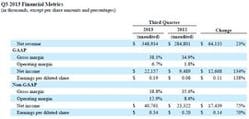

Date Announced: 24 Apr 2013 Quarterly Revenue increased 23% year-over-year to a record $349 million and quarterly Net Income increased 134% year-over-year to $22.2 million.DURHAM, N.C., April 23, 2013 - Cree, Inc. (Nasdaq: CREE), a market leader in LED lighting, today announced revenue of $348.9 million for its third quarter of fiscal 2013, ended March 31, 2013. This represents a 23% increase compared to revenue of $284.8 million reported for the third quarter of fiscal 2012, and a 1% increase compared to the second quarter of fiscal 2013. GAAP net income for the third quarter was $22.2 million, or $0.19 per diluted share, an increase of 134% year-over-year compared to GAAP net income of $9.5 million, or $0.08 per diluted share, for the third quarter of fiscal 2012. On a non-GAAP basis, net income for the third quarter of fiscal 2013 was $40.8 million, or $0.34 per diluted share, an increase of 75% year-over-year compared to non-GAAP net income for the third quarter of fiscal 2012 of $23.3 million, or $0.20 per diluted share."Fiscal Q3 was another good quarter with record revenue and earnings per share that were on the high-end of our target range," stated Chuck Swoboda, Cree Chairman and CEO. "Overall company backlog is ahead of this point last quarter and we are targeting solid growth for Q4. We remain focused on using new product innovation to grow our business and build the Cree brand." Gross margin decreased 40 basis points from Q2 of fiscal 2013 to 38.1% on a GAAP basis and decreased 40 basis points to 38.8% on a non-GAAP basis. Cash and investments increased $51.2 million from Q2 of fiscal 2013 to $937.1 million. Accounts receivable (net) increased $37.3 million from Q2 of fiscal 2013 to $181.9 million, with days sales outstanding of 47. Inventory increased $10.7 million from Q2 of fiscal 2013 to $195.7 million, with days of inventory of 82 days.Recent Business Highlights: Introduced the Cree LED Bulbs, a game-changing series of LED bulbs at a retail price point that gives consumers a reason to switch to LED lighting; Announced the availability of a new product family, XLamp® XQ LEDs, which are Cree's smallest lighting-class LEDs and 57 percent smaller than Cree's XLamp XB package; Introduced the CR Series LED Architectural High-Efficiency (HE) troffer, with an industry-leading 130 lumens per watt and 90 CRI; Released a second-generation SiC MOSFET that delivers industry-leading power density and switching efficiency at half the cost-per-amp of Cree's previous generation MOSFETs; Set a new R&D performance record with a 276 lumen-per-watt white power LED; Appointed Mike McDevitt as Executive Vice President and Chief Financial Officer.Business Outlook:For its fourth quarter of fiscal 2013 ending June 30, 2013, Cree targets revenue in a range of $365 million to $385 million with GAAP gross margin targeted to be 39.0%+/- and non-GAAP gross margin targeted to be 39.5%+/-. Our GAAP gross margin targets include stock-based compensation expense of approximately $2.3 million, while our non-GAAP targets do not. Operating expenses are targeted to increase by +/- $4 million on a GAAP basis and +/- $5 million on a non-GAAP basis. The tax rate is targeted at 20.0%+/- for fiscal Q4. GAAP net income is targeted at $25 million to $31 million, or $0.20 to $0.26 per diluted share. Non-GAAP net income is targeted in a range of $41 million to $47 million, or $0.34 to $0.40 per diluted share. The GAAP and non-GAAP net income targets are based on an estimated 119.6 million diluted weighted average shares. Targeted non-GAAP earnings exclude expenses related to the amortization of acquired intangibles and stock-based compensation expense of $0.14 per diluted share.Quarterly Conference Call:Cree will host a conference call at 5:00 p.m. Eastern time today to review the highlights of the fiscal third quarter 2013 results and the fiscal fourth quarter business outlook, including significant factors and assumptions underlying the targets noted above.The conference call will be available to the public through a live audio web broadcast via the Internet. For webcast details, visit Cree's website at investor.cree.com/events.cfm.Supplemental financial information, including the non-GAAP reconciliation attached to this press release, is available on Cree's website at investor.cree.com/results.cfm.About Cree, Inc.Cree is leading the LED lighting revolution and making energy-wasting traditional lighting technologies obsolete through the use of energy-efficient, mercury-free LED lighting. Cree is a market-leading