As part of a session on Rebates & Financial Incentives at The LED Show, Don McDougall, general manager of Solid State Capital Services, presented a set of case studies on solid-state lighting (SSL) projects that go far beyond the simple payback analysis that we typically see. The LED-focused talk discussed energy savings, the book value of real estate, tax and other incentives, and abandonment deductions that when combined make LEDs a better choice than fluorescents in most cases.

More than once during the presentation, McDougall stressed, "It's the entire package that makes the deals fly." Indeed, he said that when you fully understand the complete financials "LED fixtures blow the fluorescent products out of the water virtually every single time."

Before diving into a case study, McDougall admitted that vendors selling incumbent technologies present an uphill battle for a vendor focused on the LED alternative. But he added that most of the arguments lack credibility from either a technology or financial perspective. He counsels customers to ignore claims that they should wait for LEDs to mature and drop in cost because the technology is a better technology fit than most alternatives today.

Parking garage retrofit

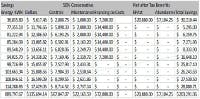

To cover the financial side, McDougall first discussed a 140,000-ft2 parking garage. He said that the first step SGS takes is creation of a ten-year cash flow model that covers the upfront cost, energy savings, benefit of controls, maintenance cost, financing cost, and a variety of tax incentives and deductions.

In the case of the garage, the SSL project delivered $204,000 in total savings over the ten years. And that was based on financing that included no out-of-pocket expense upfront. Moreover, the project was cash-flow-positive from the first month.

McDougall specifically addressed controls, saying, "Everybody forgets controls. In this case $90,000 over ten years were benefitted back to controls." He said in the case of the garage LEDs would have still been the superior choice even without the savings from controls and tax deductions and incentives.

One angle that many lighting vendors miss, but that resonates with property and building owners, is the value of the asset, according to McDougall. And LED projects and fluorescent retrofits fall in different places on the balance sheet. "LEDs are a capital improvement for a building," said McDougall. "New fluorescent lights are a maintenance [cost]."

The owner of the parking garage owned 53 similar properties. Through major LED retrofits, the owner found a way to increase the value of those facilities through what was considered a long-term capital improvement. Lighting vendors need to make such a case with tax directors or corporate executives, according to McDougall, although he said that can be problematic when a facilities director "did not want the suits in his office." In the case of the single parking garage, the property value was increased by $225,000 in what McDougall described as a conservative estimate. Over 53 properties that increase in value stretched to almost $12 million.

Auto dealership

Next McDougall used an LED project at a Jaguar Dealership to focus on the tax advantages. The deductions start with an EPAct benefit that for now is $0.60/ft2 in federal deductions for new lighting. That program could soon expire although there is a chance it could also be continued.

But the direct EPAct deduction isn't the only tax opportunity. When a business removes existing lighting, there is also a deduction known as abandonment where the book value of the replaced lighting becomes a tax deduction.

Abandonment falls into two categories with Section 1250 of the depreciation code covering primary lighting with a near 40-year life for depreciation purposes and Section 1245 covering decorative lighting with a seven-year life. Those Sections impact both the depreciation allocation that a property owner gets for installing new lights and the abandonment deduction.

In the case of the auto dealership, the lot lights are considered decorative lighting. And such dealerships generally upgrade the lighting on about a four-year cycle to ensure the autos are presented optimally for sale.

The LED project cost $200,000. The EPAct deduction was $28,000. The abandonment deduction covering the old lights was $120,000. And the 1245 allocation for the new lights was $35,000. McDougall said the owner had a net of $64,750 back in money after taxes, and with cash-flow-positive financing with no upfront cost.

McDougall said that the increasing advantage of SSL technology is leading utilities and other energy programs to move toward only incentivizing SSL projects. For instance, he said that Southern California Edison (SCE) is looking to limit its programs to LEDs because fluorescent projects don't really help SCE cut generation needs. Moreover, he said that focusing on LEDs would reduce the number of vendors that SCE deals with from 125 to 11 vendors, streamlining the cost of administering the programs.