network, and the potential of cellular radios to serve the application.

Michael Poplawski (Fig. 4), senior lighting engineer with the US Department of Energy (DOE) Pacific Northwest National Laboratory (PNNL), and Remy Marcotorchino, director of segment marketing for Sierra Wireless, further examined the cellular option. Poplawski began by discussing the potential applications and the technology needs and challenges of a ubiquitous sensory network in a building and outdoors. He referred to a recent statement by Intel that touted the LED lighting transition as a once-in-a-generation opportunity to enable a networked world.

One application Poplawski discussed is air quality. He said the San Francisco Bay Area (site of the conferences) only has three stations that monitor air quality for what is a very large geographic region. Chicago, meanwhile, is already installing sensors on a much more granular basis on light poles. He said ultimately the network could convey allergy or asthma alerts via a smartphone app.

Given the diverse set of potential applications, perhaps a cellular wireless approach is the simplest. Such networks are interoperable by definition. But Poplawski asked a question that perhaps doesn't have a single right answer: Do devices with widely varying bandwidth and latency requirements all belong on the same network? He said the industry needs to discern where wired and wireless networks fit and how best to use wireless spectrum.

Cellular communication

Cellular communications might eliminate the task of managing a network in the IoT era from building managers or municipalities. But playing devil's advocate, Poplawski said cell phones have a useful life of two years while buildings last decades. Cellular technology is already being used in some remote health devices and in some utility meters, but is such a scheme viable on a more granular IoT scale?

Marcotorchino took over and explained the evolution of wireless technology in the cellular sector that could make it a better fit for IoT usage. The 3GPP (3rd Generation Partnership Progress) that promulgates cellular standards has a number of efforts underway that could make such networks a fit for low-bandwidth, low-power, cost-sensitive devices.

The 3GPP group is better known for pushing next-generation technology with higher bandwidth. But simultaneously the group is developing layers designed to support lighter-weight nodes on both 3rd-generation (3G) GSM networks and 4G LTE networks. Down the road, EC GSM will enable IoT devices to utilize 200-kbps slices of bandwidth. And LTE extensions called NB-IOT and LTE-M will enable 100-kbps and 400-kbps streams, respectively. Such an eventuality will allow cellular operators to offer low-cost tariffs for what are sometimes called embedded systems or machine-to-machine (M2M) nodes that don't need the blazing-fast data rates that serve smartphones. Unfortunately, it will be 2017 before those technologies begin to roll out in the market; realistically, it will be 2018 or later before they are broadly available.

Security and privacy

A networked lighting future will also come with security and privacy issues that have long plagued the IT sector, and in fact might also impact network choices. Himanshu Mehra, senior product manager in the Cisco Enterprise IoT group, argued that the fact that the IT sector has protections in place in terms of security makes the IT network the best option for networking lights and sensors.

Mehra said a sensor-laden lighting network would expose many more endpoints to attack. And some of those IoT devices will not have the computer power to implement complete IP (Internet Protocol) stacks. But still he said those devices can be connected by gateways and IT networks can isolate traffic for security. For example, he said an IP network could limit endpoints from communicating with any device other than the lighting control system.

Privacy is quite a different issue. Many of the value-added applications discussed during SIL week involve the inherent collection of data about the actions of people. Maulin Patel, general manager for intelligent buildings at Current, Powered by GE, said corporations are obliged to protect the privacy of workers, customers, and visitors, and specific industries such as healthcare have their own requirements defined in HIPAA (Health Insurance Portability and Accountability Act) in the US (Fig. 5).

Organization responsibility

Collecting occupancy data for a private office is one place where Patel said corporations might be in a gray area. Were a corporation to use such data to deduce the hours an employee works, that could have employment law and anti-discrimination implications.

FIG. 5. Maulin Patel of Current, Powered by GE warned the attendees that many of the proposed applications for networked lighting could have privacy implications including using sensors to monitor occupancy in private offices.

The privacy issue might even extend to homes. For example, data from an occupancy sensor mounted on a street light might be a viable indicator of when a family is home or not. And that data could be used by criminals to target vacant houses. So the data must be protected.

