Chung Hoon Lee, the CEO of Korea-based LED maker Seoul Semiconductor, spoke about the factors that have seen three of the country’s LED makers in the top-five suppliers’ list for 2011. “This was driven by backlighting unit (BLU) demand, local infrastructure and geopolitical issues,” he said. Now these companies must react rapidly, targeting the lighting market. Seoul already has a much larger proportion of its revenue from the lighting market, said Lee. He also discussed Ariche, the company’s AC-LED product, saying that this could allow LED- lamp makers to eliminate a lot of the “junk” inside the lamp needed to drive the LED (particularly the AC-DC converter).

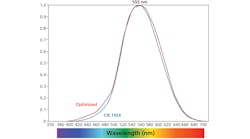

Soraa, a stealthy start-up, chose Strategies in Light to make a first public appearance. Eric Kim explained the company’s first product is an MR16 LED lamp designed to replace a 50W halogen. However, the company’s core innovation is to develop GaN-on-GaN LEDs. Because the LED material has a 1000-fold reduction in dislocation density, the LEDs can be driven much harder (250 A/cm2) than traditional LEDs, while suffering much less droop (the drop-off in efficiency at higher current densities). There are a whole range of ways in which the GaN-on-GaN LEDs are different from more conventional devices, not least the triangular chips (see photo). But a number of observers were sceptical due to the high cost of the GaN starting material. Look for a more detailed review of Soraa’s technology and products in LEDs Magazine in the near future.

Phosphors

A session on phosphors included a presentation by Seth Coe-Sullivan of QD Vision, on quantum-dot technology. While presenting results showing significant improvements in reliability, in terms of flux and temperature tolerances, Coe-Sullivan acknowledged that quantum dots for down-conversion of LEDs can only be used in a remote configuration. On-chip coating of the LED would result in a temperature and flux that was far too high.

Rene Wegh further discussed remote-phosphor configurations, stating that the main benefit is enhanced system efficacy. For warm-white LEDs at 2700K, the benefit can easily amount to a 30% enhancement. Also, the LEDs are not affected by the heat energy generated within the phosphor as downconversion takes place, so they remain cooler, and can be driven harder. Philips has made extensive use of remote phosphors in its LED lamps and also its Fortimo modules. Wegh said that quantum dots and organic dyes were good candidates as alternative phosphor materials, but that lifetime was an issue in both cases.

Automotive and Displays

Dirk Vanderhaeghen of Philips Lumileds spoke about the use of LEDs in automotive headlights, and predicted that 2013 would see the first headlights requiring a single LED module per headlight. This, he said, would reduce both cost and system complexity and open the way for penetration of LED headlights in mainstream, rather than just high-end, vehicles. He predicted that the number of cars with LED headlights would grow from 1.5 million in 2013 to 5 million in 2015, and the value of the LED components used in this application would grow from $130 million to $300 million.

Paul Semenza of DisplaySearch continued the discussion on backlights, and said that while this represents the biggest demand for LED chips currently, it would be overtaken by lighting in 2014. He also said that the cost structure for displays is less dependent on the LED cost than is the case for lighting. LEDs represent about 25% of the cost of an LED-backlit TV (obviously this varies by TV size and the backlight design), but around 5% of the whole TV cost. Semenza said that new designs have reduced the number of LEDs per backlight unit (BLU), but the price declines seen recently in the industry have made this less imperative.