MAURY WRIGHT reports on Strategies in Light presentations including the latest LED and SSL market data, and new applications and opportunities, as well as challenges, for participants in the LED sector.

Strategies in Light (SIL) 2017, including the co-located Lightspace California and The LED Show events, took place February 28 through March 2 in Anaheim, CA and the conference program and exhibits afforded attendees the opportunity to learn about the latest in LED technology and solid-state lighting (SSL) applications. Each day started with presentations of new market data from Strategies Unlimited that we will summarize. Among the most interesting of other presentations were talks about emerging applications in general lighting to life science applications, and connectivity and smart lighting was a prevailing theme. But we will also cover some identified obstacles to what is generally a very optimistic future in SSL.

Interested in articles & announcements on the LED market?

Among the most anticipated elements of the Strategies Unlimited presentations each year at SIL is the release of the top ten packaged LED manufacturers by revenue. Our research arm tracks the global market and converts the revenue figures to US dollars for the rankings. The list this year was again led by Nichia:

1. Nichia, Japan

2. Osram Opto Semiconductors, Germany

3. Lumileds, USA

4. Seoul Semiconductor, South Korea

5. Samsung, South Korea

6. Everlight Electronics, Taiwan

7. Cree, USA

8. LG Innotek, South Korea

9. Mulinsen (MLS), China

10. Lumens, South Korea

The companies on the list were unchanged from 2016. There were only subtle shifts in the ordering. Shonika Vijay (Fig. 1), senior analyst from Strategies Unlimited, noted that companies with significant investments in the automotive business had fared the best with significant growth in that sector. Companies focused on general lighting had not fared as well. Cree, for example, moved down a spot based on a general lighting focus, and a product line centered on high-power LEDs.

Still, only Nichia is clearly separated from the pack with a 13% slice of the LED market. Lumileds and Osram each have 8% shares and the rest of the list spans the 2-5% range.

LED market edges up

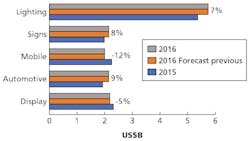

The general trend in the LED market for 2016 was up, and projections are more optimistic than what the audience heard in 2016. Fig. 2 depicts the growth in the sector from 2015 to 2016. LED revenue in the general lighting sector was up 7%. Automotive was even higher at 9%. But the mobile and display markets are declining.

The reasons for the positive news are many. Penetration of SSL technology into lighting and automotive is still relatively low, so the sectors see increases in revenue even as component prices fall. And price declines have been less severe in the past year. Vijay said price erosion in 2015 had been as high as 40% but was in the 20% range in 2016. Clearly the over-supply situation has eased, and product developers in demanding lighting and automotive applications are choosing higher-quality components. Looking forward, Vijay projected 5% growth in packaged LED revenue through 2021.

Lamps and luminaires

Moving to end products in the SSL sector, Philip Smallwood, director of research at Strategies Unlimited, presented "The future of a disrupted lighting market" (Fig. 3). The theme was that participants in the lighting sector must themselves disrupt the market to take advantage of new technologies such as connected lighting and the Internet of Things (IoT).

The LED lamp market is projected to grow from 1.7 billion units in 2015 to 4.5 billion units in 2022. But declines in average selling prices (ASPs) will mean that revenues will begin a steady decline around 2019 and of course socket saturation will be a factor as well.

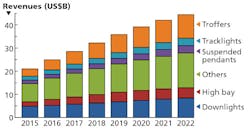

The luminaire market will grow for a much longer period with ASPs not declining at the rates of the decline in lamps, and with a lower current installed base. For example, LED-based indoor luminaire revenue will go from around $20B (billion) in 2015 to nearly $45B in 2022 (Fig. 4). Smallwood projects that the troffer space will show the greatest growth rate over the period, going from $4.4B to over $10B even as ASPs decline.