Patel said all parties should collect minimal data, avoid sensitive data, destroy data when the utility of the data expires, assess the privacy impact of gathered data, and increase awareness in their organization. He said there are many avenues to mitigate privacy risks. You can anonymize data, for example, using time-based averaging or moving averages. Or you can gather data in aggregate, covering groups of users. And in all cases, Patel said organizations should prominently display privacy notices and allow users to opt out of monitoring.

The issue is not confined to the US or North America, either. In Europe specifically, Patel said the Right to be Forgotten regulation is an issue. Patel admonished the industry to "adopt privacy by choice and not by disaster." Bad press related to privacy issues could derail the movement toward advanced lighting.

Compelling applications

Throughout SIL week, there were stories of compelling applications aplenty, but two that are under development really stuck out and were saved until the very last session in The LED Show track. The sectors involved were space exploration and healthcare.

Patricia Rizzo, senior lighting applications director at Philips Lighting, discussed a patient room project being developed for a trial at Maastricht University in the Netherlands. Cardiologists at the university hospital will compare standard rooms to four rooms equipped with what Rizzo called a circadian lighting system. The work would also fall under the generic label of human-centric lighting (HCL). Philips is simultaneously studying HCL in an office environment with the DOE having partially funded both efforts.

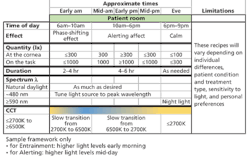

TABLE. Philips Lighting data for circadian lighting tests in a hospital room.

The hospital study will gauge the effectiveness of four-channel systems that can produce any color, two-channel systems that can produce tunable white light, and single-channel white light. The study will ultimately yield data on patient sleep quality, alertness, mood, and fatigue. And the researchers will track recovery time and patient and staff satisfaction. The full project is due for completion by the end of the year; the table on p. 34 summarizes the light tuning schedule for the HCL rooms.

Already Rizzo had advice for the audience. She lamented that "we can't talk about absolute efficacy anymore." Inherently, a multichannel system will score lower in the lm/W efficacy measure compared to non-tunable systems, both because multiple channels are involved and with color systems humans have lower sensitivity in ranges like blue. Rizzo said the industry will need to examine "connected system efficacy," meaning a measure that's centric to the circadian mission, rather than lm/W. Mark Rea, director of the Lighting Research Center (LRC) at Rensselaer Polytechnic Institute, has discussed the need for such benefit metrics at past SIL events. The Philips researchers are collecting data based on some already defined circadian-centric metrics, including the LRC-developed Circadian Stimulus (CS).

In a brief discussion of the office research, Rizzo said the group is exploring the use of light showers in select areas of an office floor where employees could get a strong dose of blue-rich light for alertness as opposed to an organization spending money to install tunable lighting throughout an office area. And during the question and answer session, Rizzo said a monochromatic blue source could deliver an effective dose with a much shorter exposure time than could a white light with enriched blue energy.

LEDs in space

The other compelling use of HCL presented at the conferences involved the International Space Station (ISS). Toni Clark, an engineer from Lockheed Martin working on the unique lighting problem at the ISS, described a new system that is being installed later this year. The ISS astronauts are fully dependent on artificial light. And inside the ISS, the lighting has been based on 4500K-CCT fluorescent lights that are shielded for electromagnetic interference. A move to LEDs will make more efficient use of energy and lessen maintenance. But Clark focused mainly on the other benefits of HCL.

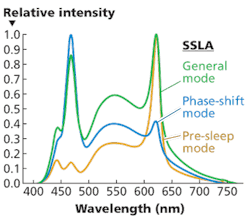

Lockheed Martin developed what is being called an SSLA (SSL Assembly) that will mount precisely in the footprint of the existing fluorescent lighting. It will require numerous launches of supply ships to deliver all of the SSLAs to the ISS. The unit is designed to deliver light at three different CCTs and specific spectral power distributions (SPDs). The unit can also generate brighter light levels than the prior fluorescent lights.

