Display backlight applications are broadly served by LED modules today while modules have penetrated a small percentage of general-lighting applications, but the lighting application will grow 32.8% through 2019.

Strategies Unlimited has published its first market research focused specifically on LED modules used both in display backlighting and general solid-state lighting (SSL) applications. "The worldwide market for LED modules" report is available now and projects general lighting as a growth market for modules through the end of the decade while documenting broad module usage in the backlighting application today.

The new report defines modules as a product with multiple packaged LEDs mounted on a printed circuit board with no driver electronics on the module. The researchers will classify such products that integrate drivers as light engines — essentially aligning with Zhaga definitions. The modules covered in the report may have optical or thermal components installed on the module. The report notes that virtually every lighting product could be said to have a module integrated within based on the definition. But the report is focused on modules that are sold on an OEM basis to lighting manufacturers as opposed to modules manufactured in house by lighting manufacturers.

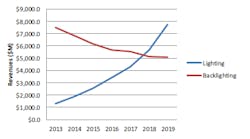

The report found that OEM modules are already commonplace in backlighting applications with some specific product categories near 100% saturation. So not surprisingly, the backlighting segment dominates module revenue today.

Still, the general SSL segment will migrate increasingly to modules through the end of the decade. Modules clearly allow lighting companies to deliver new products to market more quickly. Moreover, standardization, such as within the bounds of the Zhaga Consortium, could also enable lighting manufacturers to choose from multiple module manufacturers. The report does note, however, that Zhaga represents a small percentage of modules sold today despite the fact that major manufacturers are members of the organization.

While general lighting has overtaken backlighting as the largest consumer of packaged LEDs by revenue, lighting won't become the dominant market for modules until the 2018 timeframe. You can review some of the Strategies Unlimited packaged LED data in articles published on Strategies in Light presentations by the analysts.

Still, LED modules for general lighting represent a significant market today with the report stating 2013 revenue at $1.3B (billion). Strategies Unlimited projects that number to grow at a 32.8% rate to $7.8B by 2019.

The biggest opportunity indoors is in troffer applications and outdoors in street light applications. In part, the growth rate in those applications is simply a parallel of the overall demand for LED lighting in the applications given the huge installed base of fluorescent troffers and the fact that street lighting will be retrofitted around the globe.

Some applications will be gated by the applicability of modules, and retrofit lamps, outside of tubes, won't be a huge market for modules. Downlights conversely are ripe for modules, although the five-year growth rate isn't so impressive at 6% because of the penetration that has already happened in downlights. Primary author and Strategies Unlimited research analyst Stephanie Pruitt said, "The large installed base of troffers and high/low bay luminaires means that although the penetration of modules within LED troffers and LED area lights is lower than for downlights, the sheer size of the installed base means more potential for LEDs and strong growth for LED modules."