LED cost is dominated by the packaging steps at the back end of the manufacturing process while the entire OLED process is still expensive and inefficient with both technologies requiring significantly more R&D.

The US Department of Energy (DOE) has published its 2014 version of the "Manufacturing roadmap: Solid-state lighting research and development" with an update to both LED and OLED manufacturing progress. Understanding color uniformity issues remains problematic in both technologies along with the manufacturing steps needed to improve the consistency. LED prices are dropping although broader deployment of solid-state lighting (SSL) will require further advancements especially in terms of packaging LEDs. OLEDs, meanwhile, continue to face an uphill struggle on all fronts in terms of deployment in lighting applications.

The 2014 roadmap starts with both good news and a realistic look at the challenges of fully tapping the energy efficiency of SSL sources for lighting. The authors stated that savings specific to SSL light sources reached 188 trillion BTUs in 2013, equivalent to $1.8 billion in electrical costs. That said, the document notes that SSL penetration in lighting is still tiny. For example, the authors said only about 1% of installed A-lamps are based on LEDs. The much-greater potential in energy conservation is the driving force behind the DOE's continued support of R&D efforts and the goal of driving down cost to boost deployment. You can peruse the full roadmap on the DOE website.

As we reported previously, one primary goal of the roadmap is to guide DOE R&D investments in SSL. Again this year, the document draws heavily on discussions from the annual SSL R&D workshop that was held this year in May.

The DOE is calling for more work across LED and OLED technologies to achieve targeted color points and to understand the factors that impact long-term color stability. Indeed, color shift is one issue that can lead lighting designers/specifiers to eschew SSL technology for legacy sources, especially given the long projected life of SSL products. If color performance can't be maintained over that life then specifiers can't justify the cost of SSL.

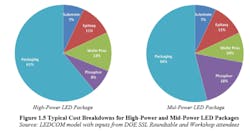

Still, light-source cost remains the primary obstacle to broader SSL deployment, even in LEDs that are being more widely used in general lighting. The nearby chart shows that in the case of LEDS, packaging costs dominate the overall expenses that comprise the manufacturing process. Today those costs are concentrated at the die level.

The DOE suggests that a number of innovations could change the LED cost equation and has funded R&D projects that range from the manufacturing process to SSL system design. So-called chip-scale packaging based on a flip-chip design, with much of the packaging work done at the wafer rather than the die level, could significantly lower costs. Moreover, luminaire designs that can use package-free or package-light components could eliminate many of the packaging steps incurred by LED makers today.

The OLED sector, meanwhile, faces a choice of two paths forward and both are full of obstacles, as we covered in a feature article earlier this year. The lighting industry has hoped to ride the coattails of the TV industry as it developed large-format OLED panels for direct-display TV applications. But the low cost and high quality of LED-backlit TVs, and the high cost of OLEDs have stymied the TV industry and therefore progress in OLED technology that might be transferrable to lighting.

The DOE reports that the OLED industry is coming to terms with the need to develop products that are truly designed and optimized for lighting applications, and then working on driving the manufacturing cost of those products down. The DOE notes that the industry needs to address cost in terms of the integrated substrate of OLEDs, organic layer deposition, and assembly. All are key to shorter manufacturing cycles and better equipment utilization.

Indeed, the LED and OLED sectors face diverse challenges but source manufacturing advancements remain the key to broader SSL deployment. Secondly, lamp and luminaire designs will increasingly be more economical as product developers learn to leverage the unique properties, such as form factor, of SSL sources.