FIG. 6. One of the most exciting projects discussed in the conferences centered on new tunable LED-based lighting that will be installed at the International Space Station and will feature three distinct spectral power distributions (SPDs) for different times of the astronaut workday.

For general illumination, the SSLA will output 4500K light just as the fluorescents have (Fig. 6). A Pre-Sleep mode will drop the CCT to 2700K. Then the team has added a Phase-Shift mode at 6500K. The cooler light could be used in a wake cycle in the virtual morning, but also has a more vital role on the ISS as the Phase-Shift name implies. The astronauts can be hit with what they call a slam shift - for example, when a supply ship arrives any time in a 24-hour period. The Phase-Shift light is hoped to provide an almost immediate adjustment to a new sleep/wake cycle for the astronauts. The Lockheed team has modeled the system extensively and soon it will be put to the test.

We expect to bring you more details on these exciting projects down the road, and perhaps we will see extensive updates during SIL week next year, February 28 through March 2, 2017 in Anaheim, CA. The transition from lighting as a commodity to networks, intelligence, and applications such as HCL will indeed bring exciting times and opportunity to the SSL sector.

Seeing bright spots (the good kind) with CSP LEDs

Despite the negative tone set by Jed Dorsheimer of Canaccord Genuity as covered in the adjacent article, there are potential bright spots in LED components. At least several industry executives commented positively in this area, and one avenue to success may lie in the transition to the chip-scale package (CSP). We covered the potential of CSP LEDs in a recent feature article. The minimal package is expected to lower manufacturing costs and potentially boost performance. During SIL, two major LED manufacturers discussed their CSP efforts and other opportunities in the SSL-centric semiconductor sector with profit potential.

A year back at SIL, Lumileds made news when the company announced that it had shipped 250 million CSP LEDs in 2014. This year, CEO Pierre-Yves Lesaicherre spoke in the Investor Forum and provided an update on the company's CSP program. He said Lumileds had sold 800 million such LEDs at the time of the SIL talk and that number would climb to more than one billion by the end of March.

Also, don't tell an executive such as Lesaicherre that LED technology advancement has stagnated. He said Lumileds upgrades its epitaxial technology on a three-month cycle.

Lesaicherre did admit that the company has excess high-power LED capacity at the present and that fact was largely driven by a faster transition to mid-power LEDs in lighting applications than originally expected. Lumileds is in the midst of refreshing its mid-power portfolio (see "Lumileds unleashes March madness with mid-power packaged LED extensions").

Still, in the long term Lumileds sees CSP LEDs as a major opportunity and one that may allow the company to rise above the crowd of commodity players. Lesaicherre said in two years Lumileds will be doing nothing but CSP LEDs.

M.J. Jou, president of Epistar, also addressed the CSP trend in a keynote address during the Plenary session on Wednesday. The title was "Survival of the fittest" and Jou delivered the message that an LED maker can still thrive through innovation.

Epistar calls its CSP technology PEC (Pad Extension Chip) because the solder pads are basically attached directly to the die. Jou said the architecture features a low forward voltage for increased efficacy. Moreover, vias allow uniform current spreading over the entire chip, which reduces droop. The simpler thermal paths off the chip also enhance reliability.

Jou said Epistar can deliver CSP LEDs that operate at power levels to 3W. The company has been supplying CSP LEDs into the TV backlight market for two years, and is now ready to service the lighting market as well.

But the TV market provided one example of a problem that will forever bedevil the LED sector. Jou said the original Samsung TV that was backlit by LEDs used 700 packaged LEDs. He said 10 CSP LEDs can handle the task in some TVs today. Every time the industry pushes LED technology forward, product developers need fewer components that are simultaneously dropping in price.

Jou also said Epistar would utilize its gallium-nitride (GaN) semiconductor expertise to impact other areas in SSL system design. For example, Jou said GaN-on-silicon (GaN-on-Si) power devices including driver ICs could result in lower cost and more functionality with fewer external components. Jou did not mention GaN-on-Si LED work that it had discussed in the past. Epistar had bought the GaN-on-Si-centric LED operations of TSMC in early 2015.