innovator of lighting-class LEDs, LED lighting, and semiconductor products for power and radio frequency (RF) applications.Cree's product families include LED fixtures and bulbs, blue and green LED chips, high-brightness LEDs, lighting-class power LEDs, power-switching devices and RF devices. Cree products are driving improvements in applications such as general illumination, electronic signs and signals, power supplies and inverters.For additional product and company information, please refer to www.cree.com.Non-GAAP Financial Measures:This press release highlights the company's financial results on both a GAAP and a non-GAAP basis. The GAAP results include certain costs, charges and expenses which are excluded from the non-GAAP results. By publishing the non-GAAP measures, management intends to provide investors with additional information to further analyze the company's performance, core results and underlying trends. Cree's management evaluates results and makes operating decisions using both GAAP and non-GAAP measures included in this press release. Non-GAAP results are not prepared in accordance with GAAP and non-GAAP information should be considered a supplement to, and not a substitute for, financial statements prepared in accordance with GAAP. Investors and potential investors are encouraged to review the reconciliation of non-GAAP financial measures to their most directly comparable GAAP measures attached to this press release.Forward Looking Statements:The schedules attached to this release are an integral part of the release. This press release contains forward-looking statements involving risks and uncertainties, both known and unknown, that may cause actual results to differ materially from those indicated. Actual results, including with respect to our targets and prospects, could differ materially due to a number of factors, including the risk that we may not obtain sufficient orders to achieve our targeted revenues given that our backlog is a low percentage of our revenue targets and our ability to forecast orders is limited; risks associated with our acquisition of Ruud Lighting; price competition in key markets; the risk that we or our channel partners are not able to develop and expand customer bases and accurately anticipate demand from end customers, which can result in increased inventory and reduced orders as we experience wide fluctuations in supply and demand; the risk that our results will suffer if we are unable to balance fluctuations in customer demand and capacity; risks associated with the ramp-up of production of our new products, and our entry into new business channels different from those in which we have historically operated; the risk that we may experience production difficulties that preclude us from shipping sufficient quantities to meet customer orders or that result in higher production costs and lower margins; our ability to lower costs; ongoing uncertainty in global economic conditions, infrastructure development or customer demand that could negatively affect product demand, collectability of receivables and other related matters as consumers and businesses may defer purchases or payments, or default on payments; the risk we may be required to record a significant charge to earnings if our goodwill or amortizable assets become impaired; our ability to complete development and commercialization of products under development, such as our pipeline of improved LED chips, LED components and LED lighting products; risks resulting from the concentration of our business among few customers, including the risk that customers may reduce or cancel orders or fail to honor purchase commitments; risks related to our multi-year warranty periods for LED lighting products; the rapid development of new technology and competing products that may impair demand or render our products obsolete; the potential lack of customer acceptance for our products; risks associated with ongoing litigation; and other factors discussed in our filings with the Securities and Exchange Commission (SEC), including our report on Form 10-K for the fiscal year ended June 24, 2012, and subsequent reports filed with the SEC. Except as required under the U.S. federal securities laws and the rules and regulations of the SEC, Cree disclaims any obligation to update any forward-looking statements after the date of this release, whether as a result of new information, future events, developments, changes in assumptions or otherwise.Cree®, the Cree logo, and XLamp® are registered trademarks of Cree, Inc.

Contact

Web Site:www.cree.com