The news is also positive in the outdoor sector, although the magnitude of the numbers is lower because the indoor market is simply a larger one. LED luminaire revenue in outdoor will go from around $3B in 2015 to approaching $6B in 2021. Smallwood said that street lighting, an early SSL mover, will continue to be the largest application growing to $2.5B in 2021.

Connected lighting

Smallwood then returned to his disruption theme, which was largely centered around connected lighting. We have written extensively about smart lighting being a huge opportunity for the industry in the last few years including in our SIL conference coverage last year. But the market data, and more precisely the projections, do introduce questions surrounding the opportunity.

Smallwood said connected lamps, such as the Philips Lighting Hue products, have "changed the dynamics of the industry in terms of connected lighting." But long term, the significance of connected lighting will be far more apparent in the luminaire space. And it will take a while for the industry to move heavily into connected lighting.

Smallwood reported that connected products accounted for only 6% of outdoor LED revenue in 2015 and only projects that number to grow to 15% in 2021. And connected street lamps were perhaps the earliest mover in the networked SSL sector. Indoor products have a larger revenue base, but penetration is even lower for connectivity. Smallwood pegged the installed base at 3% in 2016, growing to 6% in 2022. Some segments will grow faster. For example, Smallwood expects troffers to hit 13% by 2022 due to their prevalence in commercial offices.

Challenges to the IoT

Joe Costello (Fig. 5), CEO of Enlighted, presented one of the SIL keynotes, and perhaps he best described the obstacles to growth in smart lighting with a talk subtitled "How the lighting industry unwillingly set back the smart building revolution by a decade." That was certainly a surprising phrase coming from the leader of a company focused solely on smart lighting.

There are several issues, according to the always-entertaining Costello. His best quip during the keynote came when he borrowed a theme from the current US President and said too many products on the market that are touted as smart are "fake IoT." Costello said he evaluated lighting products from 27 companies that are advertising IoT capability, and said that almost none integrate intelligent sensors - a feature he considers a requisite for IoT functionality. The true title of the presentation was in fact "The sensory systems of brilliant buildings." And remember that one of Enlighted's primary value propositions is intelligent sensors with an integrated digital signal processor that can react autonomously and pre-process gathered data to minimize network traffic. Costello said the sensors on many shipping SSL products just "check a box" and could not enable the many applications envisioned for the IoT such as real-estate space utilization, asset tracking, and security.

The call for abstracts for Strategies in Light 2018 is open

until June 19. Visit the SIL website

to submit your ideas for consideration!

Still, the obstacles go further in the value chain with what Costello described as "indemic issues in the channel." The distribution channel is not in direct contact with the customer, and sensor cost is one item the channel is quick to cut to deliver a lower bid on a project. Costello termed it a "fundamental problem in the lighting industry."

Nevertheless, he sees great potential in IoT. He said even advanced tech companies like Apple have found that a building was only 33% utilized and that the cost associated with that inefficiency could be $1 million per month. He said those types of applications are how the lighting industry must sell the IoT, and follow that attention-grabbing pitch with the fact that energy savings can pay for the cost of smart lighting. But Costello said the energy pitch upfront won't work.

Back to the subtitle of the talk, Costello sees the danger as non-connected and sensor-less LED lighting being installed with a likely lifetime in the 15-year range. He said, "You are condemning these buildings to not have an IoT framework." Building owners and facility managers will not be open to again retrofitting that space with IoT capabilities for more than a decade.

Emerging applications

Of course, SSL will succeed in many more applications outside of general lighting with some already being penetrated, but with a much larger potential in the future. Consider disinfection in facilities from medical to athletic to daycare. Colleen Costello, president and co-founder of Vital Vio, presented the concept of lighting products that both produce functional illumination and disinfect a space continuously (Fig. 6).

We have written previously about how ultraviolet (UV) energy can sanitize a surface or water instantaneously. In fact, that concept was presented at SIL several years back. But UV light can't be safely used in an open building space where humans are present.

Vital Vio is using violet light that is not dangerous to the human eye and is below the wavelengths associated with a blue-light hazard for humans. But the pathogen-killing phenomenon is quite different from that associated with UV. Costello said the technology targets specific molecules in bacteria cells and delivers an overload of oxygen that explodes the cells. But such sanitation takes time.

The Vital Vio approach is centered on the use of white-light products that operate continuously and that also have violet LEDs at work. So a space such as a sports locker room can be continuously disinfected. Costello said the potential is for 90% of bacteria in a room to be destroyed in one day. One Vital Vio luminaire model also includes a concept called Eco-mode that extinguishes the white light when people are not present and cuts energy usage by only powering the violet LEDs. The company has developed LEDs specifically for the application. It does sell some lighting products today, but the business model is ultimately focused on partnerships with lighting companies.

Horticultural lighting

Of course, horticultural lighting technology was presented at SIL, although we also have a dedicated series of one-day events specifically focused on horticulture with the next set for October 17 in Denver, CO. Matt Vail, co-founder and COO of vertical-farm specialist Local Roots, neatly described the opportunity. He said food is a $6 trillion industry - only considering sales to consumers and not production or distribution. And there are myriad problems with the current food production industry. Vail said that 97% of the produce consumed in the US is grown in California or Arizona and the average ship distance is 2000 miles. Moreover, he said population growth would require 70% more agricultural land by 2050 using traditional farming techniques.

Vail said vertical farms enable 300× more production per square foot and use 100× less water. And Local Roots is installing farms in fully-computer-controlled, used shipping containers that can be located in population centers including in downtown Los Angeles for Local Roots (see a recent article for more details). Vail said horticulture represents a $10B per year opportunity for LEDs.

Quality of light

Back to general lighting, SIL would never be complete without some presentations on light quality, color rendering, and usable metrics. One issue that continues to confound is what is white? That's a question that is often answered with a CCT metric, but that truly depends on spectral power distribution (SPD), and often on human preference.

Xicato is one company that has focused on excellent color rendering in its LED light engines since its inception. But the company is also being asked for SPDs tuned to specific applications. For example, CEO Menko DeRoos said through Xicato's experience in retail stores, it learned that cosmetic counters need a light that is "way off the black-body locus [BBL]." He described the light as looking pink when shined on a white wall. But he said stores using that light for cosmetics sales had reduced merchandise returns, a notorious issue in cosmetics, to less than 1% while also boosting sales.

And clearly we have yet to hear the final chapter on color metrics. The final SIL keynote came from a Hollywood legend named Jonathan Erland, who founded The Pickfair Institute focused on lighting for cinematography (Fig. 7). Erland said 3200K tungsten lighting remains the gold standard for cinematography because of a broad and smooth SPD. He said the discontinuous SPDs of LED and HID sources don't work well in the application, although we have been guilty many times of saying the latest LED lighting can serve in place of any legacy source.

If you have a chance to see Erland present, take it! His insight extends into general lighting. He explained the differences between a camera and a human observer and how the right camera-optimized lighting makes for a good human-observed movie experience. And he described shortcomings in metrics such as TM-30 and CQS (color quality scale).

The Hollywood-centric Academy of Motion Picture Arts and Sciences has been working on a color metric that it calls the spectral similarity index (SSI). And there is an accompanying software platform called the Academy Color Predictor. Erland believes the work will also prove invaluable to lighting designers trying to discern how humans will experience light in a space.

The disruption

In closing, let's return to the disruption-centric theme advanced by Strategies Unlimited's Smallwood. There are many great opportunities in SSL, but many are centered around the IoT and new applications that would be serviced by other industry or technology sectors were it not for networked lighting.

Smallwood characterized networked lighting as a Trojan horse that rivals the PC, the Internet, and handsets as a gateway to the computing cloud. His point was that networked lighting can be the backbone of IoT applications in buildings. Lighting is ubiquitous and always powered. Moreover, street-light networks can be the backbone of smart city applications. Hold on for a wild ride.